- arrow_back Home

- keyboard_arrow_right Highlights

Applovin vs. Unity: How Applovin Has Been Winning It All!

HighlightsJournal 45 Joseph Kim April 8

We are at a dangerous crossroads where Applovin is poised to dominate the mobile ads market completely.

What’s going on? How did this happen? And what’s next?

Pay attention, folks, this one is a banger and has critical implications for the games industry’s future.

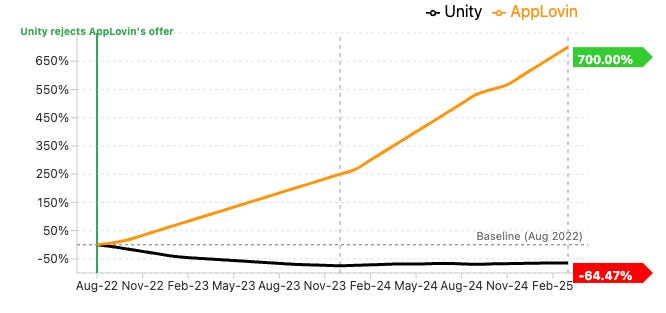

Something strange has happened in the mobile ads market since the failed merger between Applovin and Unity in August 2022. Applovin has quietly been dominating and significantly growing its share of the market.

We can easily see the relative performance of both companies reflected in their market valuations.

- What happened? How did Applovin win vs. Unity?

- Why does Applovin have a massive competitive advantage and iron grip customer lock-in?

- How does the current situation critically impact the games industry (this is important)?

- How can Unity or anyone else help create a healthier market ecosystem in the future?

- Is there any hope that any competitor can challenge Applovin?

Speakers:

- Joseph Kim. CEO at Lila Games.

- Josh Chandley. Co-founder and COO at WildCard Games.

- Matej Lancaric. UA Consultant and Host at Two and A Half Gamers.

- Warren Woodward. Co-founder and CGO at Upptic.

Applovin vs. Unity Round 2: The Empire Strikes Back

Since Unity rejected Applovin’s proposal for an all-stock merger in August 2022, the mobile advertising landscape has undergone significant changes, presenting fresh challenges and reshaping market dynamics. With rising costs and shifts in data practices post-ATT, understanding the competitive edge in the mobile ads market has never been more critical.

Today’s Mobile UA Market: Key Trends

- Increasing Costs, Longer Paybacks: Rising CPIs have made achieving positive ROAS more difficult, extending payback windows.

- Profitability Misalignment: Many studios prioritize revenue over profit, inflating budgets unsustainably.

- Fingerprinting Resurgence: Despite ATT disruptions, fingerprinting practices have returned, stabilizing some UA tactics.

- Applovin’s Rise to Market Domination: Applovin has significantly increased its market presence and influence, becoming a central player in mobile ad mediation and user acquisition.

Applovin’s Path to Dominance

Applovin has successfully captured the market by fundamentally rethinking its strategic approach:

- Dominating Supply via MAX Mediation:

- Applovin holds approximately 80% of the mediation market, creating a powerful lock-in effect.

- This stronghold significantly enhances targeting and data-driven decisions.

- Leveraging First-Party Data:

- Direct access to granular, first-party data enables more sophisticated targeting algorithms.

- Improves ad-ROAS significantly, drawing more advertisers into their ecosystem.

- Market Lock-in Advantage:

- Advertisers integrated with MAX mediation gain exclusive campaign benefits, creating a reinforcing cycle of dependency.

Unity’s Missed Opportunities and Operational Challenges

Unity, despite substantial advantages like broad SDK integrations and the acquisition of IronSource, has struggled significantly:

- Execution and Integration Failures:

- Poor operational execution post-merger created internal fragmentation, limiting effectiveness.

- Algorithmic Shortcomings:

- Historically weak algorithms led to underperformance and loss of advertiser trust.

- Organizational Conflict:

- Cultural clashes and frequent reorganizations further diluted their operational effectiveness, weakening market positioning.

- Neglected Synergy with Game Engine:

- Unity failed to leverage the strategic advantage of its widespread game engine presence to strengthen its ad solutions and integrated monetization capabilities.

Implications of Continued Applovin Dominance

If Applovin continues on its current trajectory, the broader mobile game industry faces notable risks:

- Opaque Margin Practices:

- With increasing market power, Applovin may tighten margins with limited transparency, disadvantaging developers.

- Limited Developer Flexibility:

- Growing dependency on Applovin could restrict innovation and profitability strategies.

How Unity Can Fight Back: The Vector Initiative

Unity is betting on a new AI-driven algorithm named Vector, intended to improve UA performance dramatically:

- Vector’s Promised Potential:

- Offers theoretically superior AI and targeting capabilities.

- Industry remains skeptical without demonstrable results.

- Critical Need for Operational Reform:

- Unity must rapidly enhance sales, customer service, and internal alignment to leverage Vector effectively and rebuild market trust.

Opportunities for New and Existing Competitors

Emerging and niche networks have the potential to disrupt current dynamics:

- Progressive Rewarded Video:

- New ad formats and progressive models could offer attractive alternatives with lower margins, providing new competitive advantages.

- IAP Optimization:

- Networks specializing in purchase-driven campaigns could exploit segments where Applovin has less data visibility.

Strategic Recommendations for Studios

- Ad-Driven Studios:

- Immediate integration into Applovin’s MAX ecosystem is essential for effective monetization.

- IAP-Driven Studios:

- Maintain diverse channel strategies, balancing Applovin, IronSource, and leading SANs for optimal outcomes.

Closing Thoughts

Mobile game developers face a challenging landscape dominated by a single player who has masterfully leveraged network effects to create an increasingly difficult ecosystem to operate outside of. While there’s hope for competitive alternatives to emerge, the near-term reality is that AppLovin has fundamentally reshaped the mobile UA landscape in its favor.

Applovin’s strategic success illustrates the immense value of first-party data and ecosystem lock-in. Unity’s Vector initiative offers hope but requires significant operational and executional improvements. Continuous innovation and healthy competition remain essential for a balanced and profitable mobile UA future.

Key Lesson Learned:

- Applovin’s strategic playbook offers critical insights into leveraging mediation and first-party data dominance.

Looking Ahead:

- Unity’s Vector must quickly deliver significant, observable performance improvements to prevent further market share erosion.

- Continued industry innovation, especially in new advertising formats and models, is crucial to maintaining competitive balance.