Voodoo’s Epic Plane Evolution: 3 Small Steps to Enter Top 10

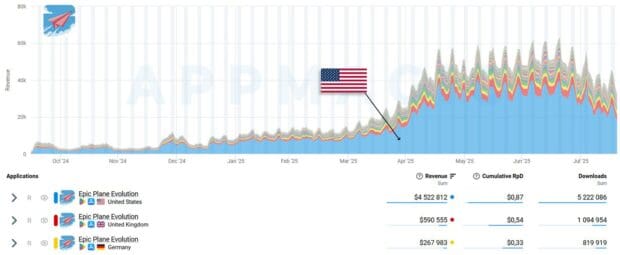

Epic Plane Evolution by Voodoo may look like just another Hypercasual title, where players pilot planes and chase distance records. And yet, released in June 2024, it pulled off something big in Q2 2025. The game landed in its category’s top-grossing chart, with monthly IAP revenue jumping from $592K in April to $1.4M in May. We noticed this growth when preparing our Top 10 Hybridcasual Games in Q2 2025, and such a breakout stood out as a case worth deeper investigation. Turns out, for a long time, the game has struggled to move past the $10–12K mark in daily IAP revenue. However, in April 2025, things shifted dramatically: revenue began to climb, driven primarily by the US market. This title had been acquiring US users before, but this time, the payoff was striking. Even more interestingly, the surge wasn’t spread evenly: the App Store became the main […]