Royal Kingdom is a Failure, Match-3 is Dead!

Journal 8 Phillip Black November 17

Royal Kingdom was supposed to be Dream Games’ next flagship. Instead, it exposed the structural Match3 rot.

What looked like an underperformance is something more fundamental: equilibrium has been achieved, and there’s no going back. Dream, King, and Playrix have had their creative and strategic instincts go dull, and in the process, the Innovator’s Dilemma has never been more real.

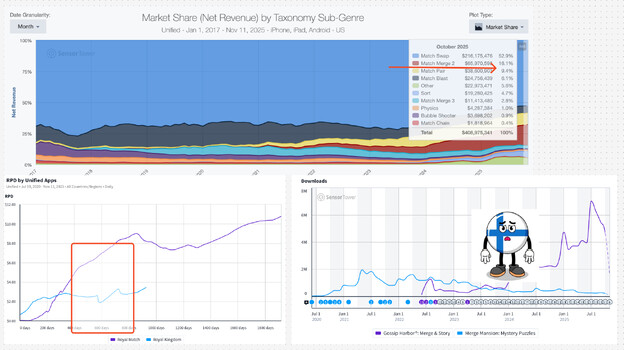

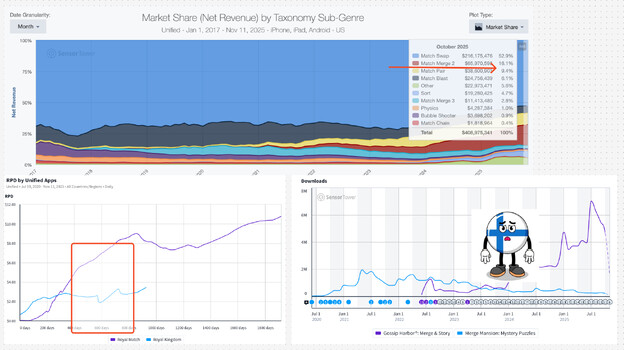

Sensor Tower reports Royal Kingdom (RK) spent $200M* digital ad spend in the United States alone (major *). Oh, yes, this doesn’t count talent pay for LeMatch and aging ’00s sitcom stars. While Royal Match (RM) took its time to scale, comparing the two games’ revenue per download (RPD) reveals stark contrast: RK should be hitting acceleration, and instead, it’s flatlining. This is the clearest indication that a genre reached equilibrium.

Match3 is facing a 2-year paybacks (!), and with the flat RPD, it suggests RK’s facing razor-thin margins. Everything about this launch screams “burned earth strategy,” and with the private equity sale, something feels rotten in the state of Turkey.

Yet, the real story is unfolding outside the walls of Match3. Puzzle has been reshaped by two subgenres: Merge and 3D | Tile match (someone call Blake Robbins and Mitch Lasky!). Together, they represent over 1/4th of puzzle revenue, up from 3% in 2022, while Match3 could close the year under 50% of puzzle revenue.

These genres are not fringe experiments; instead, they are the new center of gravity. Merge Mansion defined the space, stabilized, and stalled (classic Finnish Game industry). However, the category did not stall, as China and Israel took over, with Gossip Harbor, Toy Blast, and Travel Town posting explosive growth. Travel Town demonstrated that a puzzle can absorb higher spend velocity, and Gossip Harbor surpassed many Match3 incumbents and continues to climb. Meanwhile, Toy Blast proved Tile (“match pair”) is a sustainable long-run business, unlike whatever happened to Spyke Games.

This is the part that Match3 incumbents failed to see. Playrix is trapped in soft launch reskins (Familyscapes? Really?) while King abandoned its 3D Match experiment before it ever had a chance. Dream pushed RK toward a male skew that never materialized, then retreated into safe territory. All three behave like incumbents facing the innovator’s dilemma. They optimize the old model instead of building the new one, so trapped in their own paradigms, they can’t see the next one around the corner.

Genres do not die because players leave; they die because incumbents stop exploring the edges. They die when companies believe that the last decade’s playbook can be recycled. RK did not stumble because Dream mismanaged a campaign; it stumbled because Dream followed Match3 logic too faithfully.