SensorTower Southeast Asian Mobile Gaming Market Report 2025

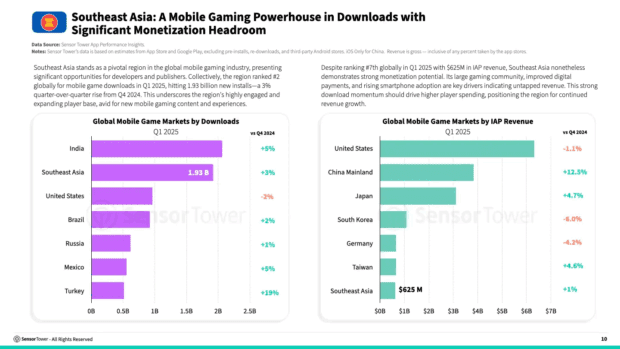

The mobile gaming market in Southeast Asia (SEA) continues to surge in 2025, cementing its position as one of the most promising regions for game developers and publishers. This report, based on SensorTower data, explores App Store and Google Play performance across SEA, including top-performing genres, market-specific trends, and leading games by downloads and revenue. 🌏 SEA is a mobile gaming powerhouse, ranking #2 globally for downloads (1.93B in Q1 2025) with $625M in IAP revenue (ranked #7). 🇮🇩 Indonesia leads SEA in downloads (870M in Q1 2025), while Thailand tops IAP revenue ($162M). 🎮 Arcade & Simulation subgenres dominate downloads, while Strategy, RPGs & Shooters lead IAP revenue. Mobile Legends: Bang Bang remains the top earner. 🔎 Subgenre deep dives are included for Indonesia, Thailand, Vietnam, and the Philippines. 💼 A special case study on Mobile Legends: Bang Bang […]