- arrow_back Home

- keyboard_arrow_right Game Radar

Mobile Game Leaders: November 2025

Game RadarHighlightsJournal 69 Gamigion December 4

Xin chào, Hallo, Hei & SELAM!

Welcome to the October 25 version of Mobile Game Leaders!

Top Trending below is the best part. Make sure that you take a look :))

Data source: AppMagic

Didn’t include our ‘Games Radar’ here, check it out!

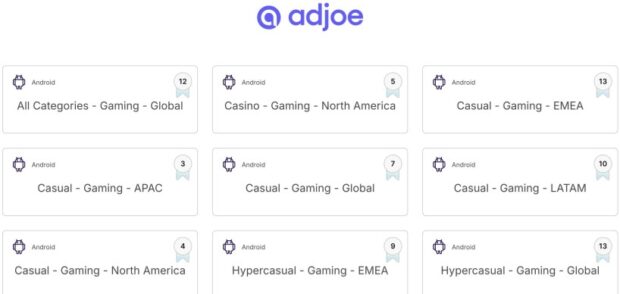

Global Leaderboard: Game Publishers

October’s “quiet rise” cooled a bit in November.

BabyBus jumped into the Top 3, pushing SayGames & VOODOO down a slot. Kids content demand clearly spiked in November.

SayGames and VOODOO both slipped compared to October’s upward swing. Their TikTok-friendly content machine is still strong, just not accelerating like last month.

CrazyLabs pushed up again, staying in the “steady grower” lane.

Vietnam continues climbing:

- ABI Games Studio up from 15 → 13

- XGame Global up from 16 → 16 but holding stronger volume

- 1SOFT stays Top 10, proving consistency

- The region isn’t “surprising” anymore. Reliable output.

Azur Games remains a wall.

Slightly down in raw volume vs October, but still #1 with a locked catalog effect.

Revenues?

- Century Games spiked from $192M → $201M, reinforcing their top-tier economy mastery.

- Dream Games increased revenue again (131M → 142M). Match-3 King keeps the crown.

- Scopely and FUNFLY also saw solid climbs out there.

- Supercell improved too ($101M → $108M), stabilizing after a quiet October.

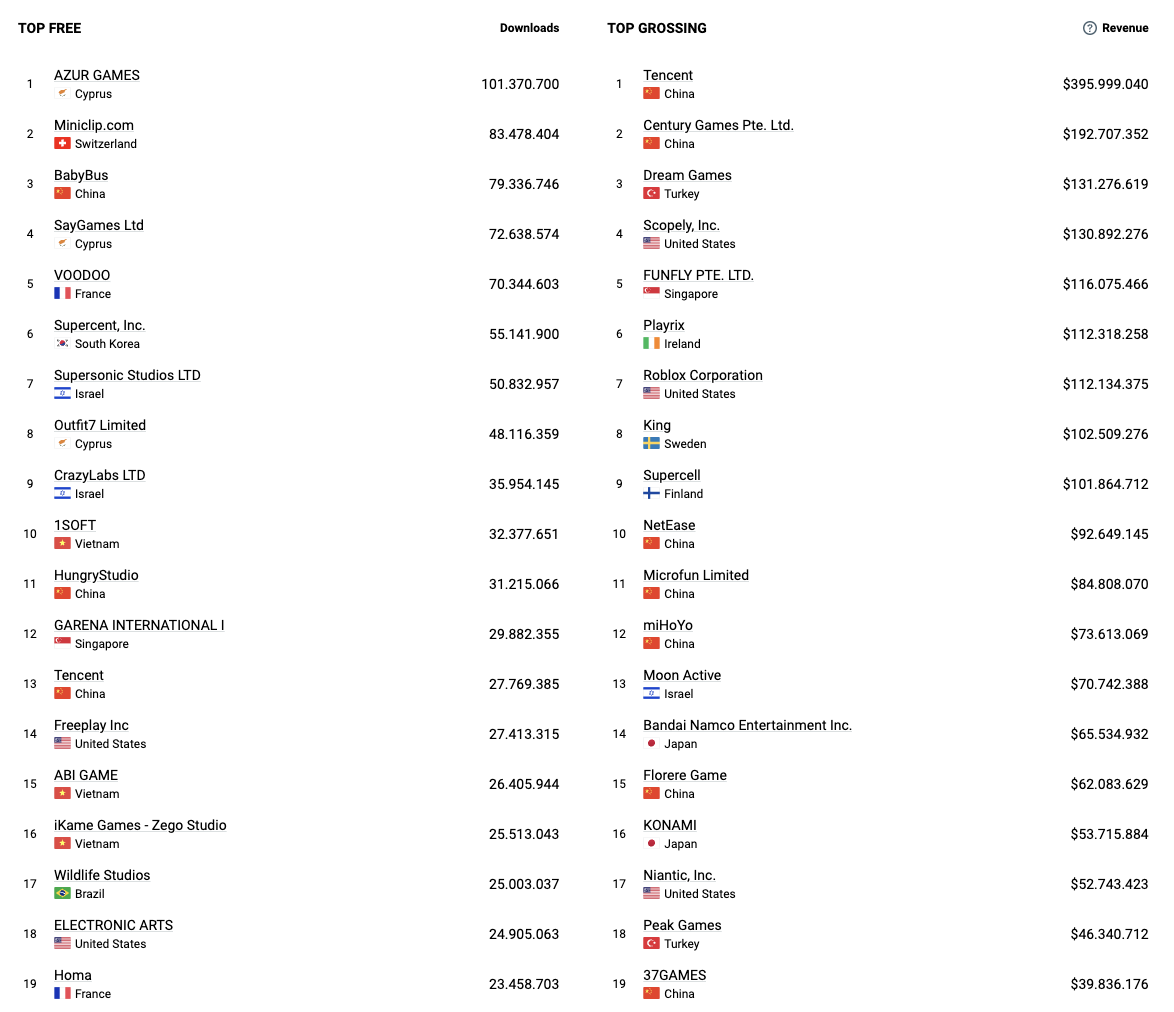

Ad Creative World

Out of 265,000 Creatives on iOS

Top GEOs by Impression

- US: 42% rocking

Leading Ad Networks?

- Meta: 34% & Mintegral: 17%

- Mobvista: 13% & YouTube: 13%

Out of 614,000 Creatives on Android

Top GEOs by Impression

- U.S: 18% & India: 19%

Top Ad Networks by Impression

- Meta: 22% & YouTube: 20%

- AppLovin: 20% & AdMob 17% & Mintegral: 13%

Top Trending Games

Zero to Hero Games out there!

Mobile Gaming isn’t dead, yet.

Seen Unicorn Studio? Looks like we’ll see them more often in the charts.

Lots of big jumps out there!

There are still lots of new games with organic scale.

New Hits Scaling in the U.S

Top 5 Highlights here for ya.

1. Hypercasual Puzzle dominated the U.S. corridor

Color Blaze Shooter grabbing the #1 spot shows the classic pattern:

clean mechanic + eye-catching VFX + fast session loop = instant U.S. traction.

Hypercasual is still the fastest way to “enter” the U.S. charts…

2. Netflix is quietly becoming a top-tier U.S. distributor

Four titles trending at the same time: Netflix Puzzled, Red Dead Redemption, WWE 2K25, Toca Boca Hair Salon 4, all climbing hundreds of ranks.

This is the strongest single-month U.S. momentum Netflix has shown all year.

3. Merge & Puzzle Hybrids continue to dominate early U.S. scale

Jigmerge Puzzles (#3), Mahjong Blast (#10), MONOPOLY Match (#12), all trending hard.

U.S. players are gravitating toward comfort mechanics with modern juice.

4. Vietnam cracks the U.S. trendings, again.

Gecko Go (#5) surging +500 ranks is a major signal:

Vietnamese studios aren’t just doing well globally, they’re scaling in the hardest market.

5. Casino & Slots show strong momentum

Cider Casino (#6) and Jackpot Heist Slot (#7) proving that when creatives hit, U.S. casino can spike instantly.

Low volatility, high CPI tolerance, but still breaking through.

Just NEED New Games & Soft-launches?