- arrow_back Home

- keyboard_arrow_right Highlights

Vietnamese Mobile Gaming: The First Domino Has Fallen!

HighlightsJournal 12 Jenifer Vu December 22

Just five days ago, in my previous deep dive The Vietnam Gaming Paradox, I discussed a painful reality: The Vietnamese market was stuck in an “M&A Deadlock.”

We had the volume. We had the “Quiet Giants”—those profitable studios silently dominating global charts. But we lacked a signal. I wrote that the market was holding its breath for a “Market-Defining Exit”—a deal that would bridge the gap between “Founder Ambition” and “Investor Valuation.”

For industry insiders, this news didn’t come as a surprise. The whispers have been circulating in private channels for months. We knew the “Big One” was close. We knew global eyes were fixed on our top-tier casual studios. We were simply waiting for the ink to dry.

And now, we have the confirmation. The first domino has officially fallen!

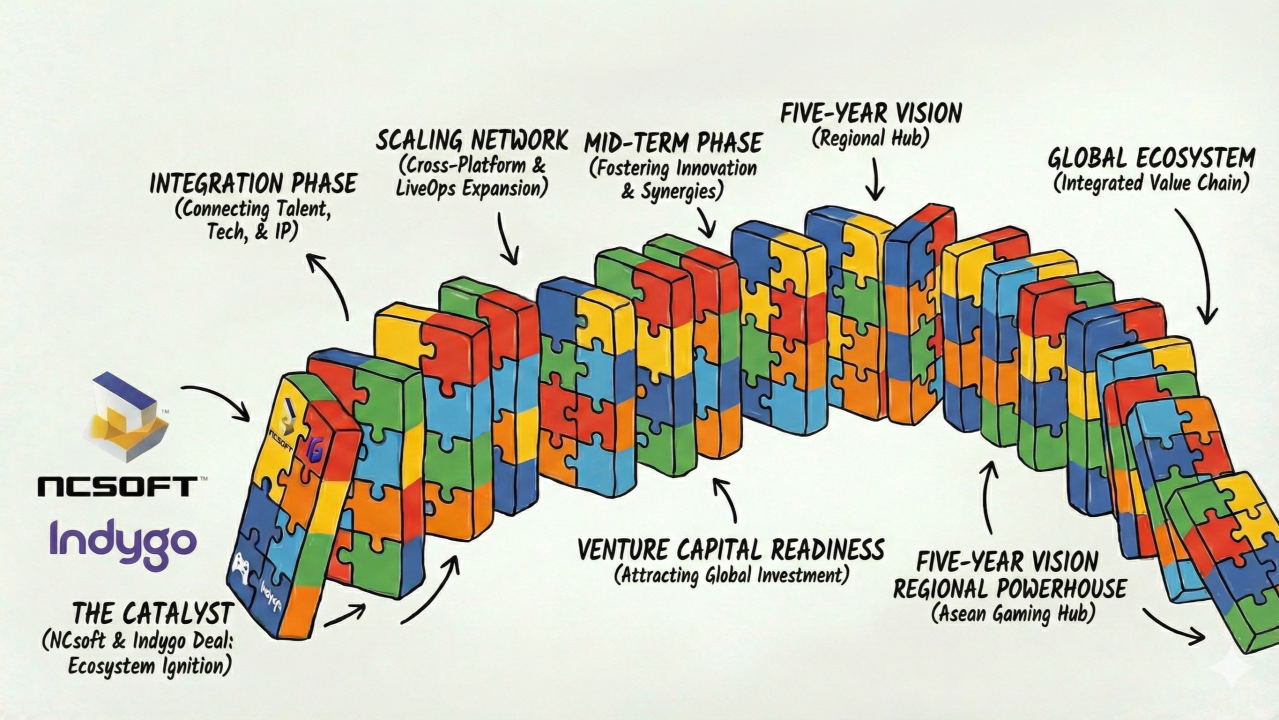

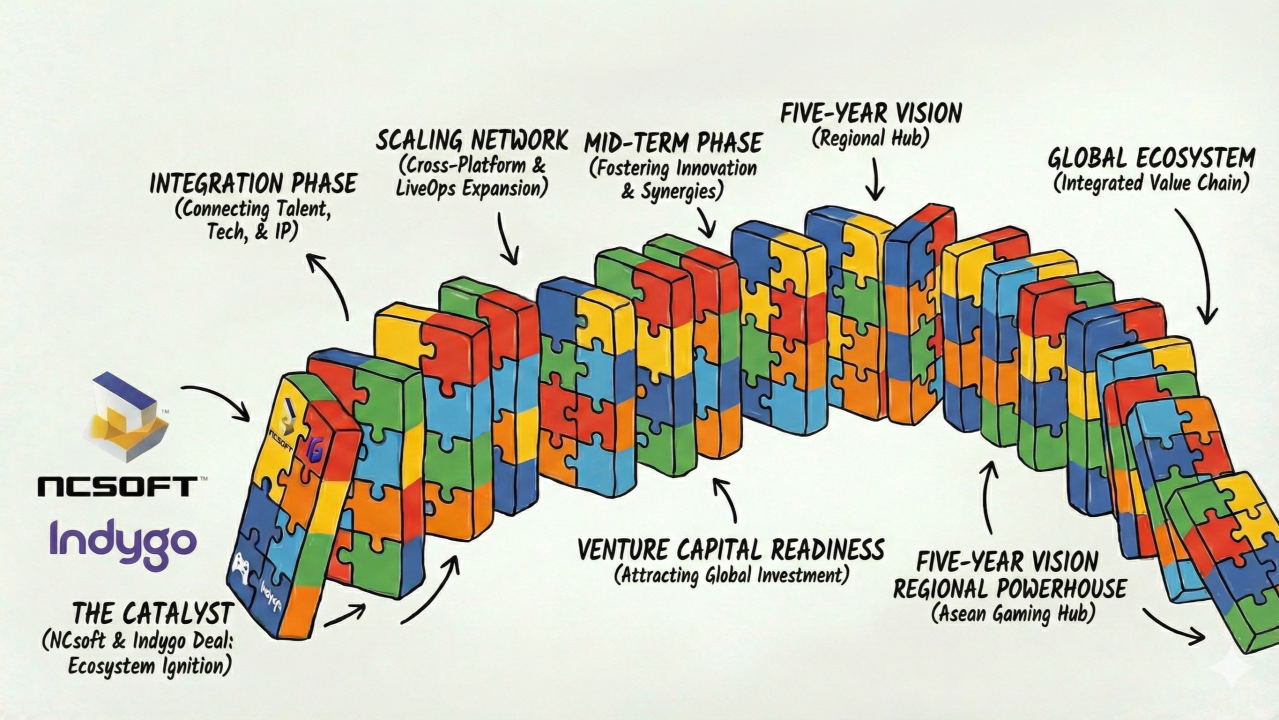

The Signal: NCsoft & Indygo (Lihuhu

If the industry reports hold true, NCsoft’s $103.8M acquisition of a controlling stake in Indygo Group (the Singapore-based parent of Vietnam’s Lihuhu) is exactly the validation the market anticipated.

This isn’t just a win for one studio. If we overlay this deal against our internal market mapping at TAC, it confirms what we have been predicting all year: Vietnam has shifted from a “Production Hub” to a “Strategic Battleground.”

Here is the deep dive into why this deal happened, and the 3 strategic shifts that will define 2026.

1. Validating the “Domino Theory”

In TAC’s Emerging Markets Report, we theorized that every gaming hub evolves through three phases: Creation → Capital → Consolidation.

- Vietnam’s status until last week: We were deep in the “Creation Phase” (1,000+ active studios, high volume, low capital).

- The Shift: This deal represents Domino #1: The first major inbound M&A where a global publisher acquires a Vietnam-centric production hub not for outsourcing, but for Strategic Asset Value.

The Impact: This deal flushes the “M&A Deadlock.” Now that a price tag ($100M+) has been set for a top-tier Hybrid-Casual studio, the “Valuation Gap” just got a lot narrower.

2. The “Why”: Synergy > EBITDA

Why did NCsoft buy Indygo? It wasn’t just because Indygo was “making money.” NCsoft has plenty of money. They bought a strategic solution to a problem they couldn’t solve alone.

- The Buyer: NCsoft is a master of hardcore MMORPGs (Lineage, Blade & Soul). But that market is saturated and expensive.

- The Target: Indygo (Lihuhu) is a master of Casual/Puzzle games. They own the mass-market user base that NCsoft lacks.

The Lesson: Indygo didn’t just sell revenue; they sold a “System.” They proved that Vietnam can build transferable tech stacks and live-ops engines that giants can plug directly into their ecosystem.

3. Strategic Hypotheses: What Happens Next?

Now that the First Domino has fallen, here are 3 Strategic Assumptions I am looking at for the next 12-24 months. I invite founders to test these against your own roadmap.

Hypothesis A: The “Efficiency Ceiling” is Coming

Currently, many Vietnamese studios win by being efficient: Lower production costs + Smart UA arbitrage = Profit.

- The Risk: What happens when privacy laws tighten further, or when a giant like King or Playrix decides to burn $100M to dominate your specific niche?

- The Reality: “Efficiency” is not a moat. Brand and Community are moats. The studios that survive the next wave will be those that transition from “buying users” to “owning IP”—just like Indygo did.

Hypothesis B: The “Barbell Effect” (The Mid-Sized Trap)

We are moving towards a polarized market structure:

- On one end: Tiny, agile indie teams (Low risk, high creativity).

- On the other end: Strategic Giants (like the newly backed Indygo) acting as market aggregators.

- The Danger Zone: Being in the middle. If you are a 50-person team doing “okay” revenue but lacking a strategic moat (IP or Tech), you will get squeezed. You are too big to be agile, but too small to compete on infrastructure.

Hypothesis C: The Rise of “Level-Up Capital” (Domino #2)

This leads to our next prediction. We will likely see a spike in Series A rounds where mid-sized studios raise funds specifically to restructure.

- The Goal: It’s not raising cash for survival. It’s raising “Smart Capital” to build the Data Infrastructure, Legal Structure (Singapore Holdings), and Management layers needed to become “M&A Ready” within 18-24 months.

My Advice to Founders: From Survival to Positioning

The $103M headline is a wake-up call. Being a “Quiet Giant”—keeping your head down and optimizing for monthly profit—is no longer enough to win the big game.

Three questions to ask your co-founders this week:

- Are we building a Cash Cow or a Strategic Asset? (A Cash Cow makes money today; an Asset solves a structural problem for a future buyer like NCsoft).

- The “Integrability” Test: If Tencent or Zynga acquired us tomorrow, would they find a messy “black box” of ad accounts, or a clean, scalable engine they can amplify?

- The Leverage Check: If we had to partner with a global giant, what is our leverage? Is it our Tech? Our Art Pipeline? Or our User Data?

The “Paradox” is resolving. The rumor has become reality. Vietnam is no longer just a “Volume Hub.” We are now officially an “Asset Class.”

At TAC, we are looking for the founders who are ready to make that shift. The $103M benchmark has been set. The question is: Who is building the system to be next?