- arrow_back Home

- keyboard_arrow_right Highlights

A Knock to Music Mobile Gaming…

HighlightsJournal 5 Bryan Cindell September 13

Every so often, a game emerges that doesn’t just entertain – it elevates. Beatstar and its sister title Country Star were exactly that for mobile music games. They didn’t feel like disposable rhythm apps with knock-off tracks and clunky interfaces. They felt premium. With sleek UI/UX, real licensed music from major artists, and exclusive song drops, these games sat at the intersection of streaming and gaming – polished, relevant, and culturally connected.

That’s why their closure on October 31, 2025 stings. Losing them isn’t just about two games going offline. It’s a setback for the entire rhythm gaming genre, which had finally been pushed forward in a meaningful way.

Why They’re Shutting Down

The reason traces back to the acquisition of NextBeat – the studio behind the games – by Duolingo. Duolingo hired much of the NextBeat team to focus on music education within its learning platform, but it did not acquire the Beatstar or Country Star IP. Without the resources to maintain the games, NextBeat made the difficult decision to sunset them.

The Business Challenge Behind Music Games

Even before the acquisition, the business model was notoriously tough:

- Constant Demand for Fresh Music

Players consume new tracks rapidly. To keep engagement high, developers need a steady pipeline of music – but every song requires costly licensing. - Upfront + Ongoing Costs

Deals often involve an upfront fee plus royalties or revenue splits. That means a song often needs to be replayed a certain amount of times to recoup initial upfront fees. - Replayability is Hard to Engineer

Making songs replayable requires thoughtful systems – progression, live ops, leaderboards, and community play – but the economics are unforgiving. Licensing deals often combine fixed and variable costs, so the model only works if players return to tracks frequently enough. On one hand, replayability comes naturally at first: players will loop songs to improve their score, climb leaderboards, or chase perfection. But as skill levels rise and mastery comes quicker, that organic replay tapers off – making it harder to sustain engagement at the level needed to balance licensing costs.

That’s why Beatstar was so special. Simon Hade, Jessica Ashton, and Olly Barnes managed to build a sustainable licensing pipeline – something most developers would never even attempt. Recreating that moat is daunting, and even if someone does, they’ll still face the same structural hurdles around replay and deal economics.

Country Star: A SKU Test Into Genres

Country Star was a bold attempt to test whether the Beatstar model could be expanded into genre-specific SKUs. It didn’t disprove the SKU concept, but it also didn’t provide a clear green light that this direction could be sustainable under the current industry structure. Licensing costs, fragmented rights, and player appetite all made it difficult to scale genre-based spin-offs as standalone businesses.

The takeaway isn’t that SKU models are dead, but that the economics need to change before they become viable. The structure of deals, replayability mechanics, and the overall licensing framework all have to evolve for a genre-specific app strategy to work long-term.

The Marketing Challenge

Music games like Beatstar and Country Star face steep obstacles in user acquisition. Mobile marketing in this genre is a high-stakes environment where creative constraints make it tough to stand out. If a song resonates in an ad, it can drive installs, but if it doesn’t, iterating on the campaign is challenging, often forcing developers to move to the next track.

Players also expect seamless experiences, such as quickly accessing songs featured in ads. When games gate these songs behind progression, it can lead to frustration and churn. This tension between acquisition and retention is a common challenge in the genre, yet Beatstar became one of the most downloaded rhythm games on mobile, showcasing its ability to navigate these headwinds.

The Industry’s Fragmentation Problem

Another layer of difficulty is the music industry itself. Licensing isn’t just expensive – it’s messy. Rights are split between publishers, labels, and artists, with little alignment between them. Even artists themselves are frustrated by the disjointed system. Rapper Tinie Tempah, when asked about gaps in the music market, described it as “fragmented and disjointed, with publishing and records not really talking to each other.”

The positive spin: awareness of this problem is growing. The more the inefficiencies are acknowledged, the more likely it is that labels, publishers, and tech partners will experiment with new ways of working together. Whoever cracks this coordination issue – bringing rights and revenue streams into a more coherent structure – will be well-positioned to thrive in games and beyond.

The Good News Moving Forward

It’s not all doom and gloom. Two shifts in the industry could open the door for the next great music game.

1. Labels Are Hungry for Sync Revenue

Music publishers and labels are increasingly leaning into synchronization (sync) licensing as a way to diversify revenue. Sync income now represents a meaningful share of publishing revenue – well into the double digits – and has been growing rapidly year over year, driven by demand from TV, streaming, gaming, and social media. Investors are even securitising music royalties – including sync income – into multi-billion-dollar asset classes.

This is good news for developers. If music games can be pitched as regular sync channels, labels may be more willing to structure flexible deals that work for both sides. The appetite is there.

2. Lower Platform Cuts Are Emerging

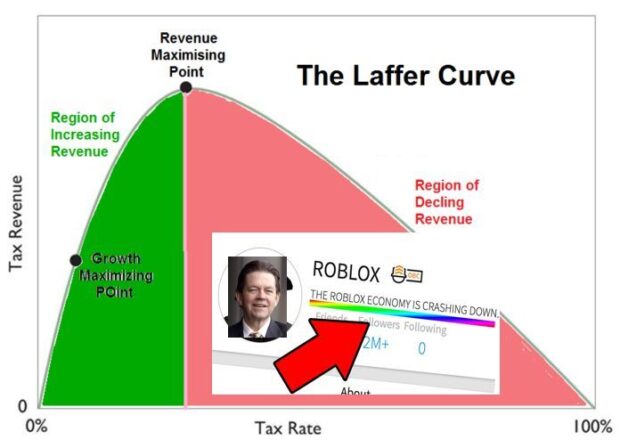

Historically, on top of paying labels and publishers, music games lost another 30% of gross revenue to Apple and Google’s app stores. That tax made the already thin margins even tighter.

But the walls are starting to crack. With the rise of webshops and regulatory pressure forcing platform holders to loosen their grip, developers now have alternatives – lower-cut third-party services or even in-house direct payment systems. This means more revenue can flow back into licensing and design, making the economics of music gaming more attractive than they’ve ever been.

Silver Lining: The Talent Isn’t Gone — It’s at Duolingo

Perhaps the most overlooked silver lining is that the people who made Beatstar and Country Star great aren’t disappearing. The core NextBeat team has joined Duolingo, a company already renowned for making learning engaging, playful, and sticky. With that DNA, it’s almost certain they’ll continue to build innovative, beautifully designed products – only now at the intersection of music and education.

That’s not the same as another Beatstar, but it does mean their expertise in music rights, UI/UX, and gamified design will continue shaping interactive music experiences in new, exciting contexts.

Another Avenue: Artist-Exclusive Apps

If genre SKUs face structural hurdles, another promising route could be artist-exclusive apps. Instead of trying to serve entire genres under one umbrella, developers could collaborate with individual artists or groups to build interactive apps around their catalogs.

This approach narrows the licensing scope, making deals easier to negotiate, and taps into one of music’s most powerful forces: superfans. In today’s industry, superfans generate a disproportionate share of revenue – streaming spins, merch sales, concert tickets. An interactive app that gamifies their favorite artist’s music could become both a marketing tool and a monetization channel.

We’ve already seen hints of this potential:

- Travis Scott’s Fortnite Concert (2020) drew over 12 million concurrent players, proving how music + interactivity can generate cultural moments and huge engagement.

- BTS and K-pop fandom apps like SuperStar BTS and Weverse have shown that fans are eager to engage with rhythm mechanics, collectible systems, and exclusive drops when tied directly to their favorite artist.

- Lil Nas X’s Roblox Concert and Ariana Grande’s Fortnite Rift Tour reinforced that fans will flock to experiences where music and gaming collide in exclusive, artist-led ways.

An artist-exclusive rhythm app could build on this momentum – offering fans exclusive access to songs, behind-the-scenes content, or even early releases in a playable format. With sync revenues becoming a bigger priority for labels, and direct-to-consumer tech breaking down distribution walls, this could become a viable path forward.

Closing Thoughts

Beatstar and Country Star proved that mobile rhythm games could be premium, cultural, and sustainable – if only briefly. Their loss is a setback, but not the end. The demand for interactive music experiences is only growing, and the industry conditions around licensing and platform revenue are shifting in ways that may finally favour developers.

The challenge now isn’t whether another Beatstar will come – it’s whether the next studio can blend music licensing, replayability, and monetization into something sustainable. If they can – and if fragmentation is addressed, or if artist-exclusive apps become viable – the genre still has a future worth tapping (Ba-dum-tss! 🥁) into.

RIP Beatstar/Country Star – you will be missed!