3 Genres Generating 80% of Revenue

AnalysisHighlightsJournal 100 Andrei Zubov August 14

A new force is emerging in 2025 that cannot, and shouldn’t be ignored: Hybridcasual Puzzle games have become one of the key points of interest across the market!

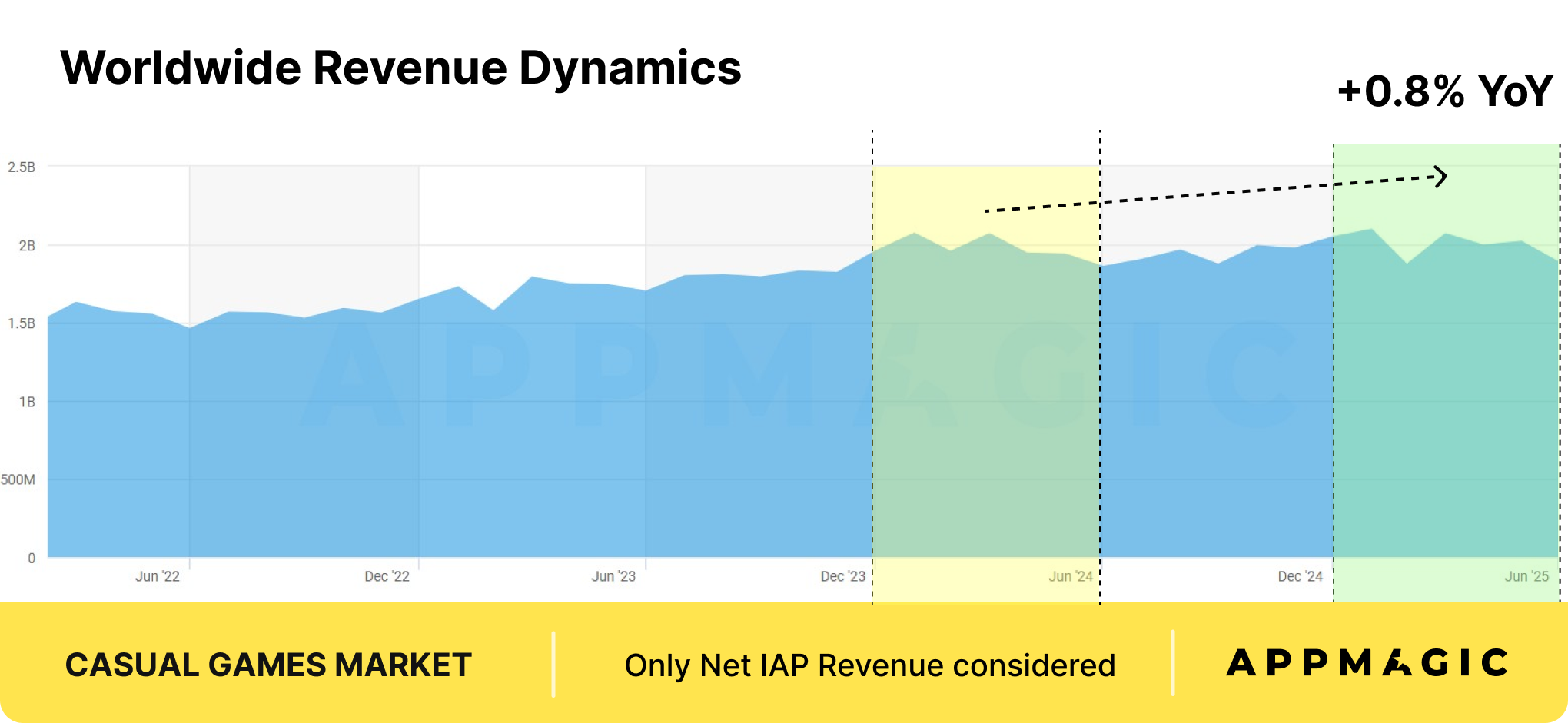

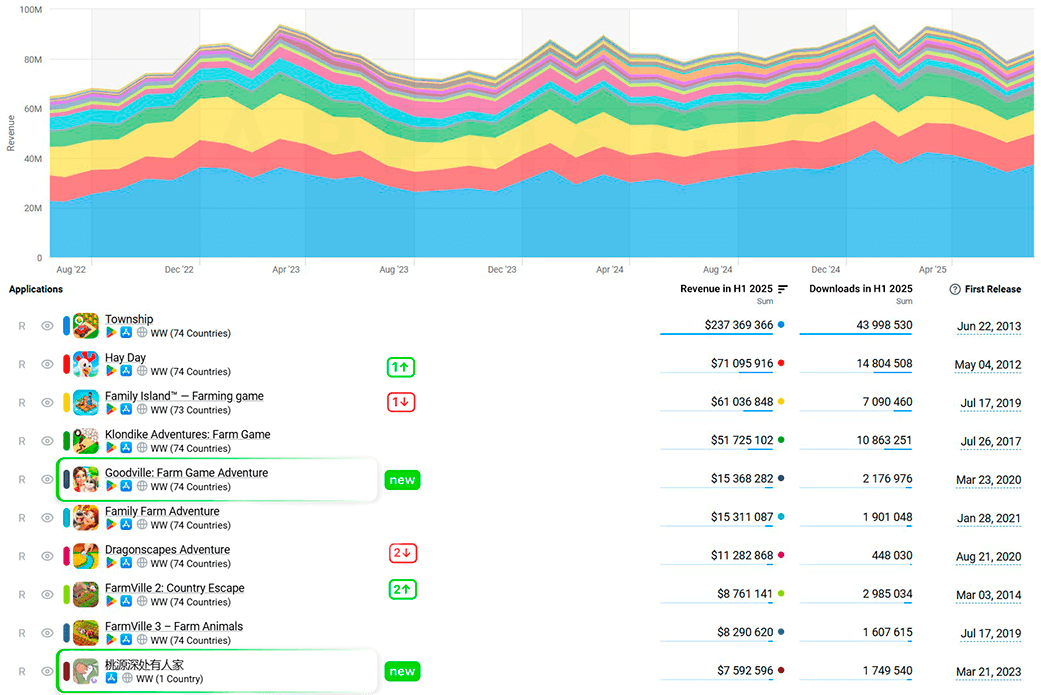

To put these shifts in context, we need to start with the bigger picture. In H1 2025, global Сasual games revenue grew by 0.8% YoY, with downloads up by 5.8%. As a result, Casual games generated about $12B in Net IAP Revenue worldwide.

Market Segment Comparison Dashboard: Casual market revenue

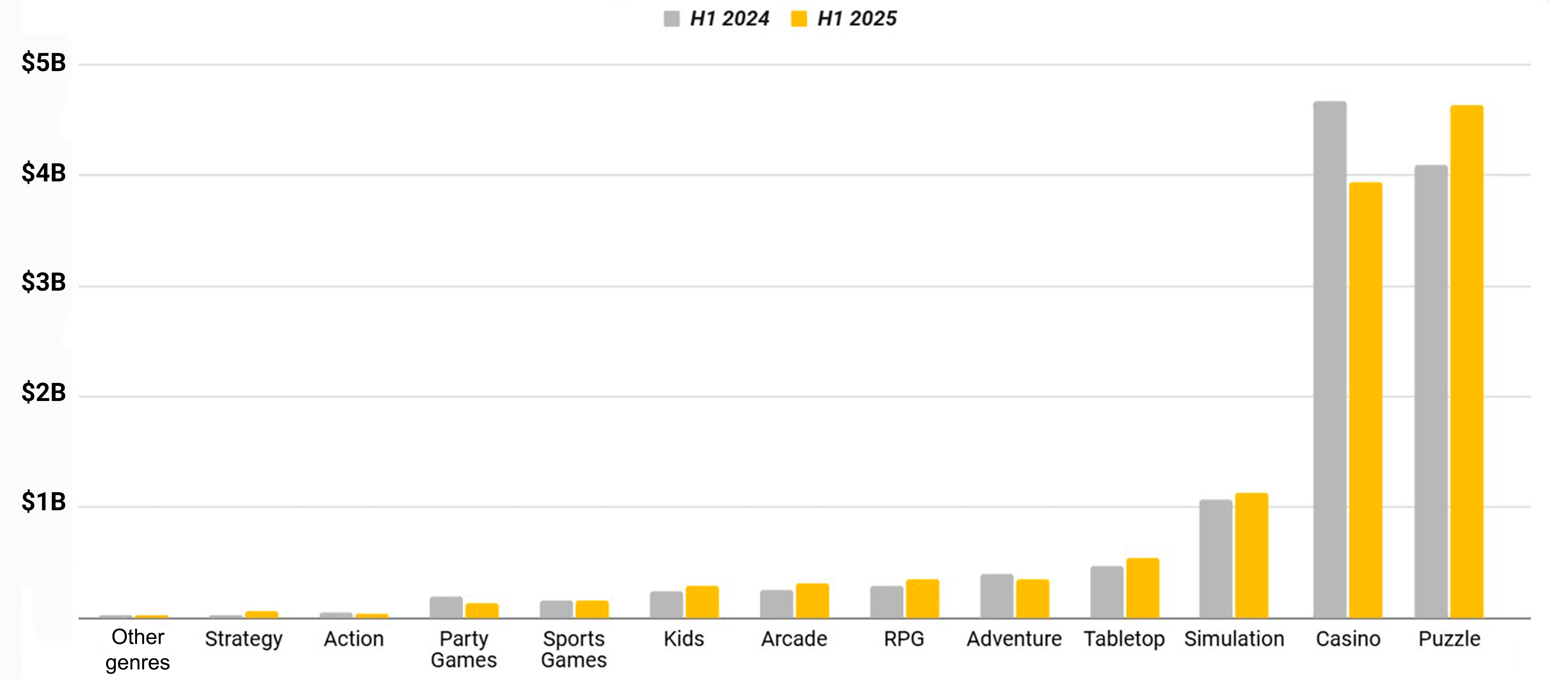

That is a huge figure, but here’s the reality: nearly 72% of this $12B comes from just two genres, Puzzle and Casino. Add Simulation as the third (but sturdy) wheel, and you’ve got 80% of the market revenue concentrated in just three categories.

The dominance goes even deeper. Among the Top 100 Grossing Casual games of H1 2025, 41 are Casino titles and 32 are Puzzles: so, 73 out of 100 games are from these two genres only!

Market Segment Comparison Dashboard: Casual game genres

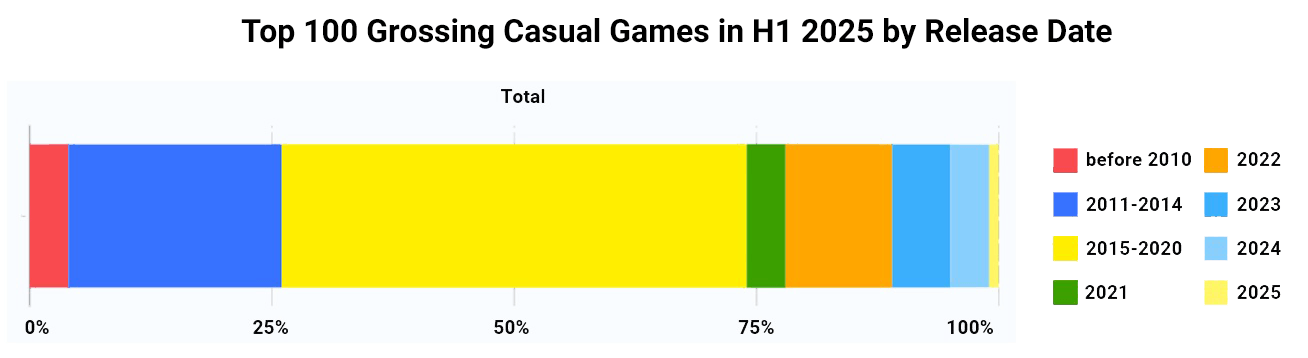

And it’s not just about genre concentration. Nearly half of the Top 100 were launched between 2015 and 2020, while only 11% came from recent releases (2023–2025). As we’ll see further in this report, not only are the biggest games holding their ground, but they are still growing and finding new ways of increasing their profits.

Top Apps: Top Grossing Casual games

So far, the picture might look grim: the dominance of the biggest genres and oldest titles seems hard to contest. But that’s just the surface. Inside each of these genres lies a far more complex structure: dozens of subgenres, each with its own story of success and failure. And some of them are multiplying their revenue quarter over quarter!

Exploring the three biggest Casual genres—Puzzle, Casino, and Simulation—we’ll break down the key trends, standout performers, and the strategies behind their results. Here’s what you’ll find inside:

- How Match-3 shows almost no growth once you remove the two biggest games

- Why Merge-2 with Complex Meta grows 94% YoY and doesn’t seem to slow down

- What happened to Match 3D, and why it has fallen short of last year’s expectations

- A new wave of Hybridcasual Puzzles and how they may show revenue growth x12

- How Casual Casino is settling into its new normal, and the emergence of new Plinko games

- How Farming games keep setting new revenue records in 2025 despite their veteran status

Yes, it’s a lot. But no need to rush—start with your favorite genre or just take your time and explore. Enjoy the read!

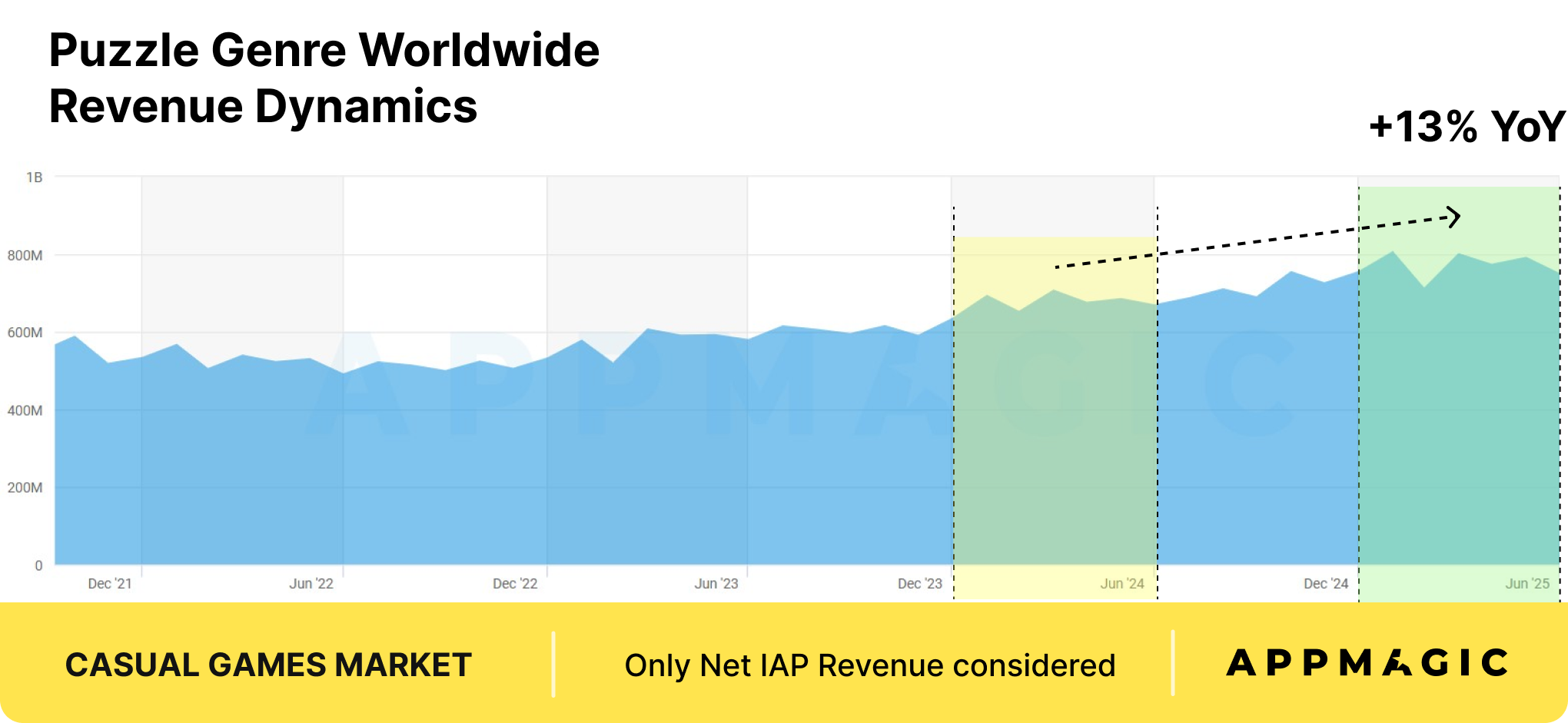

Puzzle: Main Casual Genre

Puzzle has remained the top-performing genre for many years, and H1 2025 is no exception, bringing in $4.6B in revenue (+13% YoY). Its leading subgenres are:

- Match-3: $2.7B Revenue (+7% YoY), 394M Downloads (–17% YoY)Royal Match, Candy Crush Saga, Gardenscapes

- Merge: $850M Revenue (+62% YoY), 287M Downloads (–3% YoY)Gossip Harbor®: Merge & Story, Travel Town – Merge Adventure, Seaside Escape®: Merge & Story

- Match-2 Blast: $282M Revenue (+4.6% YoY), 28M Downloads (–47% YoY)Toon Blast, Toy Blast, Angry Birds Dream Blast

While Match-3 generates over half of all Puzzles’ revenue, its influence extends far beyond the genre, setting benchmarks in monetization and retention strategies across the Casual market. Its growth comes solely from the genre-defining hits Royal Match and Candy Crush Saga, which continue to evolve and scale despite their maturity.

The Merge category’s current leaders are the Merge-2 with Complex Meta titles. With rising player expectations and stiff competition, only those with polished gameplay, strong monetization foundations, and balanced LiveOps stand a chance to break through.

As in our previous report, we’ll take a closer look at these categories. Plus, we’ll look at the state of Match 3D. Though not amongst the big three, we’ve been analyzing this genre for three consecutive Casual reports already, so it’s a good opportunity to check if our expectations have been met.

At the same time, Hybridcasual Puzzles are quietly reshaping the market. Built on simple core loops, they borrow best practices from Casual hits to boost engagement—and often become a testing ground for innovative features that later spread across the broad Casual genre.

Match-3: The Heavylifter of the Puzzle Genre

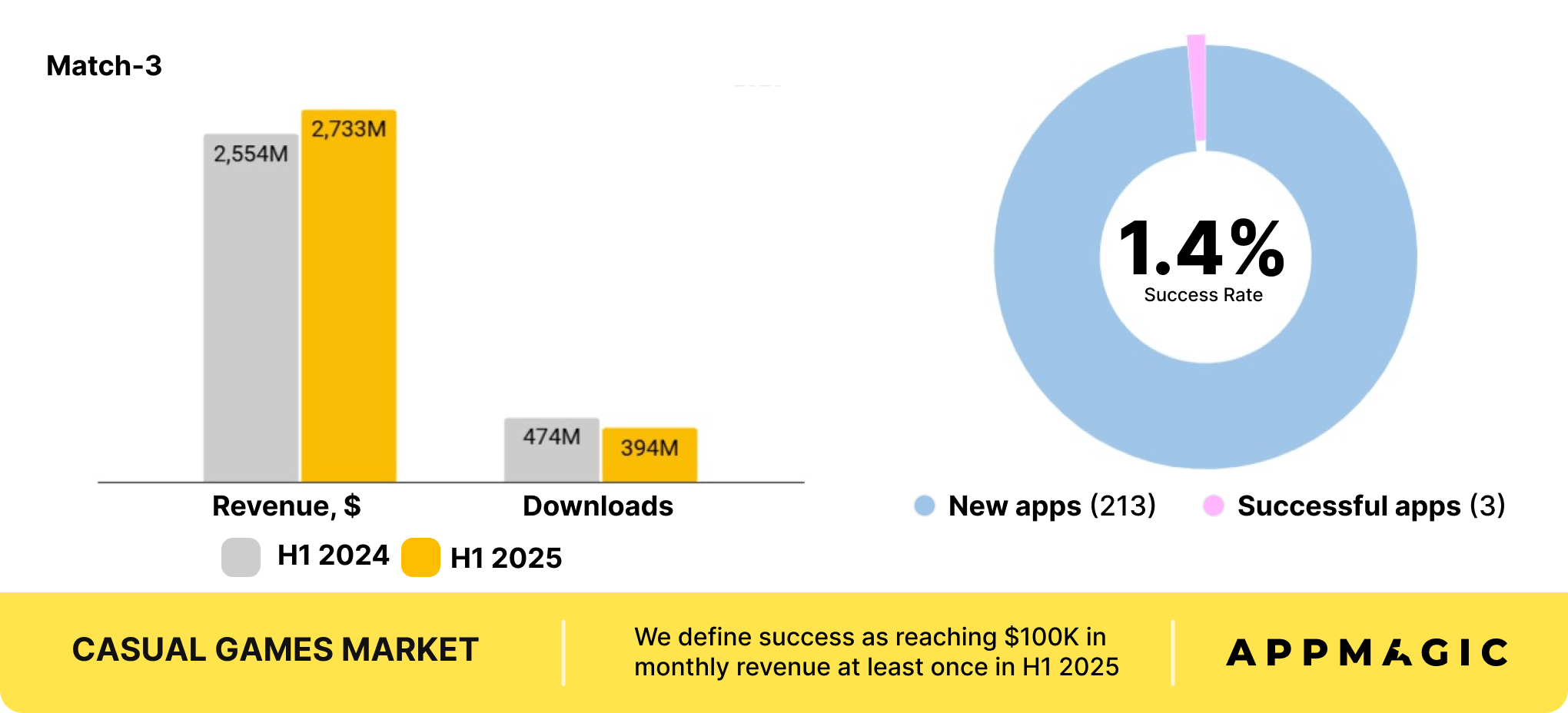

With over $2.7B in revenue and 395M installs, Match-3 remains one of the largest and hardest genres to break into. And yet, despite a 17% drop in downloads, the genre still showed 7% YoY revenue growth in H1 2025.

What really matters, though, is where this growth came from. It wasn’t the new hits—it was the dominance of its long-standing leaders:

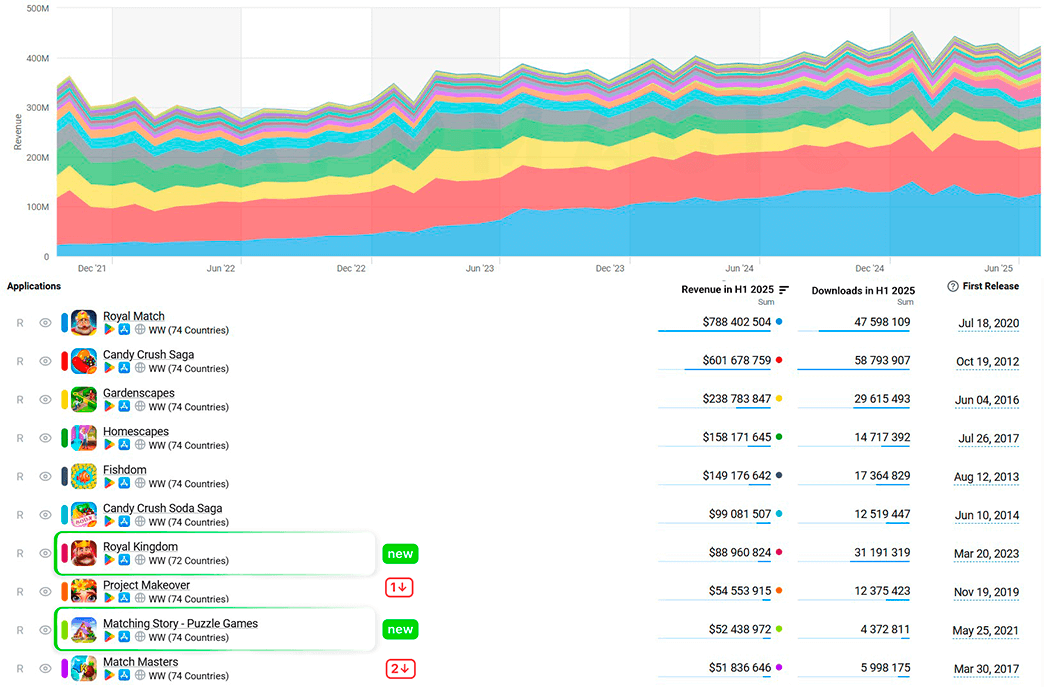

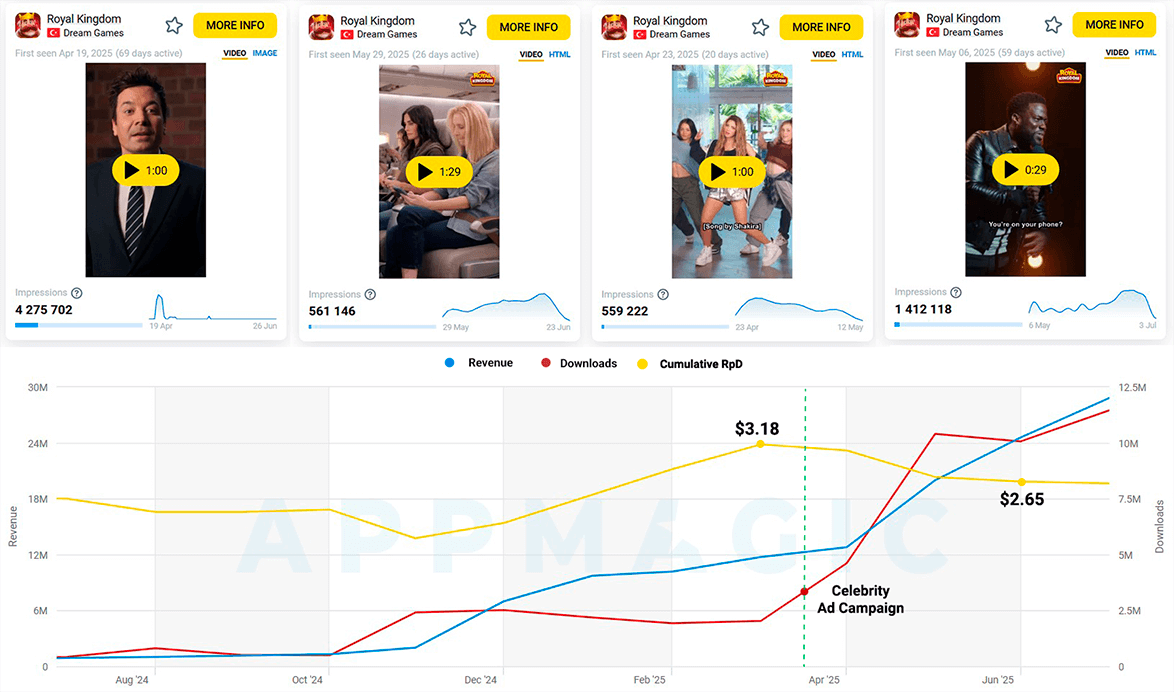

- Royal Match by Dream Games grew by 15% YoY, reaching $788M

- Candy Crush Saga by King grew by 11% YoY with $602M revenue

While Royal Match saw its growth slow down toward the end of the half-year, it still firmly holds the top position in the genre. Meanwhile, Candy Crush Saga is hitting new highs more than a decade after launch: H1 2025 is its best half-year in terms of IAP revenue across the entire period covered by our data, which goes back to 2015.

Together, these two games account for more than half of the genre’s revenue. Without them, Match-3 would have shown almost no movement at all—just a tepid +1% YoY fluctuation, from $1328M to $1343M, which is well within the margin of error.

Market Segment Dashboard: Match-3

However, that doesn’t mean that nothing is happening in the genre. One of the biggest events in recent Match-3 history came at the end of November 2024—the release of Dream Games’ second title, Royal Kingdom. When we were finishing the Casual Games Report 2024, there was simply not enough data yet to evaluate the game’s performance.

At the time, our initial assessment led to two key conclusions:

- Royal Kingdom not only had some big shoes to fill, but also shared many core elements with its predecessor, making Royal Match a competitor in its own right.

- In its first few months, the game’s performance was on par with Royal Match during its early launch phase.

Turns out, not much has changed in H1 2025, and this is good news!

Royal Kingdom is still holding strong: seven months into its release, the game has so far earned around $98M. For comparison, Royal Match earned $116M during the same post-launch period. While the gap might seem significant, Royal Kingdom outperformed its predecessor in the seventh month ($25M vs $21M), which means the overall balance mаy even out in the coming months.

App Comparison Dashboard: Royal Match vs Royal Kingdom

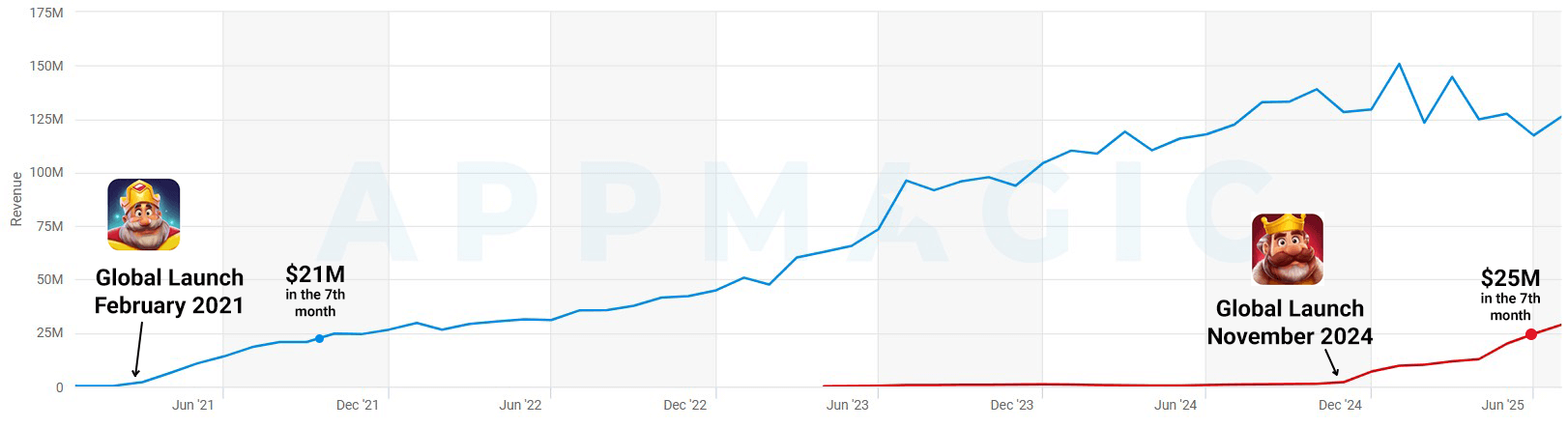

At the same time, Royal Kingdom saw notable growth in installs, more than doubling its monthly downloads twice in a row: from 2M in March to 4.6M in April, and then hitting its highest peak at 10.4M in May. This huge surge was fueled by an ambitious UA campaign launched in mid-April, featuring high-profile celebrities such as LeBron James, Shakira, Jimmy Fallon, Courteney Cox, and Kevin Hart.

Clearly, the campaign was a blast—you see that downloads spike, right? But there’s a catch. The campaign targeted a broad and diverse audience, and the main question across the industry at the time was whether or not those users would actually stick around and spend. With campaign costs likely sky-high, getting the downloads was only part of the job; converting that reach into real revenue was the true challenge.

Ad Intelligence: Royal Kingdom creatives

Let’s see if the company managed to pull it off. On the one hand, revenue growth appears to be keeping pace with installs. On the other hand, RpD tells a different story: after steadily rising post-launch and peaking at $3.18 in March 2025, cumulative RpD dropped to $2.65 by June. So, what’s going on?

As a matter of fact, it’s not necessarily a bad sign. The decline has nothing to do with performance in the US market, which accounts for 73% of the company’s revenue and has maintained stable metrics even after the campaign was over. Instead, the drop in global RpD comes from a surge in downloads from lower-LTV countries, which shifted the overall traffic composition and brought the average down.

Meanwhile, Royal Kingdom is steadily gaining momentum in the charts. Dream Games clearly has both the resources and the confidence to support large-scale UA campaigns, and even bold, expensive bets like this one might pay off in the long term. After all, no one enters Match-3 these days expecting short-term ROAS or quick wins.

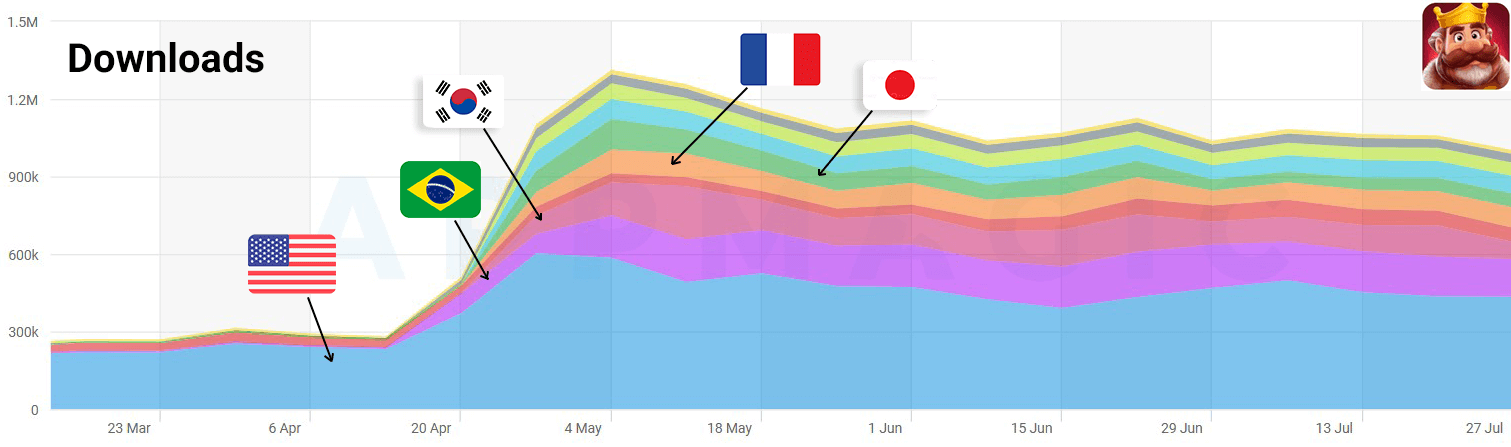

Royal Kingdom downloads by country

Other than that, the genre didn’t see many changes. With a success rate of just 1.4%, only three titles managed to surpass our $100K/month benchmark during H1 2025: Family Farm Match, Puzzle SEVENTEEN, and the bronze medalist with a name originally in Japanese: 君のことが大大大大大好きな100人の彼女ビビーン!!とパズル. In case you’re now curious, it translates as 100 Girlfriends Who Really Really Really Love You Vivien!! and Puzzles. Neat, right?

Another release, 假日乐消消 (roughly translates as Holiday Fun), hit its $100K/month only in July, while we were writing this report. But let’s be honest, $100K per month is just the beginning in this genre. To call a Match-3 game a real success, you’d typically expect much higher figures.

Just how high, though? That you can decide for yourself, and we will help you spot these success stories ahead of others. Add our Match-3 Top Apps page to your bookmarks. It’s available to everyone and makes it easy to track changes in daily, weekly, monthly, and yearly charts. You’ll also find plenty of games that didn’t make it into this report!

🎯 Games to watch in 2025:

- Austin’s Odyssey by Playrix: The studio’s iconic character is off on a new adventure. The game is currently in soft launch—once again, as this isn’t its first test run—and we’re excited to see what happens when it finally goes global!

- Matching Story – Puzzle Games by Vertex Games: A rising title that secured the No. 9 spot in the H1 2025 rankings with over $52M in revenue, maintaining steady growth since last year and showing strong symptoms of long-term potential.

- Match Villains by Good Job Games: One of the fastest risers this year, gaining momentum in both installs (jumped 170+ spots in the chart in 2025) and IAP revenue (up 80+ spots).

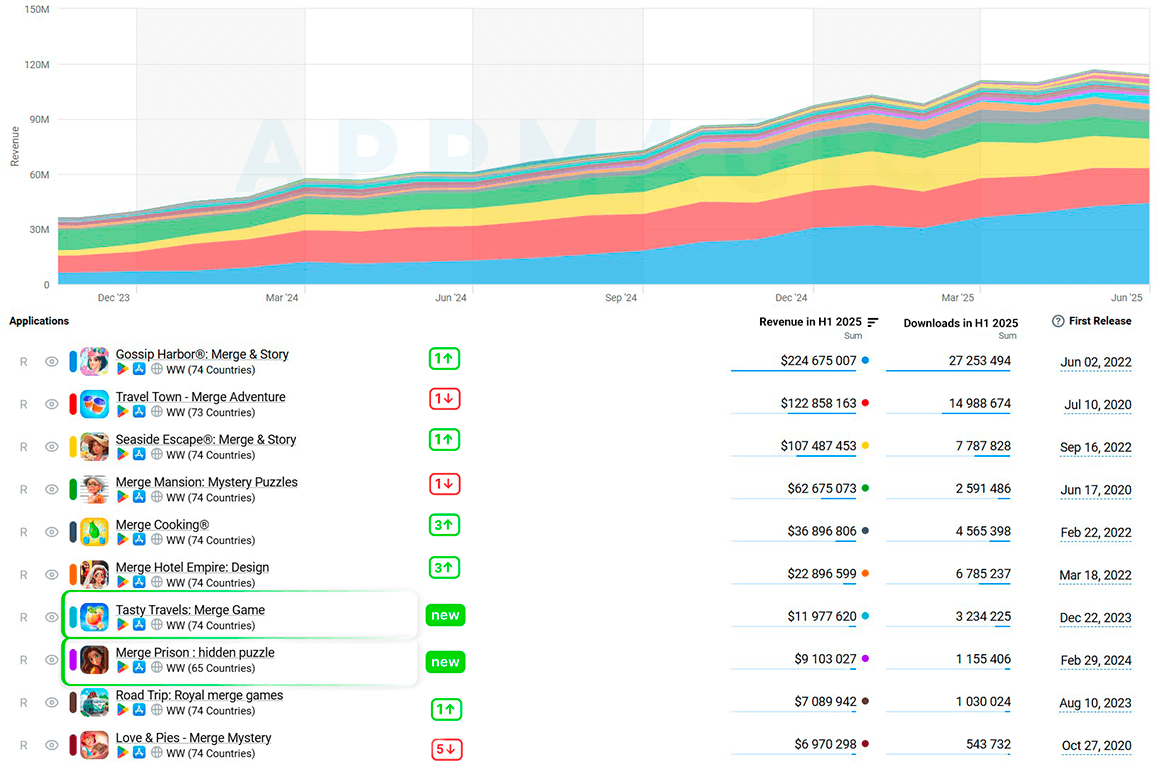

Merge-2 with Complex Meta: The Unstoppable Growth Year after Year

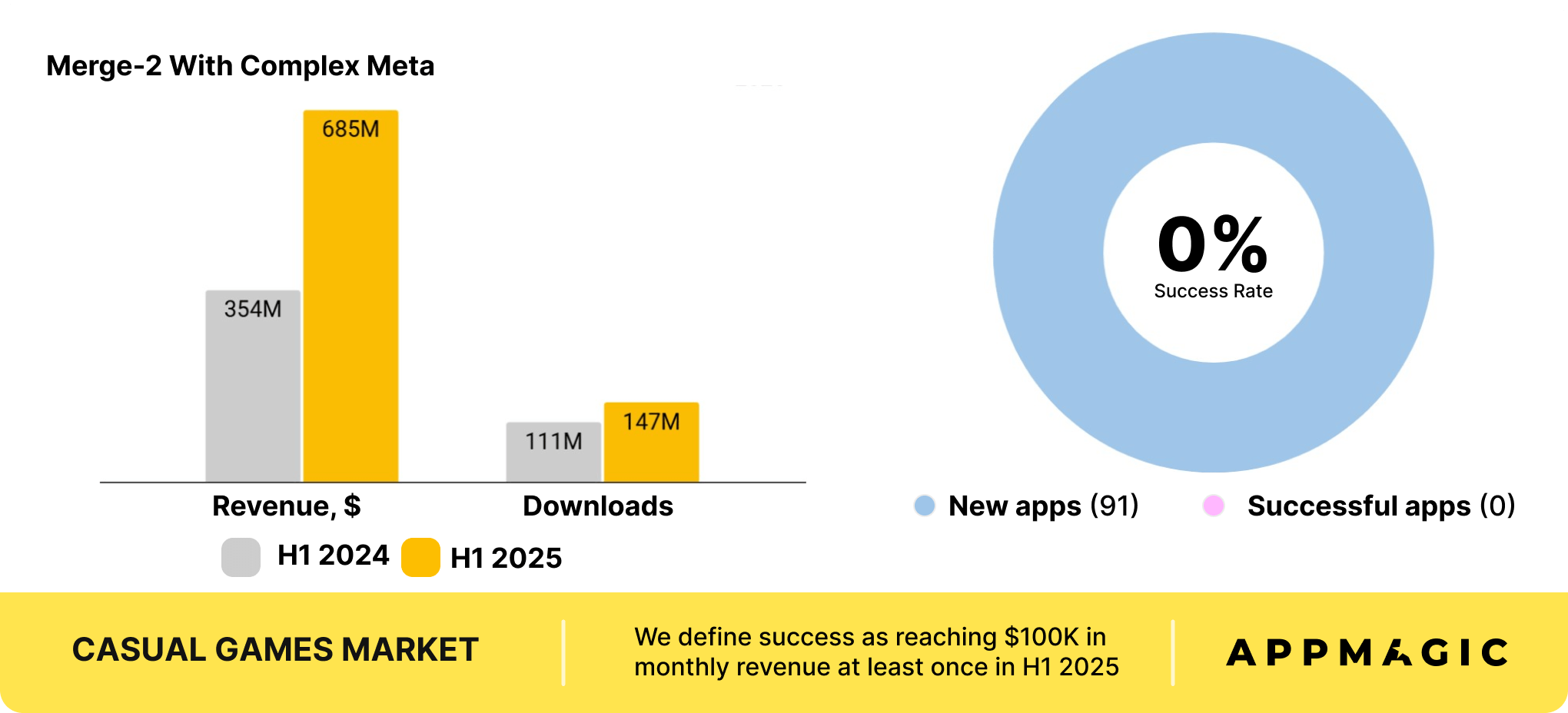

The Merge-2 with Complex Meta genre’s total revenue grew by over 94% YoY in H1 2025, with downloads increasing by 32% in the same period. The fact that revenue growth has far outpaced the installs points to a significant rise in RpD as well: from $3.2 in H1 2024 to $4.7.

While such a dynamic is impressive and might look promising for new developers, the genre is actually becoming harder to break into. As we’ll see further in this section, its top-performing titles rely on rich, well-crafted LiveOps, raising the bar for newcomers who have to keep up from day one. That’s probably one of the reasons why none of this year’s 91 new titles have hit the $100K/month milestone.

And it’s not just the new studios feeling the heat: competition at the top is just as intense. Two new titles broke into the Top 10, while the rest kept rotating positions, with not a single game staying in one place. For comparison, in Match-3, the Top 6 titles didn’t move at all!

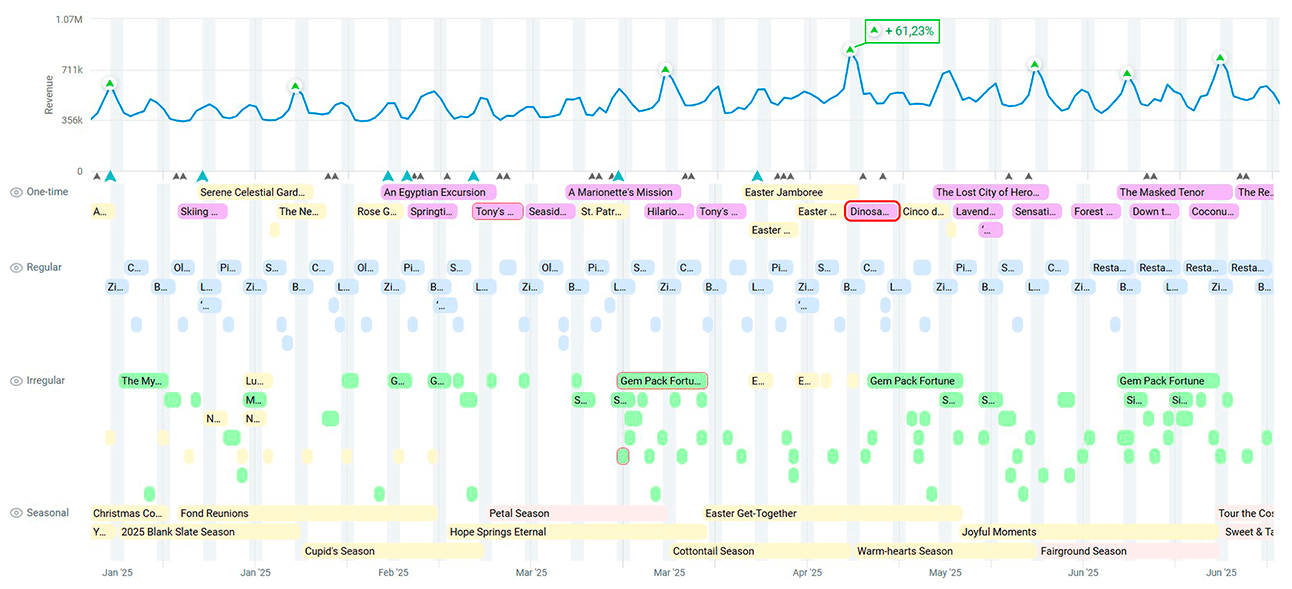

For most of 2024, Travel Town dominated the genre. However, by October, Gossip Harbor had pulled ahead—and as of H1 2025, it still hasn’t given up the crown. A key factor in the game’s continued leadership is its thoughtful and adaptive use of LiveOps. Frequent events, layered progression goals, and targeted reward systems keep players engaged and spending, driving both retention and revenue.

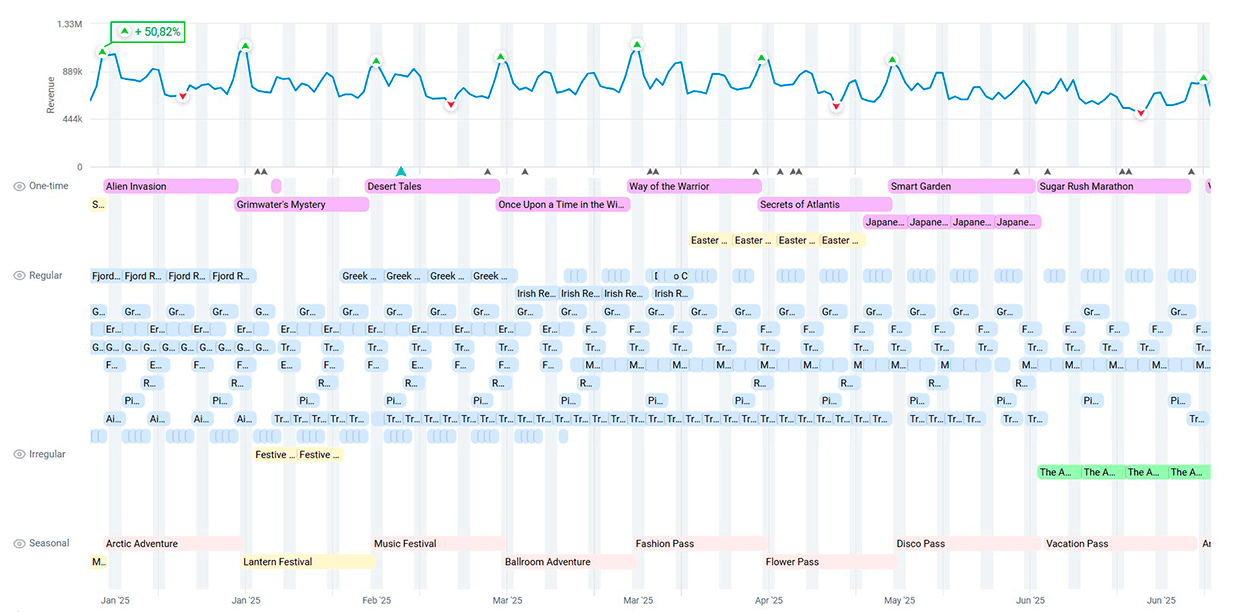

Using AppMagic’s LiveOps & Updates Calendar, we can track a variety of event formats and lengths, strategically combined to match various player motivations. One standout result in H1 2025 came from the Dinosaur Discovery event, which was associated with a ~60% revenue increase. To be fair, it wasn’t just one event that did the job: the real impact came from how it was timed and stacked with others, especially with the start of a new battle pass. Still, the events with separate merge decks are a part of regular rotation and often get reskinned, which is another sign of their effectiveness.

Gossip Harbor’s LiveOps & Updates Calendar

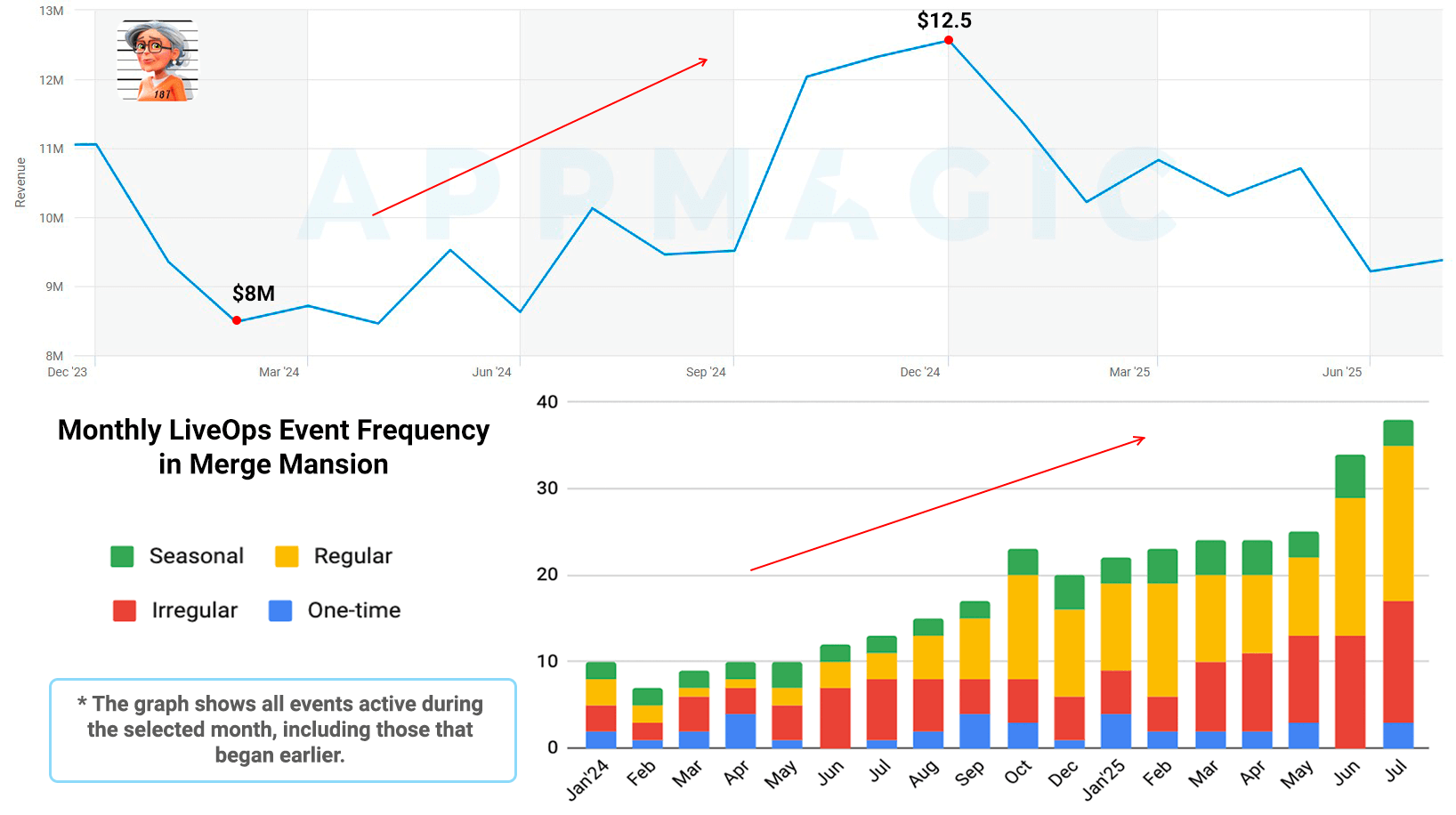

Strategic event planning like this can directly impact IAP performance, especially when it creates urgency and value. Not so long ago, we covered how Merge Mansion, the long-time top-grossing title, doubled down on LiveOps after losing its dominance and falling from the 1st to the 4th position in the genre. While it didn’t reclaim its spot, the numbers speak for themselves: from 5 events a month and $8M revenue in February 2024 to more than 15 events and $12.5M in monthly revenue by December.

We put together a detailed analysis of how Merge Mansion improved its LiveOps and achieved a 50% revenue boost. The piece was produced in collaboration with our partners at GameMakers—and it’s definitely worth a read.

Merge Mansion revenue dashboard

In H1 2025, the game showed revenue growth compared to H1 2024—which, to be honest, was one of the weakest periods for the game lately. That’s why we’re seeing a YoY increase of 18%, even though performance in recent months has been far from strong, as the chart above shows.

Yes, the game failed to carry the momentum it had built last year, despite adding more events to its LiveOps schedule. This can be partially explained by the new reality: Merge-2 players now expect frequent, high-quality LiveOps by default. In today’s competitive environment, LiveOps is essential just to stay relevant—but even the best events are no longer a silver bullet for success.

💡 Want to learn more? Take a look at Merge Mansion’s events in our LiveOps & Updates Calendar.

Overall, the story of Merge-2 shows that strong market growth doesn’t mean easier entry. With tough competition from long-standing leaders, newcomers now have to think ahead, developing LiveOps and meta systems, earlier than ever before. But here’s the good news: the top Merge-2 titles are packed with ideas worth borrowing, offering plenty of inspiration for studios ready to take notes.

Actually, there is even better news: we’ve already collected the most valuable insights from casual LiveOps—including Merge-2 and other Puzzle genres—in one place. Have a read of our 70-slide report here.

🎯 Games to watch in 2025:

- Tasty Travels: Merge Game by Century Games: The game made its way into the Top 10 this year and keeps growing its revenue as we write this report.

- Flambé: Merge & Cook by Microfun: A new game from the developers of Gossip Harbor and Seaside Escape, so what else is there to say? Well, how about this: the game climbed 270+ spots in the top-grossing charts and keeps growing as you are reading it!

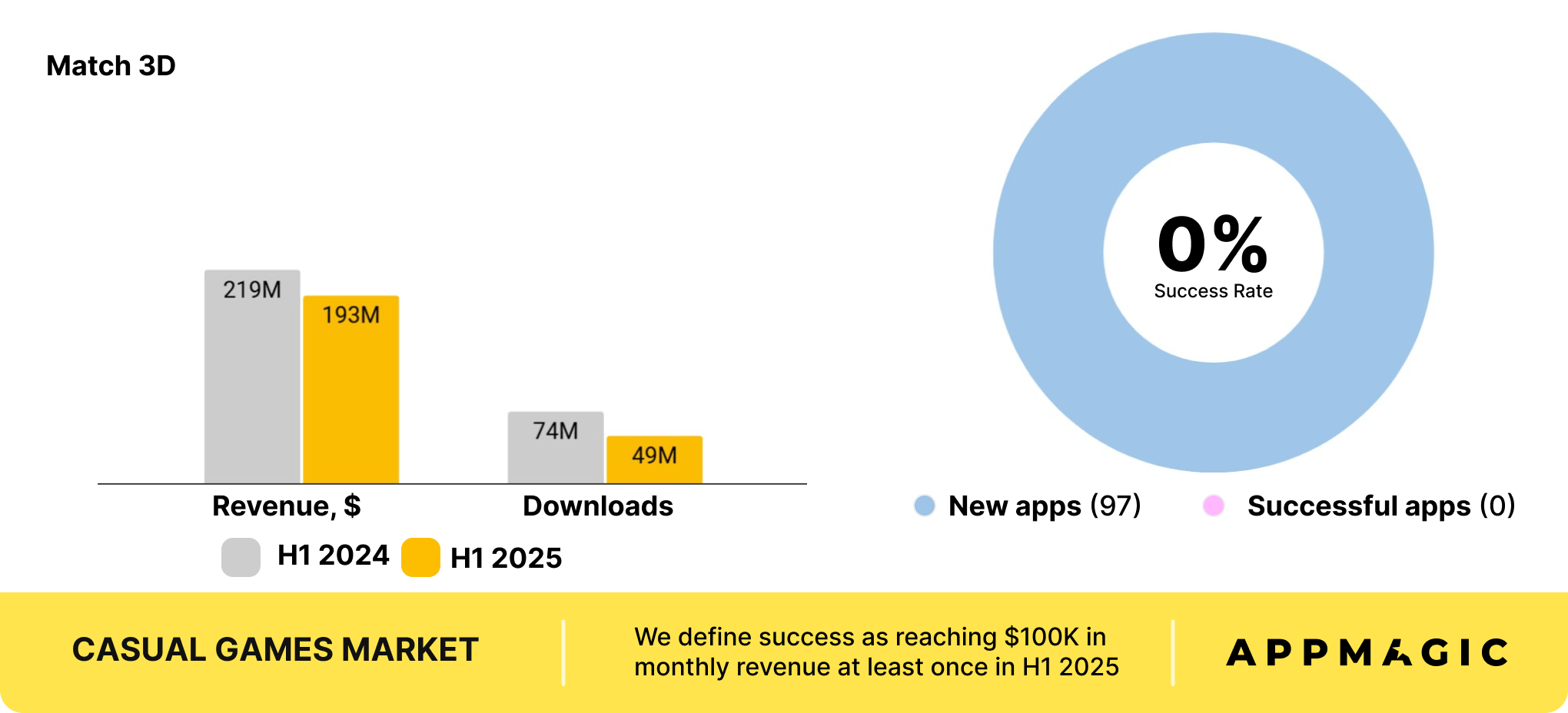

Match 3D: High Expectations Going Low

Back in 2024, Match 3D looked like the next Casual breakout. It evolved fast, shifting away from its Hypercasual roots with meta features, adjusted progression curves, and refined monetization tactics. Last year, the genre nearly doubled its revenue and hit a record $219M in H1 2024. Such an outstanding performance set high expectations across the industry, and we were no exception!

Unfortunately, the momentum didn’t carry into 2025: revenue declined by 12% ($193M), and downloads tanked by 34% to 49M. As a result, YoY growth stalled, and none of the new titles surpassed our $100K/month success benchmark.

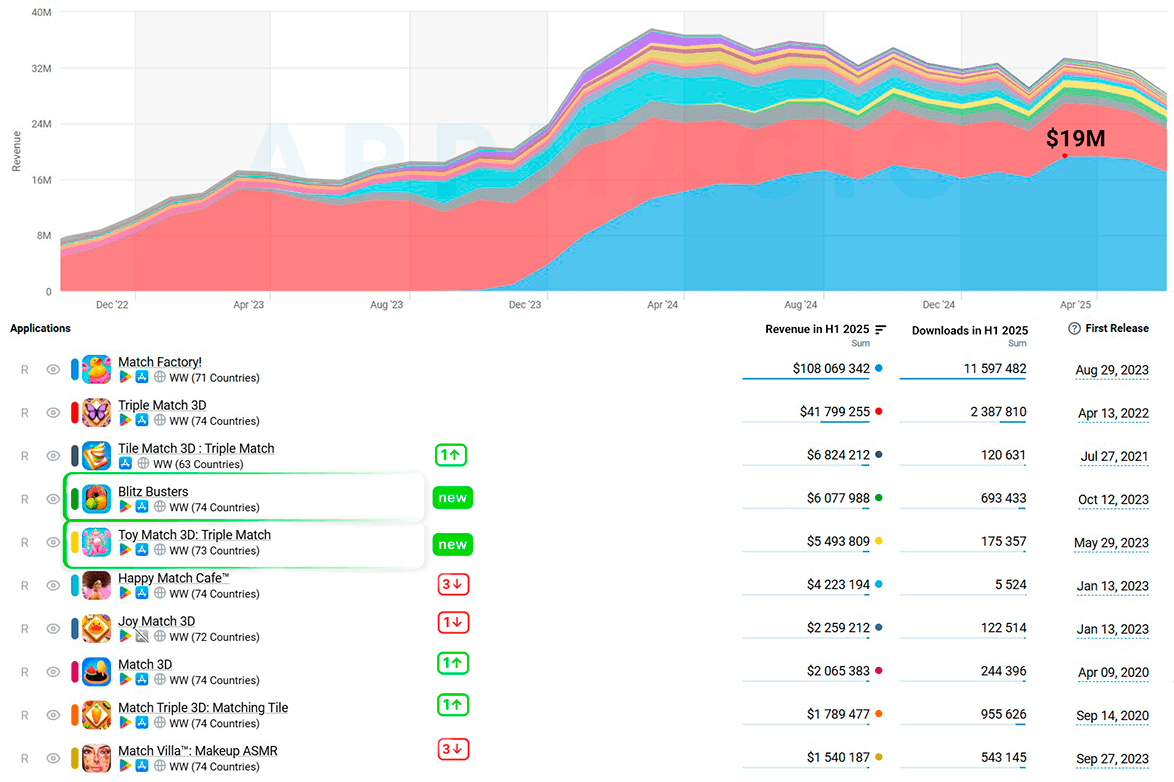

Match Factory! accounted for 56% of the subgenre’s total revenue in H1 2025, increasing its market share and hitting $19M in monthly revenue—an all-time high for a Match 3D game. Triple Match 3D holds a solid 22%, while the remaining 22% (roughly $42M) is split among all the other games in the category. Despite this tough landscape, Blitz Busters and Toy Match 3D: Triple Match have found their way into the Top 5, generating $6M and $5.4M, respectively.

This suggests there’s still room to grow, but only for those who execute well. Once again, the game’s success comes down to a smart mix of balanced LiveOps and best practices borrowed from bigger genres like Match-3, Merge-2, and Casual Casino—all built on top of a unique and polished gameplay. We explored this formula in more detail in our previous casual games report, which you should definitely take a peek at to get the full picture!

Not long ago, Match 3D was one of the hottest Casual genres, and many studios still chase its former success. But in H1 2025, its relevance is fading. Now, Hybridcasual Puzzle games—with similar core simplicity and light meta—are stepping in to shape player expectations and define the new directions for the market.

🎯 Games to watch in 2025:

- Blitz Busters by Spyke Games and Toy Match 3D: Triple Match by PLAYNEXX: Both recently broke into the grossing Top 5, and show an extremely high RpD in the US: $13 and $27 respectively.

- Box Jam! – 3D puzzle by Playoneer Games: The game borrows design and themes from the growing Hybridcasual Puzzles, making players look for blocks, spools, and screws.

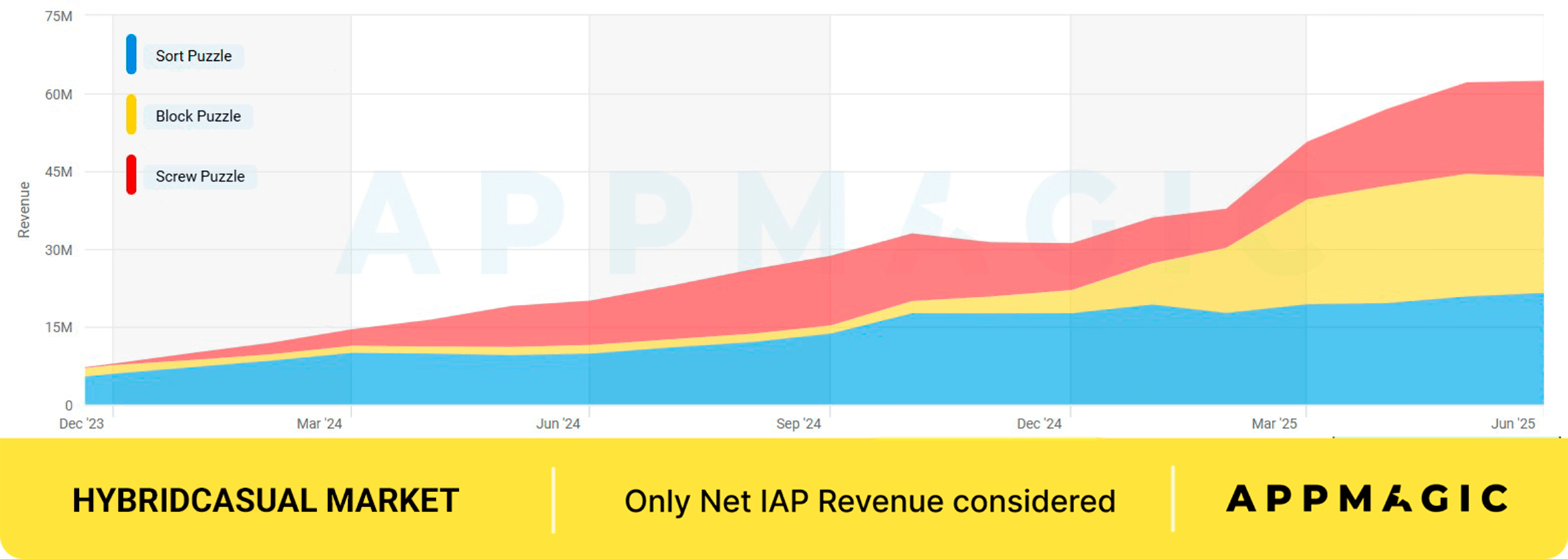

Hybrid + Casual Puzzle: Screw, Sort, and Block

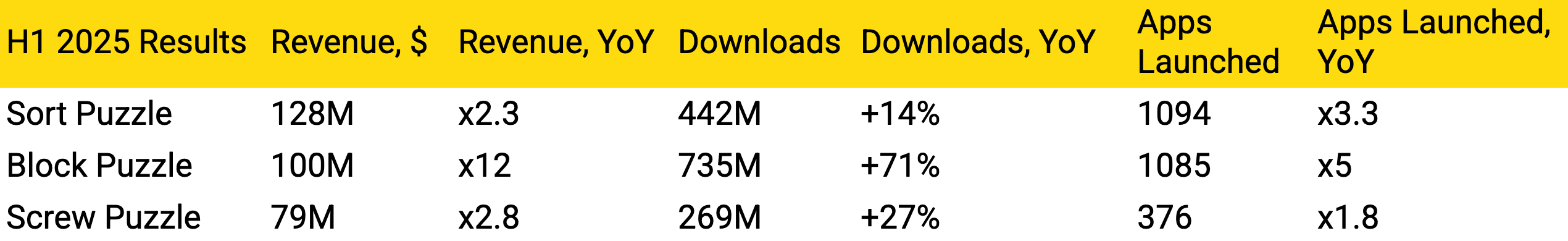

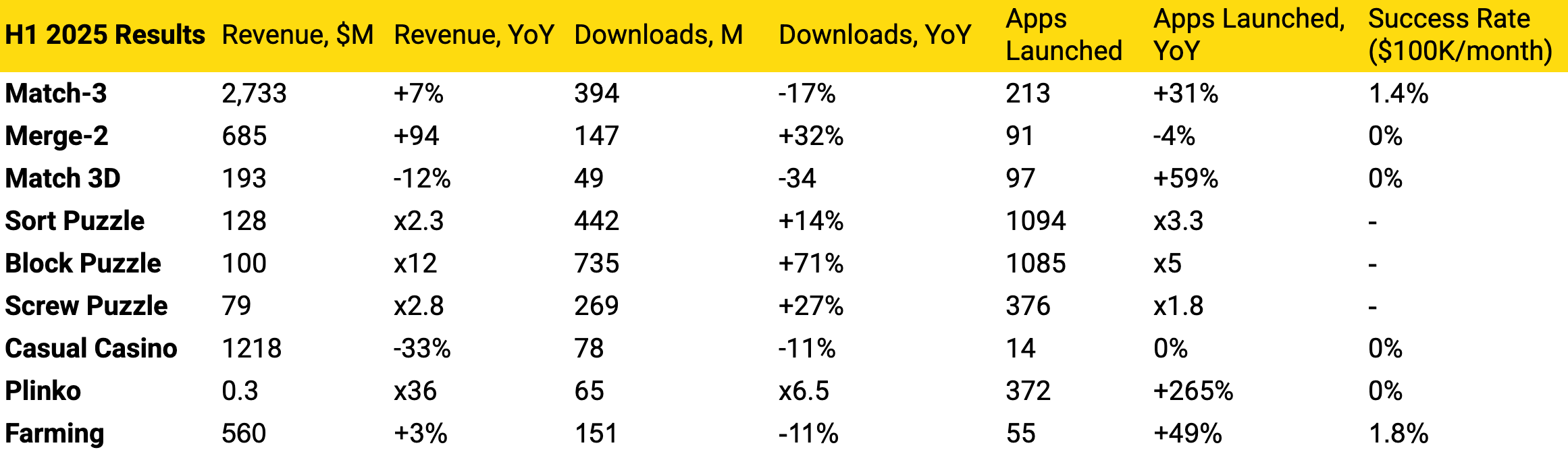

If you scrolled down to this section right after opening the report, we totally understand. Screw, puzzle, and block are some of the most used words in the industry these days, and that’s no surprise. Let’s just look at the YoY numbers for H1 2025:

- Block Puzzle: Revenue x12

- Screw Puzzle: Revenue x2.8

- Sort Puzzle: Revenue x2.2

Such explosive growth shows the power of Hybridcasual in 2025. These genres carved out a solid space between Hypercasual and Casual, mixing their simplistic and addictive core mechanics with deeper meta layers, LiveOps, and refined monetization.

That balance between Casual and Hypercasual, however, is a tricky thing, and many devs approach it differently. Some lean more toward deeper meta and richer LiveOps, while others focus on simpler experiences and do the opposite. As a result, some of those Puzzles are classified as Casual, while others still bear the Hypercasual tag in our classification. To avoid confusion, we decided to keep the genres as is: some Casual, some Hypercasual, most Hybrid.

Hybridcasual puzzles revenue dashboard

Hybridcasual by nature, these Puzzle games combine both IAP and IAA, but rely on ads more heavily than classic Casual Puzzles typically do. Therefore, applying a flat $100K/month IAP benchmark here wouldn’t be entirely fair.

Either way, there are a lot of newcomers! In H1 2025, over 2,500 new games were launched across these three genres—more than 1,000 titles each for Sort and Block Puzzle, while Screw Puzzle added another 376 to the mix.

Curious how Hypercasual evolved into something deeper? Read our Top 10 Hybridcasual Games of Q1 2025 overview to learn more!

Compared to the revenue surge outlined above, downloads didn’t grow as explosively: +14% for Sort Puzzles, +27% for Screw Puzzles, and +71% for Block Puzzles. This contrast reflects a structural shift. These games have long been relatively strong in downloads, thanks to their simple Hypercasual core. What changed in 2025 is monetization. After transitioning to a Hybridcasual model, their revenue started growing from a very low base, resulting in sharp YoY jumps.

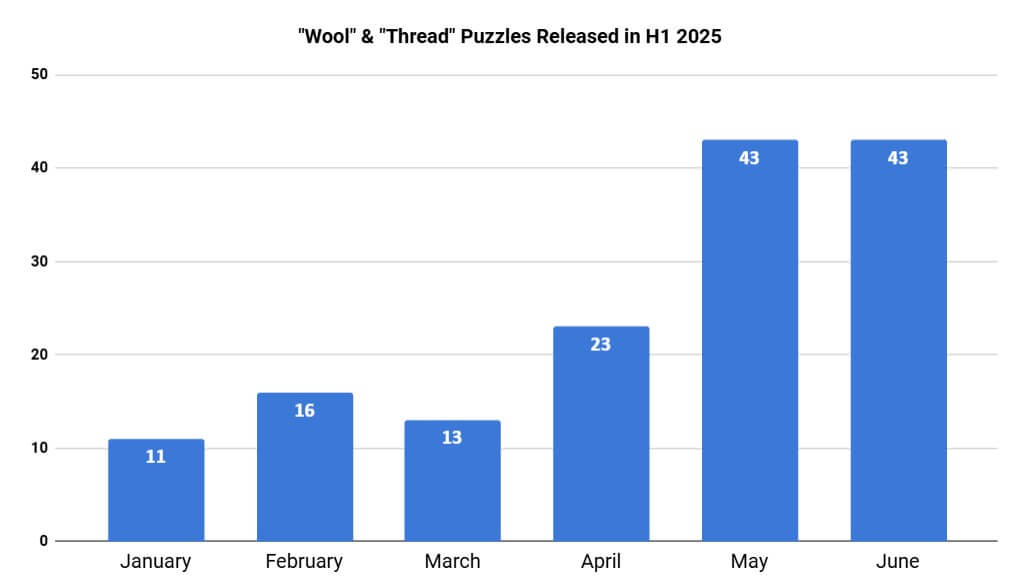

This evolving space offers fertile ground for innovation and growth. New ideas emerge fast, and one standout example is Wool Sort, a new title that climbed the charts rapidly in April and reached 7M total installs in Q2 2025 alone.

The game brought a creative twist to Screw Puzzle mechanics, swapping bolts for spools of colorful thread that players sort and weave into complete images. While Wool Sort still leans toward Hypercasual, it is getting increasingly comfortable in the Hybrid territory and keeps improving its monetization, meta, and LiveOps with each update. Soon after, its breakout success made waves across the market, and the stores filled up with what can be defined as “wool puzzles”.

“Wool” & “Thread” games in our Advanced Search

The developers have jumped on the trend, using related keywords like “wool”, “thread,” “yarn,” and “tangle” in their ASO, along with knitting-inspired icons. Our Advanced Search shows that, from January to June 2025, 149 new titles used “wool” and “thread” keywords, with more than 100 of them launching after April.

We were among the first to pin down the trend and analyse how it was unfolding in real time. Take a closer look here!

These market segments move fast, and chart leaders like Screwdom, Color Block Jam, and Goods Puzzle offer plenty of creative ideas, which can spread across genres. We’ll leave the Hybridcasual deep dive for another time and turn our attention back to the Casual market, but there is definitely more to explore in our next Hybridcasual Report Q2 2025, so stay tuned and keep an eye on our Blog updates!

🎯 Games to watch in 2025:

- Cube Busters by Spyke Games: This Block Puzzle entry from the creators of Tile Busters and Blitz Busters launched in June 2025 is showing great performance as we speak.

- Knit Out by Rollic: A new Sort Puzzle hit from one of the best masters of Hybridcasual, now in the subgenre’s grossing Top 5.

- Wool Craze -Yarn Color Sort 3D by SparkWish: This Screw Puzzle game uses the same 3D perspective as Screwdom but builds on the wool trend as its main theme. And it sure landed the title in the genre’s Top 5 as of now.

Puzzle: Takeaways

Puzzles are huge. But most importantly, they are diverse.

In Match-3, it’s not so much about creative ideas or fresh approaches anymore. Long-term success depends on something else: bigger budgets for UA, LiveOps, and enough financial resilience to survive the long ROAS payback period.

Merge-2 shows a tremendous 94% YoY revenue growth, but that might be misleading. Most of this money comes from the top four players that doubled down on LiveOps and refined their monetization over the years.

As for Match 3D, it can no longer be called one of the best-growing niches in the market. Its momentum has slowed, and the role of “catchy core + simple meta” has shifted to Hybridcasual Puzzle games. Block, Screw, and Sort Puzzles are now the rising stars of the industry, multiplying their revenue thanks to deeper meta layers and a more mature approach to events and monetization.

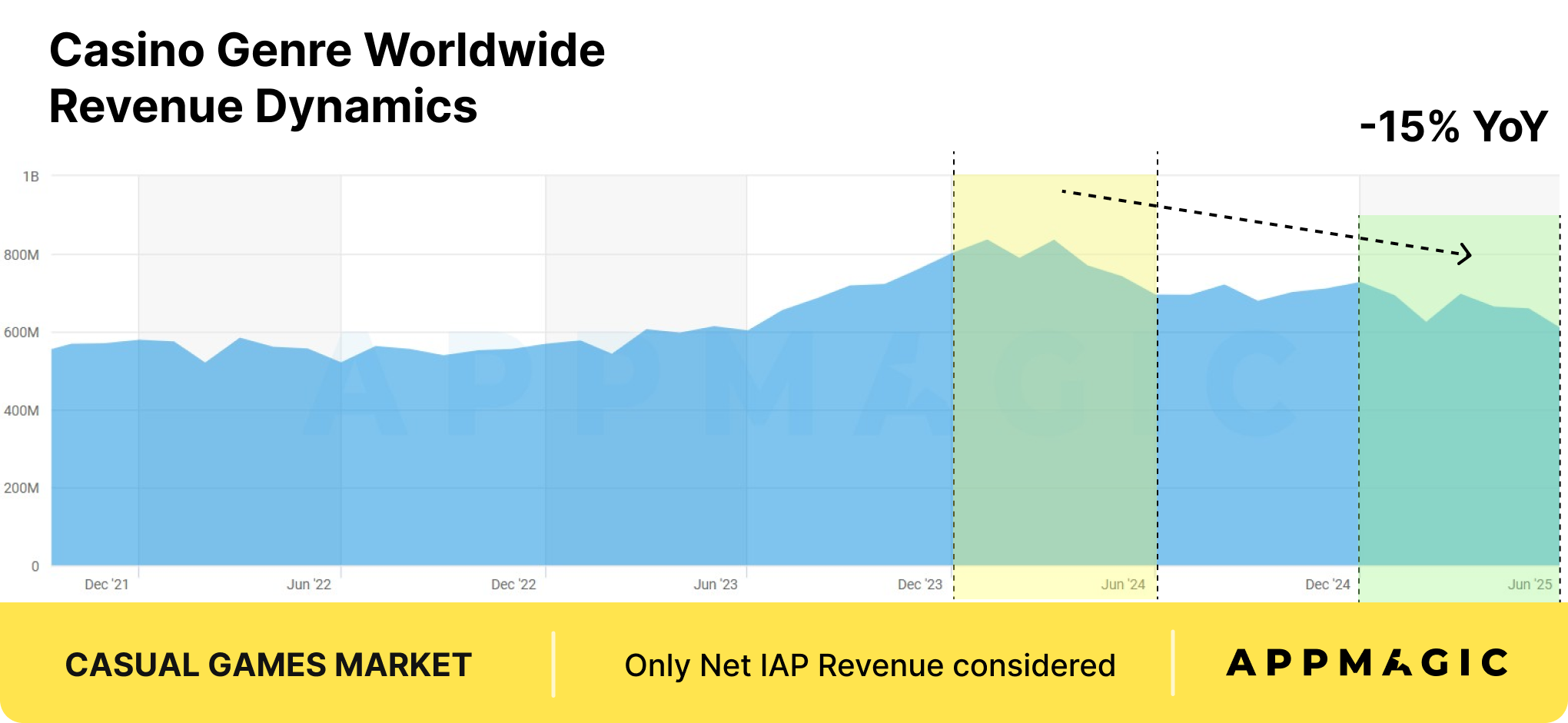

Casino: Influencing the Casual Market

In our classification, Casino is the second largest Casual genre after Puzzles, with almost $4B revenue in H1 2025 (–15% YoY). Its biggest subgenres include:

- Slots: $1.6B Revenue (–7% YoY), 245M Downloads (–8% YoY).Lightning Link Casino Slots, Jackpot Party – Casino Slots, DoubleDown™ Casino Vegas Slots

- Casual Casino: $1.2B Revenue (–32% YoY), 78M Downloads (–12% YoY).Monopoly GO!, Coin Master, Dice Dreams

- Casino Card Games: $455M Revenue (+6% YoY), 229M Downloads (+8% YoY).WSOP Poker: Texas Holdem Game, JJ斗地主-欢乐棋牌休闲合集, Zynga Poker- Texas Holdem Game

While the gameplay of Casino games can certainly be called Casual, their iGaming-inspired aesthetics make both design and mechanics feel quite different from other Casual genres. There is one exception, though: Casual Casino, which is designed to appeal to a more casual audience. In fact, it shows how Casino mechanics, when used right, can add a fresh layer of engagement to Casual experiences.

This is especially clear in LiveOps, where gameplay elements like Monopoly GO!’s dice throws and other Casual Casino-inspired mechanics are increasingly showing up across the broader Casual market. Since the beginning of the year, the use of Casual Casino mechanics in LiveOps has grown by 16.5%.

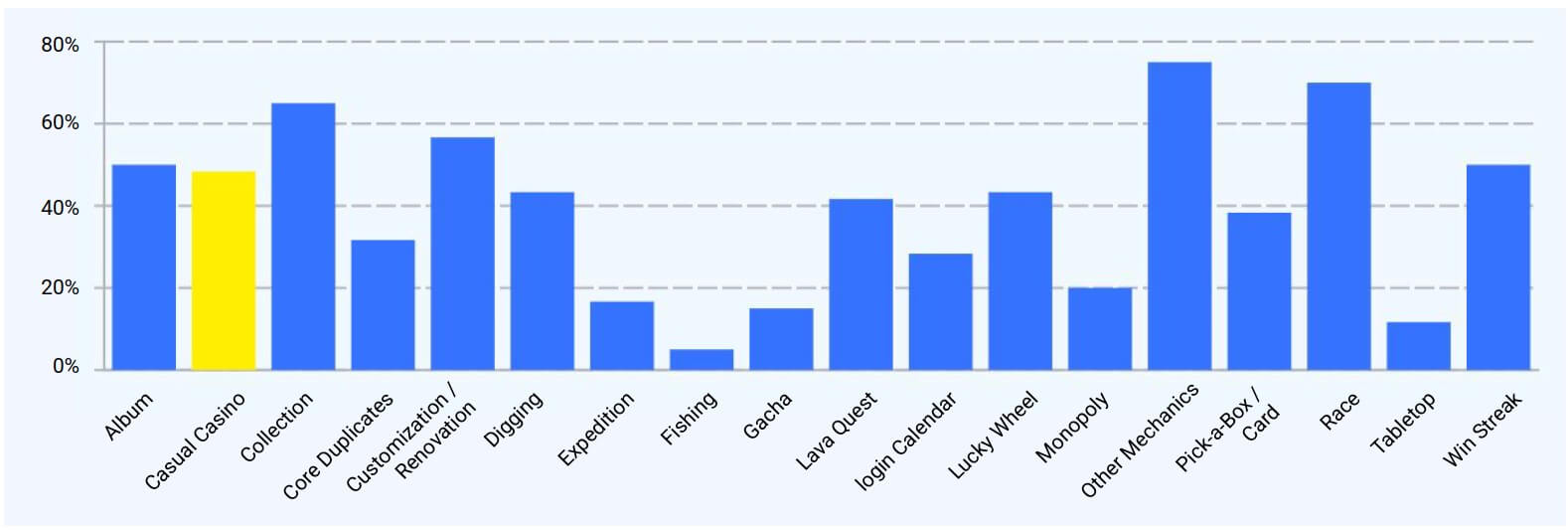

Representation of LiveOps mechanics in H1 2025

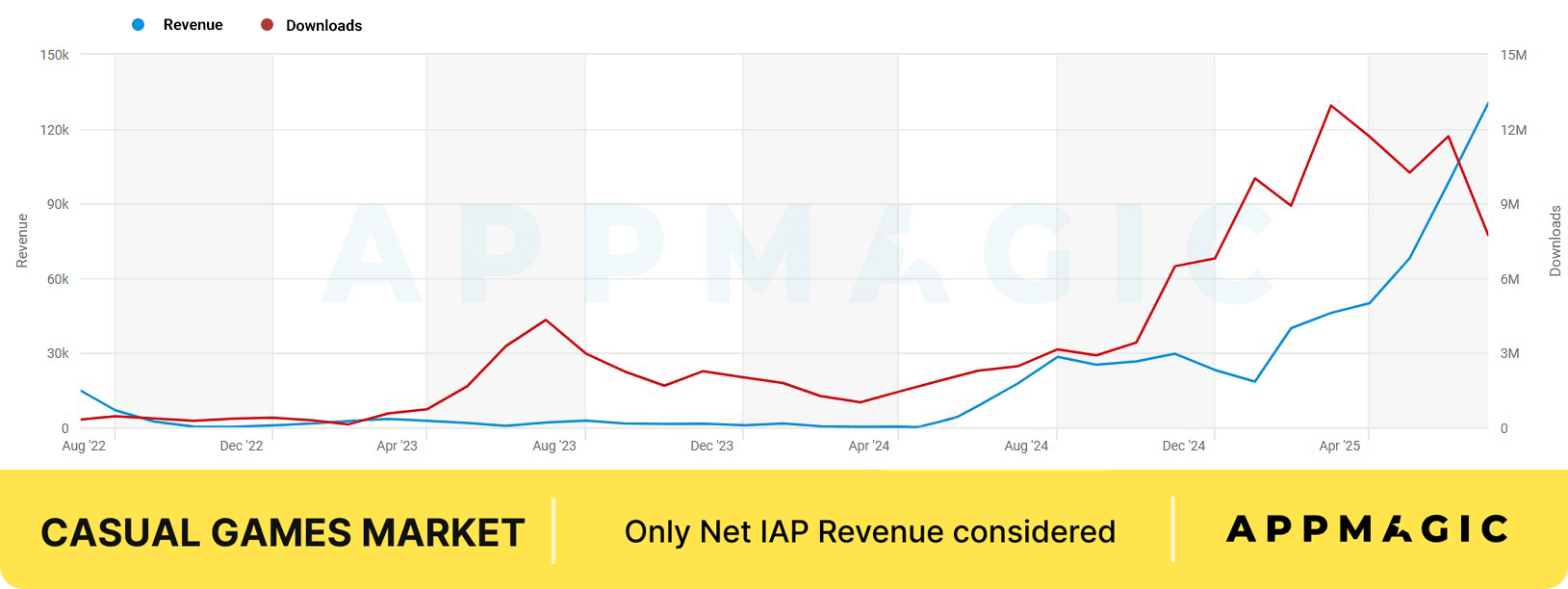

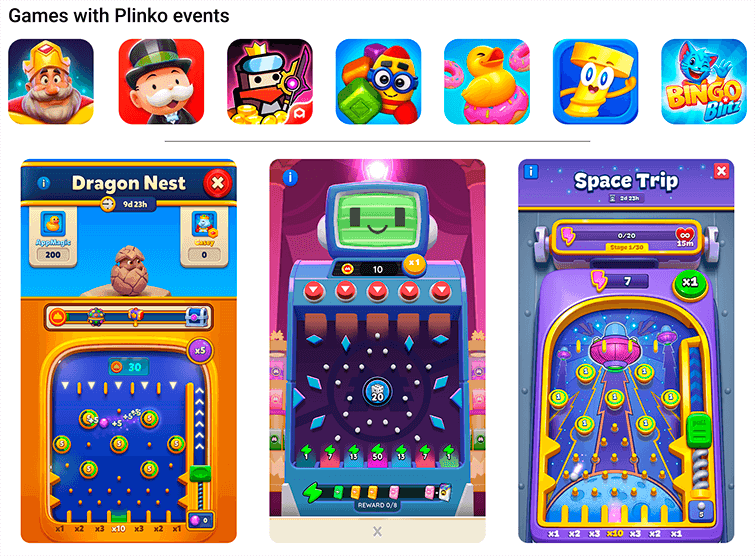

One of such mechanics is Plinko, but in this case, it gets even more interesting, as it’s gaining traction not just as an event format, but as a standalone, fast-growing subgenre.

So, while the broader Casino category might not seem like an obvious fit for a Casual games report, Casino and Plinko are well worth a closer look for anyone trying to understand today’s Casual landscape.

Casual Casino: The New Normal

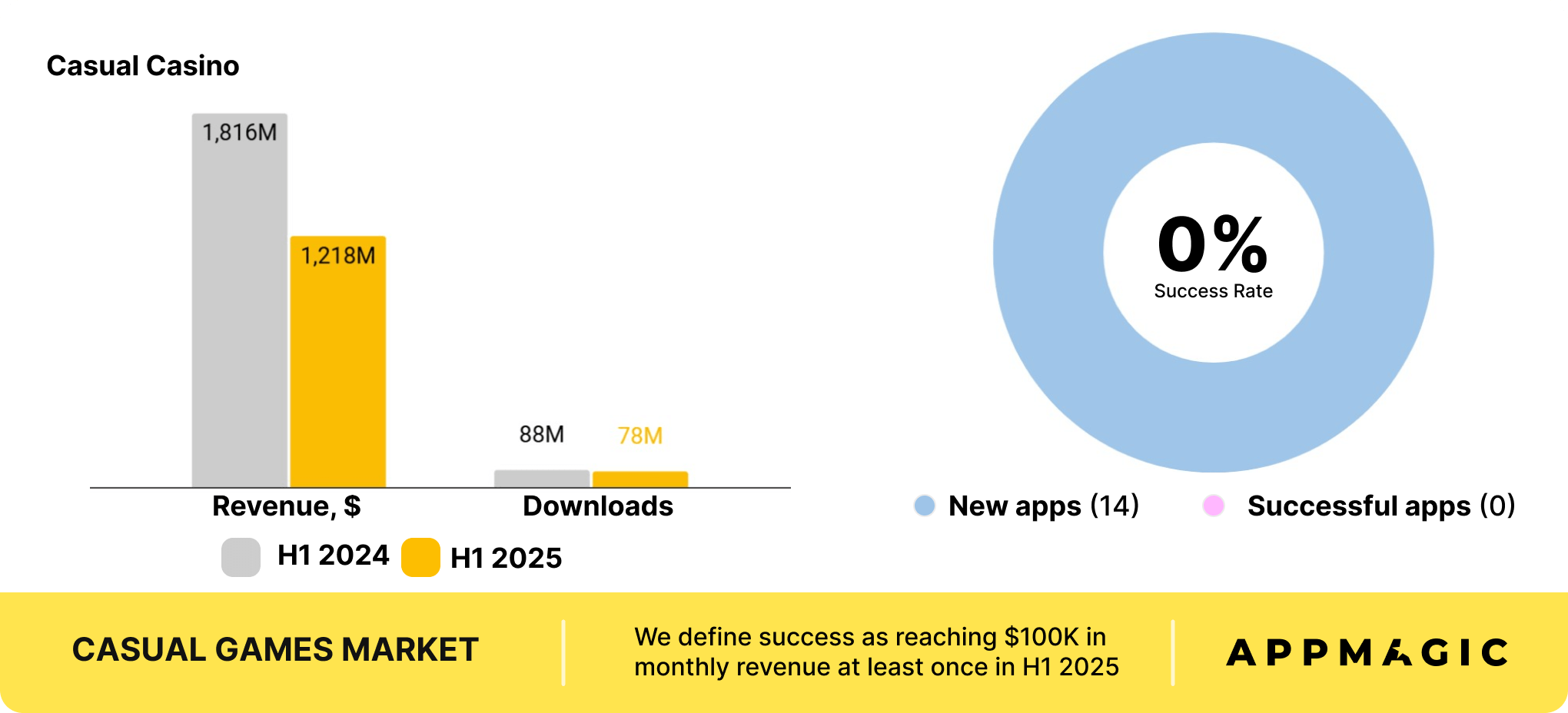

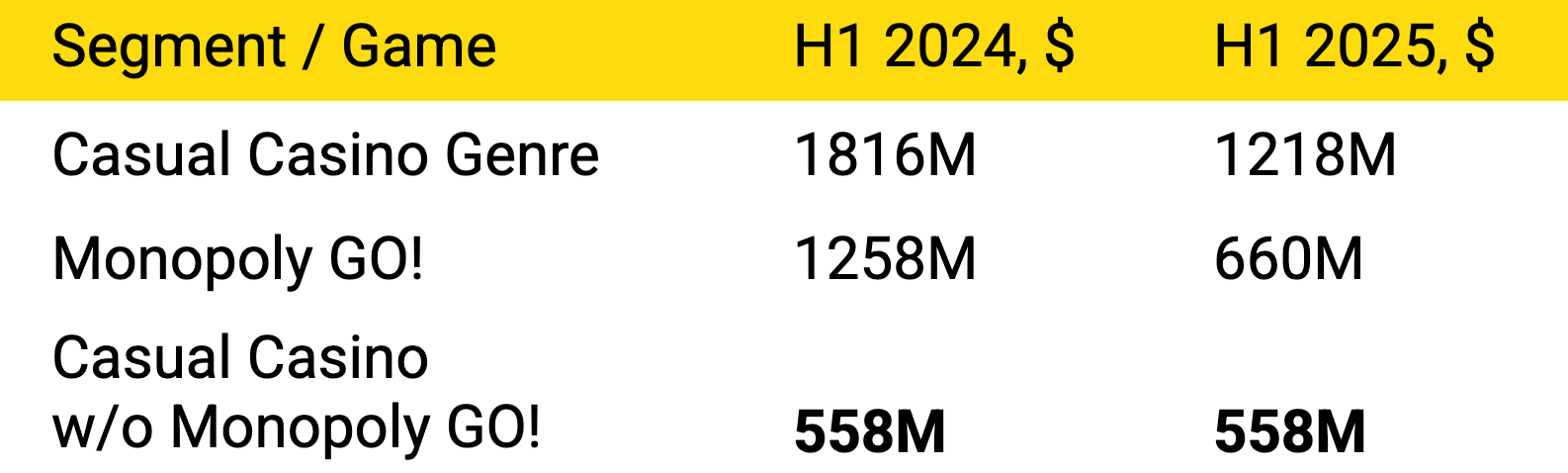

For Casual Casino, the first half of 2025 marked a shift toward a new normal. The genre saw a 33% YoY revenue decline, falling to $1.2B.

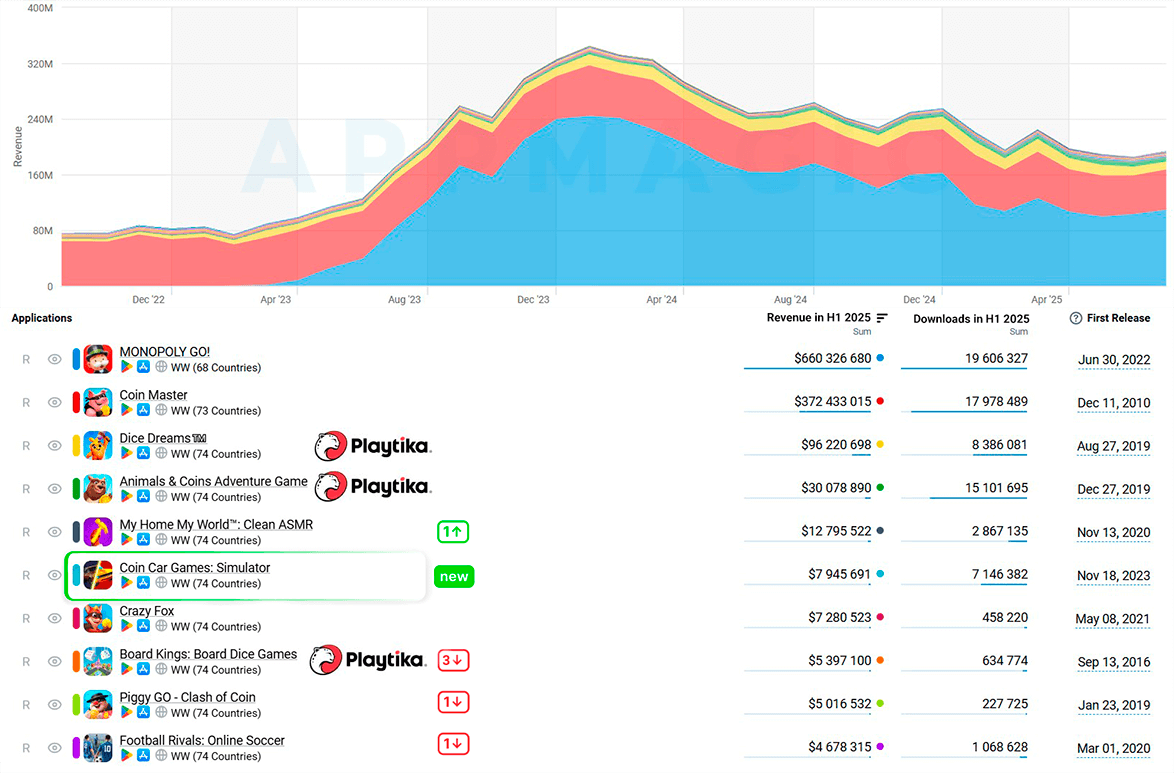

The reason is straightforward: Monopoly GO! scaled back significantly in the second half of 2024. And the game’s influence on the genre is impossible to ignore: in H1 2024 alone, Monopoly GO! generated $1.26B—more than the entire genre earned in H1 2025!

Casual Casino revenue dashboard

But what changes if we exclude Monopoly GO! from the picture? Well, everything. In both H1 2024 and H1 2025, the rest of the genre brought in roughly $558M, showing literally no movement year over year.

In our previous report, we placed high hopes on Playtika, which had made some bold M&As in the genre. In 2024, the company completed two major acquisitions:

- In September 2024, it acquired InnPlay Labs, the studio behind Animals & Coins Adventure Game, the fourth-largest title in the genre, for $300M.

- In November 2024, Playtika made a $2B acquisition of SuperPlay, the studio behind Dice Dreams, the third-largest Casual Casino title.

As a result, Playtika ended up owning four out of the Top 10 Casual Casino titles in 2024. However, the growth we had expected didn’t quite follow. In H1 2025, the company’s Casual Casino games generated $136M: just a 5% YoY increase.

One of Playtika’s Casual Casino games, Pirate Kings, has now dropped out of the top league, making room for Coin Car Games: Simulator by Celestial Roads, which crossed the $1M/month mark in early 2025.

The game continues the trend we first highlighted in the Match-3 space last year, following the success of Chrome Valley Customs and Truck Star. Back then, developers layered a male-first car restoration meta on top of a Match-3 core, and it led them to millions in revenue, but still not enough to hit the top of the genre. Now, we’re seeing the same approach applied in Casual Casino and can’t wait to see where it goes!

Other than that, there’s been almost no movement in the genre. Out of 14 new games launched in H1 2025, none surpassed our $100K/month success benchmark. That is hardly surprising, given that 93% of the genre’s revenue still comes from just three titles.

The genre may be slowing down, but the influence of Casual Casino continues to shape the broader Casual market. We saw clear evidence of this while analyzing the 40% YoY growth in the Clicker/Idle genre, a big share of which was fueled by Carnival Tycoon.

Take a closer look at the game, and you’ll spot all the familiar cues: visuals and gameplay heavily inspired by Monopoly GO! and Coin Master all layered with a Tycoon core. This formula helped it surpass $40M in total revenue, and by May 2025, the game topped the subgenre’s charts.

Casino mechanics are easy to grasp and highly engaging, which explains their ongoing popularity beyond the genre itself. As leading titles spark innovation and growth across the Casual market, we’re seeing some Casino mechanics increasingly integrated into LiveOps strategies across genres—and that’s something we’ll explore in the next section.

🎯 Games to watch in 2025:

- Coin Car Games: Simulator by Celestial Roads: The only new entry in the Top 10. Male-first Match-3 games haven’t managed to compete with the genre leaders yet, but will the formula work better with a Casual Casino core?

- Top Tycoon: Coin Theme Empire by BeheFun Games: The game made over $1M revenue in July 2025. So, while it didn’t make the report period, let’s see how it performs during the rest of the year.

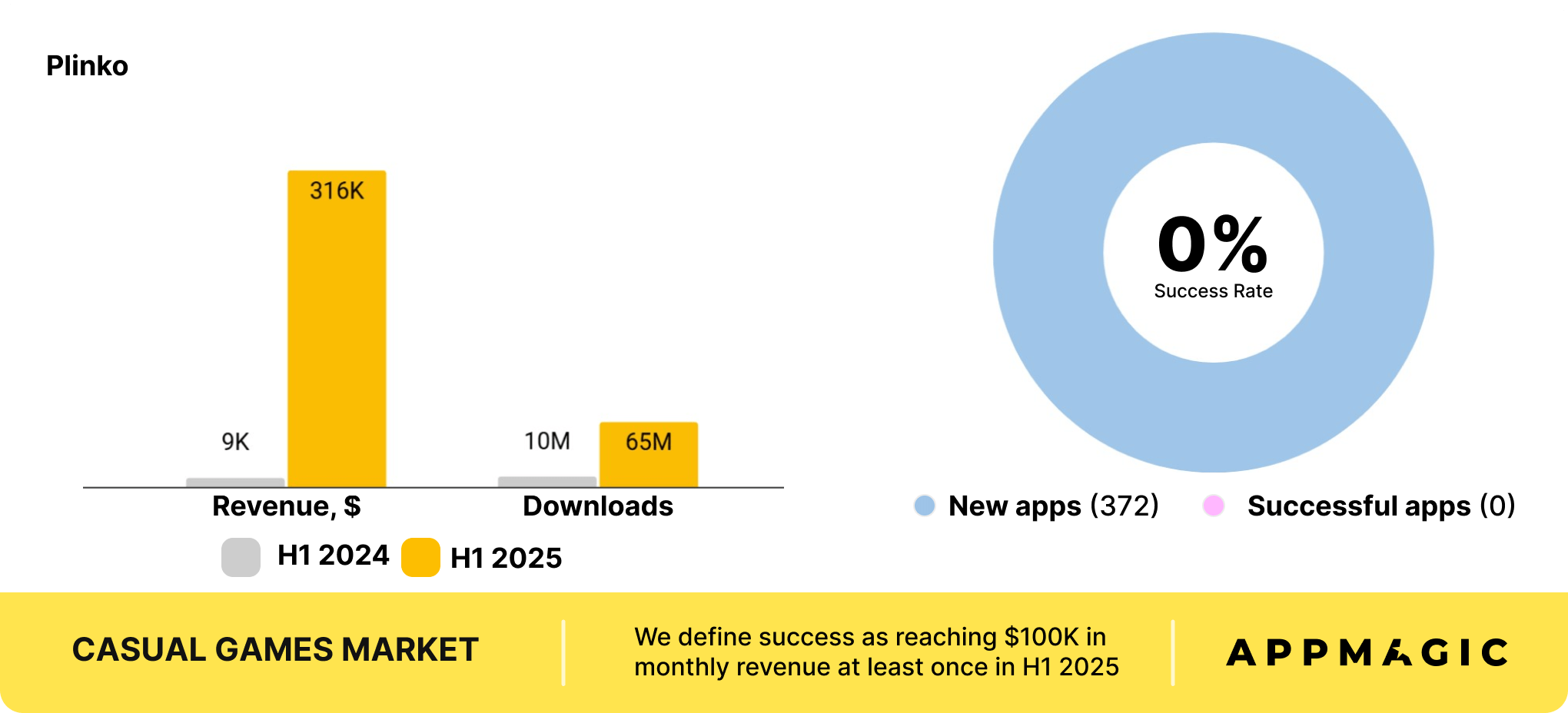

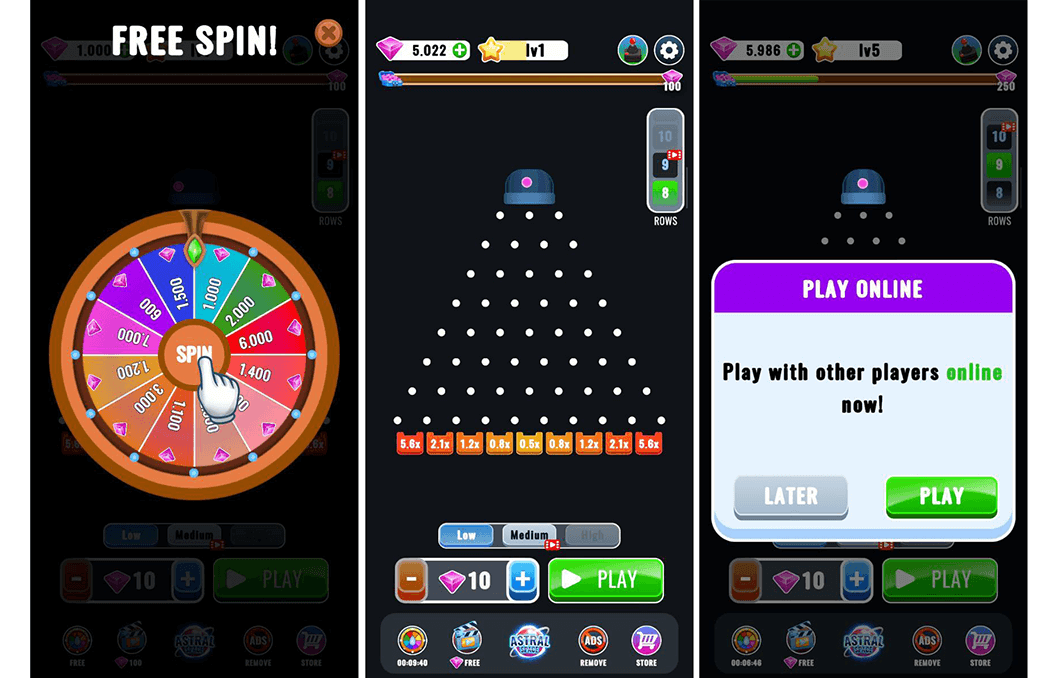

Plinko: The Fastest-growing Casino Subgenre

Plinko is a mechanic where players drop a ball or chip from the top of a vertical board filled with pegs, watching it bounce unpredictably until it lands in one of several reward slots at the bottom. The gameplay is simple, quick, and satisfying, mixing chance with a light sense of control.

For a long time, the entire subgenre was essentially defined by a single top-grossing title: Plinko Galaxy. But in 2025, things started to shift. Plinko games saw an explosive 36x YoY revenue increase, marking the emergence of a niche that barely existed a year ago. As a result, the subgenre now accounts for a “whopping” $316K revenue and 65M installs in H1 2025!

Yes, it’s not much. But this might be the beginning of something bigger, and it’s definitely worth keeping an eye on in the months ahead. After all, this growth doesn’t come from nothing. For years, Plinko-style gameplay has been a staple in LiveOps across Casual games, including Royal Match (Dragon Nest), Match Factory! (Space Trip), Monopoly GO! (Sticker Drop), and Bingo Blitz (Complete Quests For Extra Prizes!). Its popularity is easy to explain: the mechanic monetizes intuitively through extra attempts and boosters, which casual players are already familiar with.

LiveOps & Updates Calendar, Plinko events are most commonly used in:

- Casual Casino: 45%

- Puzzle: 12%

This doesn’t mean, however, that the growth we see comes from the influx of new, casual audiences. On the contrary, Drop Space – Drop Balls x1000, one of the top-performing newcomers that drives the subgenre’s growth, stays close to Plinko Galaxy in both gameplay and visuals, offering a more polished but not fundamentally different experience.

What sets it apart, though, is its more aggressive ad monetization model and a distinct go-to-market strategy: Drop Space – Drop Balls x1000, along with Drop Balls x1000: Drop & Win, targets India and Pakistan, while Plinko Galaxy focuses on the UK and Australia. On top of that, Drop Space launched with a significantly larger UA budget, which allowed it to dominate its target regions, push competitors out of key placements, and scale quickly—something that smaller Plinko titles just can’t afford.

Today, Plinko shows great early potential. However, its future growth might be limited: low long-term retention and a heavy reliance on ad revenue keep the model closer to that of Hypercasual. The move that seems logical after reading through more than half of the report is going Hybrid to deepen and diversify the experience. After that, Plinko might grow into something bigger, though unlikely to compete with the leading Casino genre in the near future.

🎯 Games to watch in 2025:

- Drop Space – Drop Balls x1000 by Joker Game: Current market leader accountable for over 50% of all the IAP revenue and almost 85% of installs in the niche.

- Plink Poly – Plink x1000 by Joker Game: The latest entry from Drop Space developers, first detected in stores by the end of June, so its story will unfold in H2 2025.

Casino: Takeaways

Both during the rapid growth of Monopoly GO! and after it scaled down, Casual Casino has remained one of the hardest genres to enter. Even major publishers struggle to compete organically—forcing companies like Playtika to rely on M&A to acquire titles capable of surviving under the two dominant leaders.

Still, despite being heavily monopolized, the genre remains one of the key sources of innovation for the broader Casual market. Its LiveOps tactics—collection mechanics, dice events, co-op competitions—are now used well beyond Casino.

Plinko is a different example of the same influence: it has already appeared as an event mechanic in many Casual games, which makes it all the more interesting to watch how this new subgenre comes up with its own monetization logic, regional UA strategies, and growing developer interest.

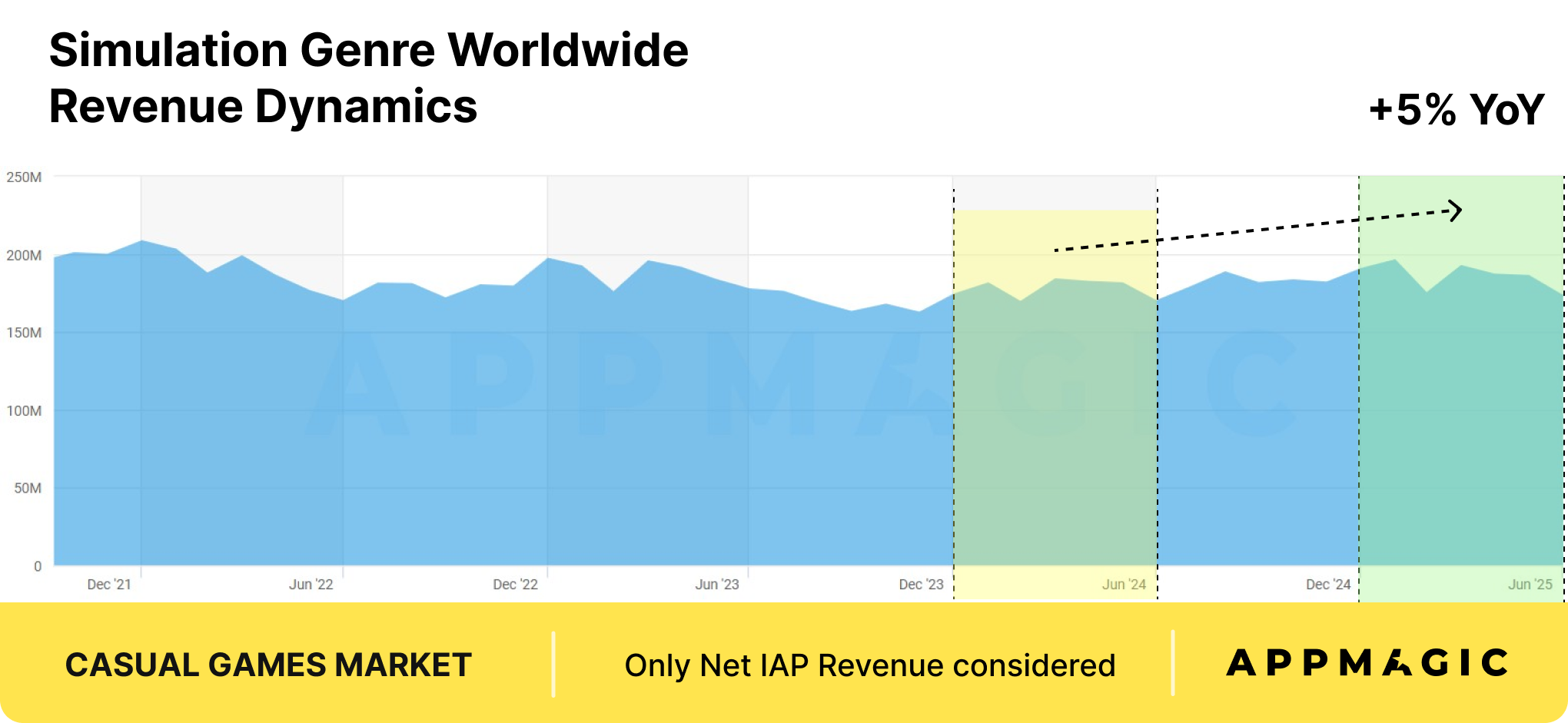

Simulation: Farming New Opportunities

Simulation wraps up our list of the top-grossing Casual genres, with over $1.1B (+5% YoY) in revenue in H1 2025. Its largest subgenres include:

- Farming: $560M Revenue (+3% YoY), 151M Downloads (–10.5% YoY)Township, Hay Day, Family Island™ — Farming game

- Time Management: $85M Revenue (–2.6% YoY), 261M Downloads (–2.6% YoY)Cooking Diary® Restaurant Game, Happy Diner Story™: Cooking, Cooking Madness: A Chef’s Game

- Life Sim: $80M Revenue (+30% YoY), 148M Downloads (–3% YoY)BitLife – Life Simulator, The Sims™ FreePlay, 心动小镇

As you can see, the genre is heavily dominated by Farming games, which account for nearly half of its total revenue. That is why Farming, one of the oldest genres in the mobile games market, will be our primary focus in this report. Yes, there are some niches that nearly ended up here as well, like Job Simulation, which grew by 147% YoY. But they are too small in relative terms and still have some ground to cover before looking into them any closer.

As for the broader Simulation genre, it’s actually quite an active segment with a steady flow of newcomers. In H1 2025 alone, 1,411 new games were released, with only 55 of them from the dominant Farming subgenre. Despite this variety, the genre is just as tough to break into as it is crowded: only 0.4% of new titles reached our $100K/month benchmark.

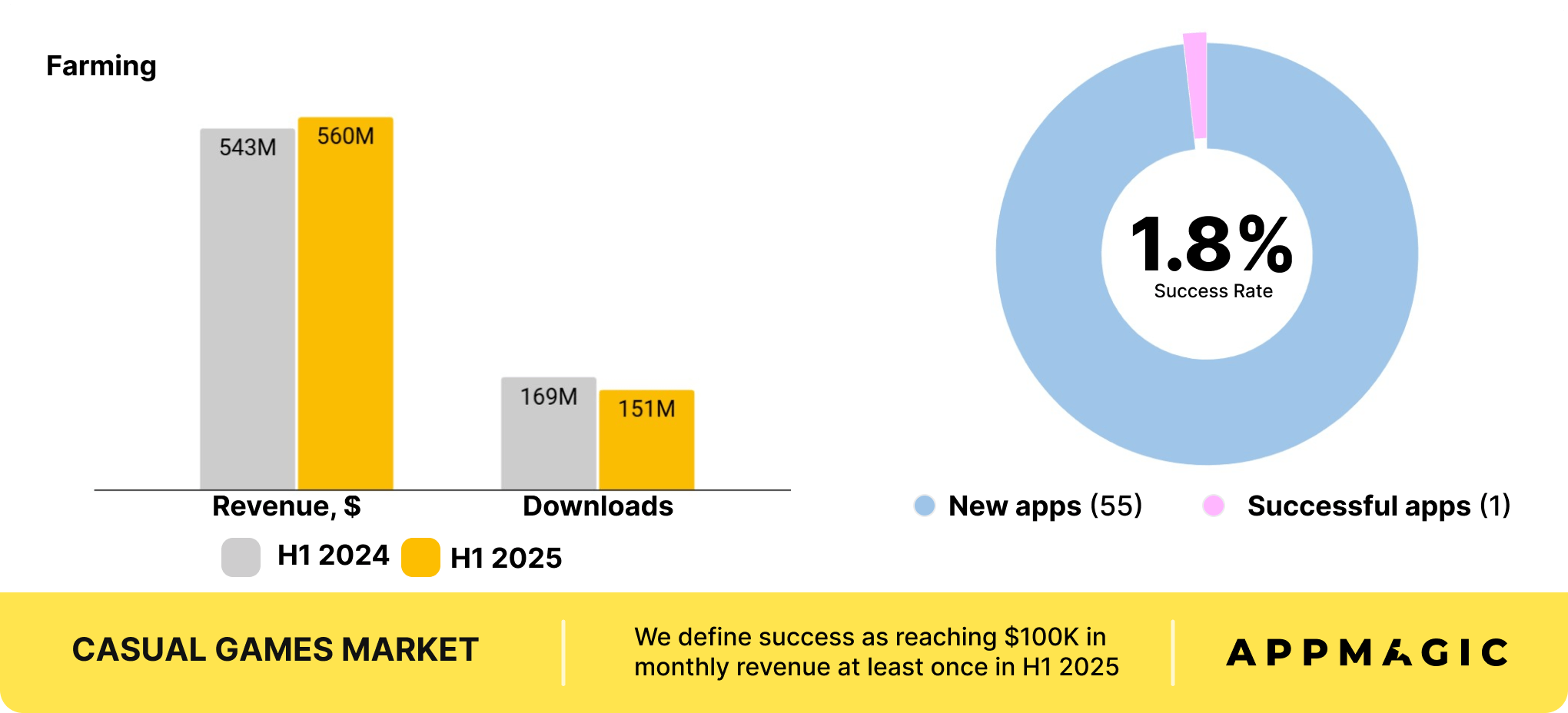

Farming: Half of the Simulation Genre

The Farming games market saw a modest 3% YoY revenue growth, despite a 10.5% drop in downloads. Considering that Farming is one of the pioneers of mobile gaming, this segment shows remarkable stability!

Just think about it: one of the most mature mobile genres continues to retain its audience and even still manages to grow revenue—all without viral hits, breakout innovations, or major shifts in design. That alone makes it worth a closer look.

Out of the Top 10 grossing titles of H1 2025, 8 were released in the 2012–2020 period! But the biggest part of Farming’s stability is the performance of Township, an absolute leader of the genre. This hit by Playrix generated $237M in H1 2025 and alone accounted for 42% of the entire Farming genre’s revenue!

Farming games revenue dashboard

Not only has Township led the genre for over six years, but it also achieved an all-time high in January 2025, reaching $43.6M in monthly revenue. And this isn’t an exception. Hay Day, the second-highest title in the genre, earned $12.6M in April—its highest monthly revenue since 2017!

Similar to genres like Merge-2, we once again see how genre veterans keep growing their revenue and, therefore, driving the market. And, if you’ve been reading diligently, you can probably guess the secret sauce already: it all comes down to LiveOps, monetization, and consistent updates that keep players engaged and invested in the long run.

Let’s take a quick look at Township’s event calendar: its dense LiveOps grid and consistent rotation of time-limited themed and holiday events keep the content feeling fresh and relevant.

Township’s LiveOps & Updates Calendar

It gets even more interesting, as some of Township’s most effective events borrow mechanics from other Casual genres, adding a separate new core alongside Farming. And what genre do you think shows up in these events more than any other? You knew it: Match-3, the space Playrix knows inside out.

Events like Air Show, Ernie’s Cup, and Alien Invasion introduce Match-3 levels as temporary gameplay, rewarding players with valuable in-game items and freshening up their experience. This cross-genre Match-3 feature is often accompanied by events like milestones, collections, or leaderboards, which further strengthens the effect. In synergy with those overlapping events, these contributed to revenue spikes of up to 51% in 2025!

And that’s how a single mechanic can diversify the game’s LiveOps across multiple formats and refresh the gameplay to keep retention high. For developers, it’s a good reminder that looking beyond your own genre for inspiration can lead to deeper engagement and higher IAP revenue.

Though Farming is often overlooked compared to more recent genres, it remains one of the largest Casual segments—and it’s not falling behind. Yes, it’s tough out there for newcomers: only one out of 55 new Farming titles released this year made it past the $100K/month benchmark, bringing the success rate down to just 1.8%. But those who made it prove that the games in this space follow the same trends and make full use of the same tools and opportunities as does the rest of the Casual market.

🎯 Games to watch in 2025:

- Goodville: Farm Game Adventure by Goodville AG: A continuously growing Farming title that made its way into the Top 10 grossing games.

- Sunshine Island: Farming Game by Goodgame Studios: Launched back in 2023, the game wasn’t a breakout hit—yet it has shown strong long-term resilience. It’s been growing steadily and is now generating around $1M in monthly revenue.

Simulation: Takeaways

Though Simulation is a large genre, half of its revenue comes from Farming, one of the most mature segments in the industry. Not only does it keep growing, but its top titles—Township and Hay Day—have hit new revenue records in H1 2025, following strategies similar to other big genres we have analyzed!

The other half of the Simulation market revenue is spread across smaller subgenres, and none of them showed dramatic growth compared to the success stories we’ve highlighted earlier in this report. Still, Simulation hasn’t been left behind: developers continue to experiment, adapt, and find new ways to grow revenue in an increasingly competitive market.

Casual Games Report H1 2025: Key Takeaways

Casual games keep changing on many fronts, as developers fight through all the UA and economic challenges of the market.

Some genres continue to grow. Match-3, Merge-2, and Farming show how mature titles not only dominate the market but also keep hitting new all-time highs by refining their LiveOps and monetization strategies. At the same time, they raise the entry bar, forcing developers to think more about mid- and long-term retention from the very start.

Some genres are in decline. Match 3D is a clear example of how a genre can hit its ceiling and stabilize at revenue levels far below the top tier of Casual. Still, developers endure: experimenting, adapting, and finding new ways to make millions. With any luck, the slowdown is only temporary.

Some genres are hanging over. On paper, Casual Casino is in decline. But in reality, it’s recovering from the intoxicating success of Monopoly GO!. The explosive growth is over, and the genre is adjusting to a new normal. Before Scopely’s hit, Coin Master made the space nearly impossible to enter. Now, it’s dominated by two titles instead of one. However, the entry barriers are still super high.

Some genres are exploding. And that’s the best thing about the gaming industry. When one door closes, another one opens. This time, it is Hybridcasual Puzzles that, in many ways, are a natural evolution of everything the market has learned in recent years:

— Between 2018 and 2020, studios mastered the art of creating instantly hooking core gameplay and monetizing it through ads, riding the Hypercasual wave.

— From 2021 to 2023, the focus shifted to adapting in a post-IDFA, post-pandemic world, where growing LTV through LiveOps and deeper monetization became the new standard.

From 2024 onward, hybridization has been establishing itself as the new go-to course of action, eventually becoming a self-proven trend in 2025. It is safe to say that Hybridcasual Puzzles combine the best of both worlds: catchy, accessible core gameplay layered with meta progression, events, and scalable monetization. And the segment is likely to be in the center of the industry’s attention at least for the rest of the year.

Thanks to you, game developers, innovation always finds its way!