- arrow_back Home

- keyboard_arrow_right Highlights

AI in Gaming: $1.8B VC Investments

HighlightsJournal 5 Gamigion May 11

Written by our partner, InvestGame.

In the current investment landscape, a few themes dominate headlines as strongly as Artificial Intelligence. According to CB Insights, global AI funding exceeded $100B in 2024, with companies like Databricks ($10B – Series J), OpenAI ($6.6B), and xAI ($6B – Series B & $6B – Series C) raising the largest rounds.

While the potential of AI in gaming is broadly recognized, dedicated AI-first gaming startups still lag in capital and visibility compared to enterprise- or productivity-focused peers. This raises crucial questions: Why is AI still underpenetrated in gaming startups? Is there genuine whitespace for gaming-specific AI solutions? How do investors perceive this burgeoning segment?

To explore these points, we’ve closely tracked AI usage in gaming over the past five years from 2020–2024. Our findings indicate a substantial, though still emerging, market: over 178 AI startups secured around $1.8B across 264 deals.

While funding for AI in gaming remains relatively modest, the technology is already reshaping the industry, less as speculative hype, more as practical, targeted solutions addressing industry-wide inefficiencies across the value chain:

- Increasing need for diverse, rich game content under tight development deadlines

- Elevated marketing and development budgets

- Saturated content distribution channels—too much noise makes it hard for games to stand out

While AI is not a single solution to all problems, it can directly address core pain points for gaming companies:

- Content & creativity acceleration: AI tools streamline asset creation, world-building, and NPC behaviour, allowing developers to build rich, immersive games faster with less manual resources.

- Development efficiency & scaling: AI-driven infrastructure, build automation, and testing systems help studios reduce technical bottlenecks, speed up production cycles, and scale live multiplayer experiences.

- Player engagement boost: AI-driven analytics, moderation, marketing, and personalized experiences can improve player retention and community involvement, and raise ad effectiveness, boosting engagement and driving business growth.

For a detailed analysis, check out the accompanying report:

Methodology: Identifying an AI-First Gaming Startup

To precisely measure AI investments in gaming, we focused exclusively on companies developing AI solutions designed to significantly improve efficiency in core gaming processes, excluding those companies using AI solely for internal purposes as end-users. The selected companies would meet the following criteria:

- Clear focus on AI-driven solutions/products

- Technologies aimed at enhancing core game development/content creation processes

- Venture funding received from 2020 to 2024

- Excluded internal AI end-user applications

These startups fall into three primary sub-segments:

- In-Game Content Generation or Content (~45% of rounds raised by AI-focused gaming startups): AI tools that generate or enhance game assets, worlds, and characters within engines, procedural world-building, real-time NPC behavior and dialogue, 2D/3D art creation, animation, audio, and storytelling.

- Development Infrastructure or Development (~27%): AI solutions to optimize development workflows, automate QA, and manage infrastructure and live operations. These backend-focused tools improve productivity, stability, and scalability for testing, deployment, and operations.

- Other AI-focused (~28%): AI-driven solutions beyond the core game creation process, including marketing automation, user acquisition, esports, social/community platforms, monetization, and player engagement tools.

Funding Trends: Dominance of Early-Stage Activity

Early-stage rounds dominate this market: of 213 disclosed deals, 203 were Seed or Series A, mostly below $5m. Although average deal sizes tripled from 2020 to 2024, larger Series B+ rounds remain rare, with just 10 occurring post-2020.

In 2022, AI gaming startups almost reached $0.5B in annual funding, with 40% of capital driven by Parametrix AI and Stability AI raising $100m and $101m rounds, respectively. Excluding these two rounds, annual deal value steadily grew at ~35% CAGR through 2024, with yearly deal numbers rising from 35 to 73 over four years.

Segment Dynamics: Content Creation Leads, Infrastructure Gains Momentum

Between 2020 and 2024, deal activity in AI gaming startups doubled. Despite this growth, the distribution across sub-segments remained relatively stable. In-Game Content Generation led the way, comprising approximately 65% of total deal value and 45% of all transactions. This dominance underscores its pivotal role in F2P games with live operations, where continuous content updates are crucial for player retention and optimizing unit economics, making it a scalable and attractive investment opportunity.

Concurrently, Development Infrastructure witnessed increased investment, with deals rising from 16 in 2022 to 24 in 2024, consistently representing about one-third of AI-related activity. Although this segment attracts comparatively less capital, it addresses the escalating demand for automation and efficient backend operations, which are critical factors as game development becomes more complex and the industry faces mounting pressure to enhance game quality and stability.

Between 2020 and 2024, the ten largest VC-led rounds in AI gaming were dominated by startups focused on AI tools for In-Game Content Generation, with previously mentioned rounds by Stability AI and Parametrix AI, both driven by demand for generative art and world-building tools.

- Stability AI provides open-source diffusion models, mainly for creating game art—textures, concepts, and environments—supporting the visual asset pipeline for integration into game worlds.

- Parametrix AI focuses on procedural narrative and environment generation to streamline level design and develop AI-driven NPCs for video games.

- Gcore is the sole Development Infrastructure sub-segment participant among the top deals, raising $60m in 2024. Originally a cloud infrastructure provider for studios like Wargaming, its globally dispersed data centers and next-gen GPUs now position it to deliver low-latency AI inference services directly to gaming companies.

These investments underscore a clear trend: scalable tools that reduce manual overhead and improve efficiency are attracting the most investor attention.

Additionally, capital is increasingly concentrated among market leaders. The top 5 startups attracted 35% of total AI gaming funding raised over the last five years, with the top 10 commanding around 50%, suggesting fewer opportunities for emerging players to disrupt established leaders. These numbers are also close to levels observed among a more mature group of other non-AI Gaming Infrastructure startups (~35% and ~45%, respectively), essentially, the “picks and shovels” required to build, operate, and scale games.

Strategic Shift: AI as the Core of Gaming Infrastructure

AI startups now dominate investments in gaming “picks and shovels”, rising from just 4% in 2020 to about 65% in 2024 (excluding blockchain-powered Gaming Infrastructure companies). This reflects a strategic pivot among investors towards specialized, scalable AI tools.

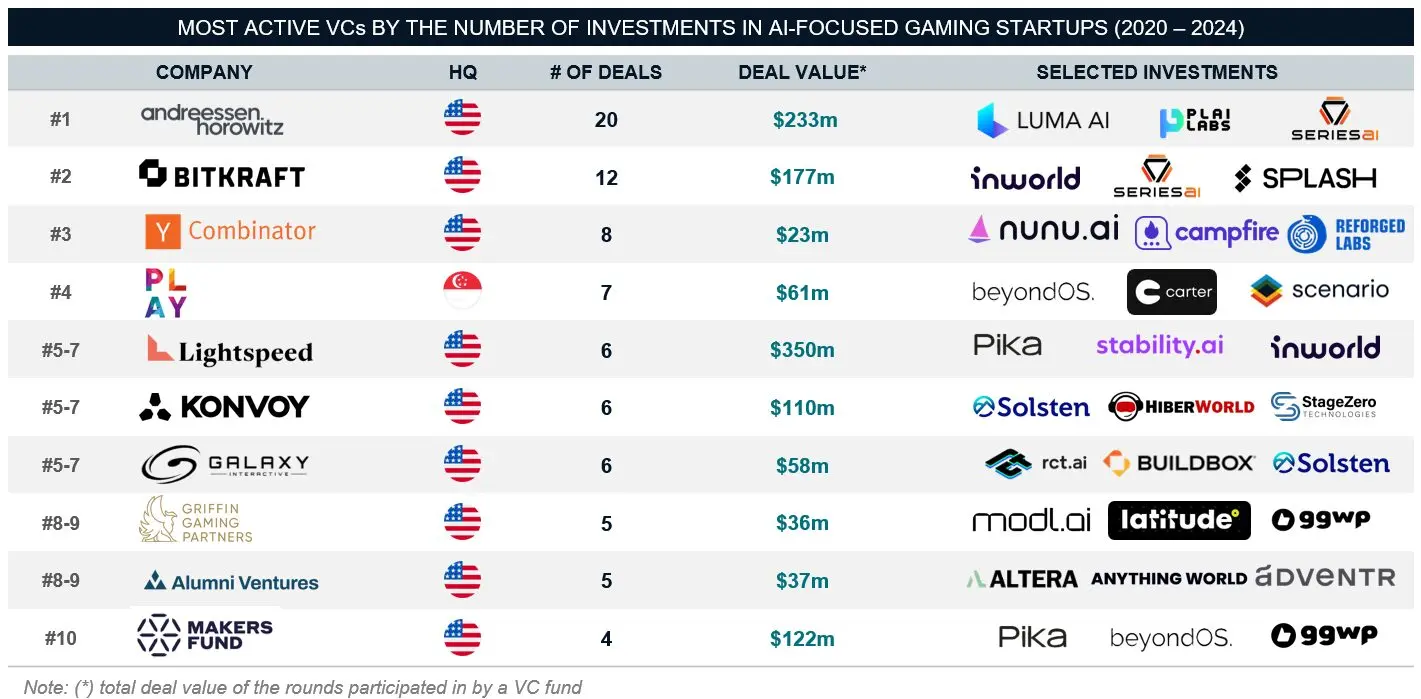

Top-tier VCs increasingly recognize gaming as a key testbed for broader AI adoption, deploying $1.2B+ into different ventures. Yet, despite larger checks emerging (the average tripling since 2020), investments are currently heavily weighted toward Early-stage profiles.

The space is still young. There is minor Late-stage activity, with a few Series B and later rounds closed, all but one of which occurred in 2022 or later. These companies have varied trajectories, from Pika and Inworld AI, which secured Series B funding less than two years after founding, to companies such as Ready Player Me and Medal.tv, which were founded between 2014 and 2017 and only received Late-stage funding in 2022–2024.

The road to exit takes time. Even market leaders face challenges. Take Stability AI as an example. By early 2024, it confronted financial strain, including high operational costs and legal disputes, which led to the resignation of its founding CEO. To address financial pressures, Stability AI secured additional funding in Jun’24.

However, there is precedent for optimism. In Jul’24, Canva acquired Leonardo AI, a platform creating high-quality images and assets for gaming and more, for $320m+, signaling that opportunities for large checks from strategics are already present. Additionally, ~20 smaller acquisitions have occurred in this space since 2020, with half of these exits occurring since early 2024, including Epic Games’ acquisition of Loci in Apr’25 and Infinite Canvas acquired by Pocket Worlds in Jan’25. This trend is likely to continue as strategic investors seek to bring proven AI tools in-house to support their production and live ops pipelines.

Conclusion: What’s Next for AI in Gaming?

AI in the gaming industry remains in early development, with AI-enabled tools for In-Game Content Generation acting as the primary driver of demand. The volume of Late-stage deals is still limited. Still, current momentum at Early-stage suggests likely growth in Late-stage activity over the coming years as companies continue scaling and AI adoption continues growing in gaming.

This is shifting the Gaming Infrastructure segment, with AI-focused startups becoming the dominant focus, setting it apart from other sub-segments. Simultaneously, as noted in our previous feature, Gaming Content companies still lead overall VC funding, but Gaming Infrastructure is undergoing a structural shift, with AI-focused players becoming the primary driver of deal flow.

If current momentum continues, we expect:

- More Series B+ rounds closing from 2025 onward

- Expansion of VC participation, as firms view gaming as a viable testbed for broader AI adoption

- Strategic M&A is expected to pick up pace, particularly from platforms and engines looking to acquire proprietary AI tools—following the path set by Canva–Leonardo AI acquisition

The next chapter will depend not on speculative narratives but on execution: Can these tools integrate into the production workflows of major studios? Can they deliver repeatable ROI? If so, the $1.8B already deployed may represent only the beginning of a much larger investment cycle.