About the author

John Wright

With over 11 years of experience in the AdTech/Gaming industry, I am passionate about creating engaging and profitable mobile games that reach millions of players worldwide.

HighlightsJournalReports 104 John Wright April 16

it’s a clear indication that we are seeing capital injection into games and studios, which does have a direct and positive correlation to how the industry is doing right now.

The good news is that based on this report we’re seeing early signs of renewed vitality as we enter 2025, following a highly challenging couple of years marked by funding contractions and market hesitations.

While total deal volumes and funding remain below peak 2021–2022 levels, the report shows (to me) the worst is behind us.

Few points to highlight:

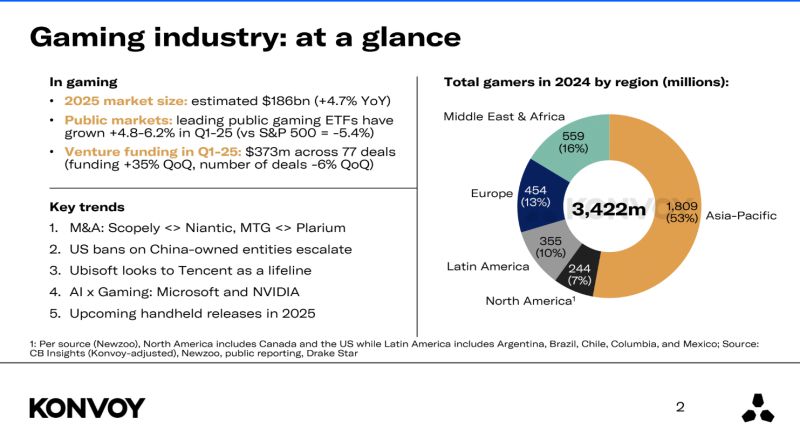

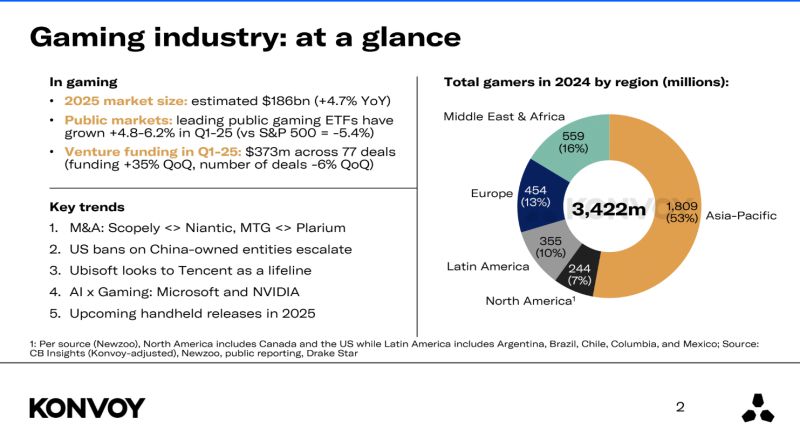

– Private market funding in gaming grew +23% QoQ, climbing from $570M in Q4 2024 to $700M in Q1 2025.

– Venture capital specifically saw $373M raised across 77 deals, a 35% increase in funding quarter-over-quarter, despite the number of deals dipping slightly by 6%.

This signals increasing investor confidence, with larger capital injections being deployed across fewer, more promising opportunities.

– Additionally, Q1 2025 marked the most active quarter for M&A in gaming since early 2022, recording 43 transactions, a sharp uptick from the 25 deals in Q4 2024, further emphasizing deal momentum.

Geographically, the investment landscape continues to be dominated by the United States, Europe, and Asia (particularly China):

– North America led Q1 2025 with $198M in gaming venture funding, of which $111M (56%) was growth-stage capital, showcasing a mature but still growing ecosystem.

– Asia followed with $115M, supported by strong early-stage activity.

– Europe reported a modest $60M, yet a staggering 97% of that was early-stage funding, reflecting an ecosystem in a generative phase where new studios and platforms are being seeded.

Together, these regions accounted for all of the gaming venture deals in Q1 2025, showcasing a concentrated global focus in capital deployment.

– To put current performance into context, the $373M in VC funding this quarter is still a fraction of the $10.2B raised in 2021 or even $7.0B in 2022, but the directional shift is encouraging.

– The underlying metrics, such as a $67M jump in growth-stage funding (+125% QoQ), suggest foundational strength and increasing appetite to scale proven concepts.

One small (or rather big) caveat is the current political tensions around the tariffs and how that’ll effect deal flow over the next 6 months. The escalating trade restrictions and tariff rhetoric from the U.S. government against China-owned entities pose potential risks. Given China’s role as both a gaming powerhouse (with 702M gamers and $47B in spend) and a strategic partner for many Western publishers, any further geopolitical tightening could have downstream effects on capital flows, market access, and joint ventures.

Overall, I’m optimistic that the industry is on the up but will watch this space gingerly for the new few months, let’s pray for additional QoQ growth and then we can celebrate.

About the author

With over 11 years of experience in the AdTech/Gaming industry, I am passionate about creating engaging and profitable mobile games that reach millions of players worldwide.

Please login or subscribe to continue.

No account? Register | Lost password

✖✖

Are you sure you want to cancel your subscription? You will lose your Premium access and stored playlists.

✖