- arrow_back Home

- keyboard_arrow_right Highlights

Scam Ads by Meta Turned Into a Massive 16B Dollar Business

HighlightsJournal 7 Gamigion November 16

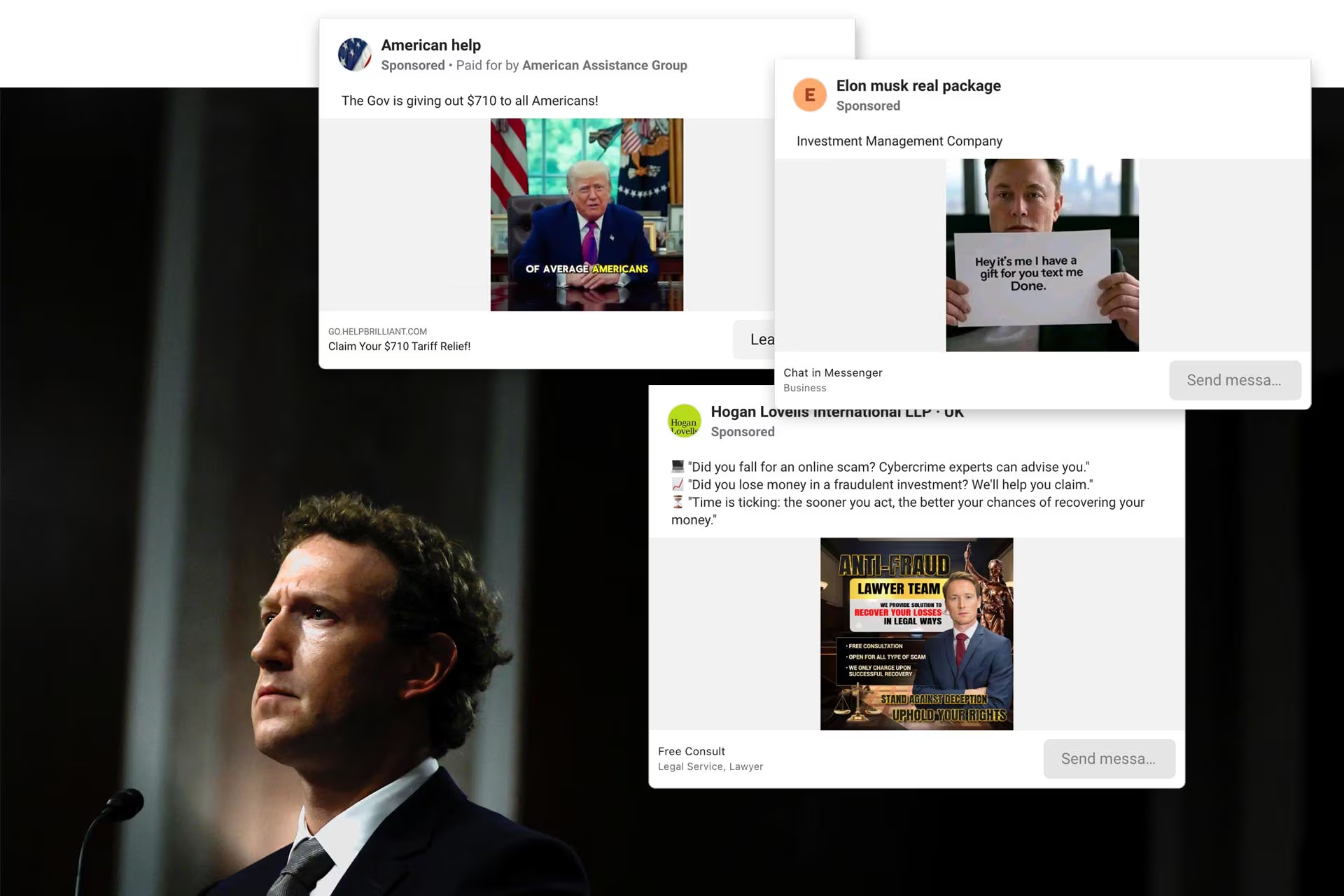

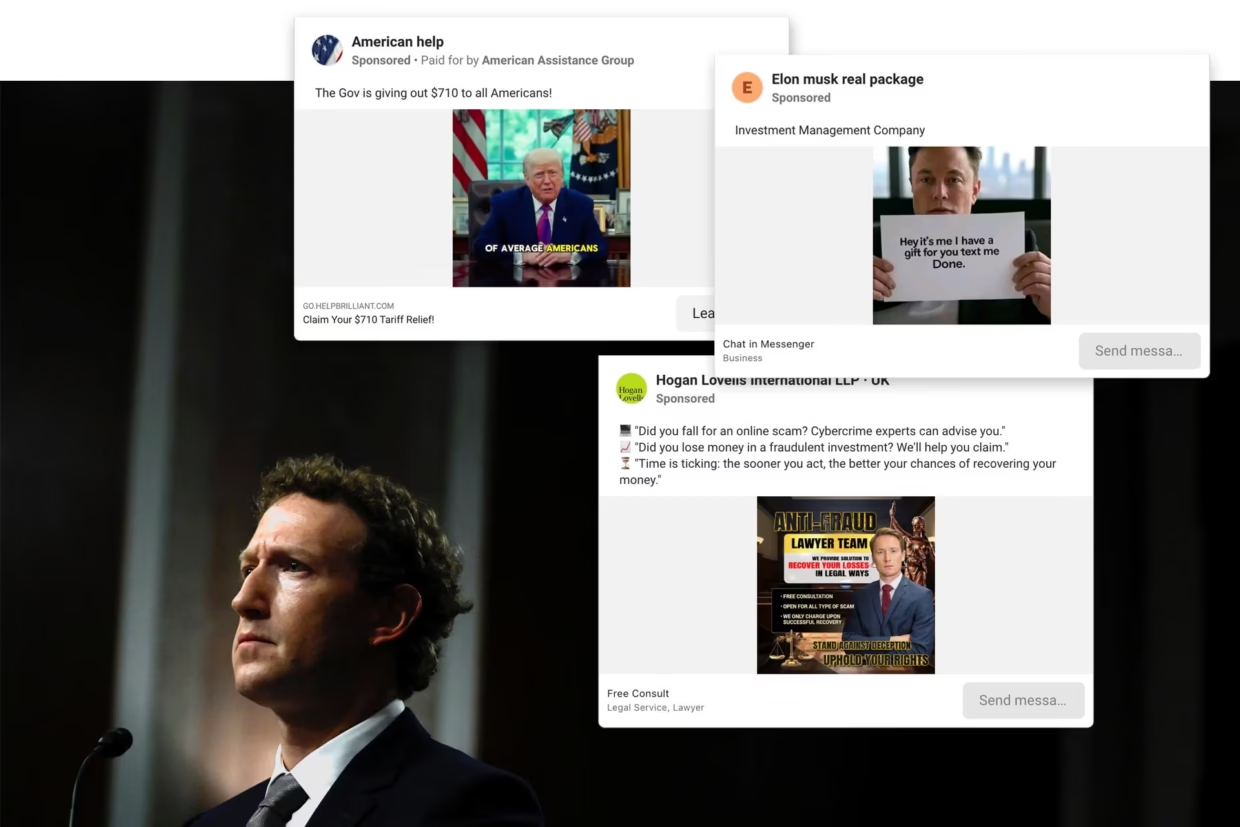

Internal Documents Reveal Meta Is Making Billions From Fraudulent Ads

Meta is facing a new kind of spotlight. Not the shiny AI kind. The regulatory, eyebrow-raising, how-is-this-even-real kind.

According to internal documents obtained by Reuters, Meta projected that up to 10 percent of its 2024 revenue would come from ads linked to scams and banned goods. That is about 16 billion dollars tied to fraudulent advertising.

And here’s the jaw-dropper. Meta internally estimates that its platforms show users 15 billion scam ads every single day.

Yes. Billion. Per day…

This is the scale of the digital underground economy running straight through Facebook, Instagram and WhatsApp.

Fifteen Billion Scam Ads a Day

Meta categorizes these as “higher risk” ads with clear signs of fraud. Fake e-commerce stores. Investment scams. Illegal casinos. Shady medical products. Deepfake celebrity endorsements. You name it.

Meta earns around 7 billion dollars annually from this category alone.

And the algorithm makes the problem worse. If you click one scam ad, Meta’s personalization system happily feeds you more. A full spiral.

The Internal Dilemma

The documents show a company caught between two forces.

1. Crack down harder and sacrifice billions in revenue.

2. Leave things as is and risk fines, legal pressure and reputational damage.

Meta picked the middle route. Not a full purge. Not a blind eye. A slow, targeted reduction.

Internal strategy papers outline a plan to reduce scam-linked revenue:

• 10.1 percent in 2024

• 7.3 percent by end of 2025

• 6 percent by 2026

• 5.8 percent by 2027

The company is preparing for up to 1 billion dollars in regulatory penalties. But one document notes that Meta earns 3.5 billion dollars every six months from the highest risk scams alone. Fines would hurt. They would not cripple.

The Penalty Bid Trick

One of the wildest internal tactics revealed is something called penalty bids.

When Meta’s systems detect a suspicious advertiser but cannot confidently ban them, it lets them keep buying ads but at a much higher price. They get punished by paying Meta more.

The logic is simple.

Scammers lose margins.

The auction becomes harder to win.

User exposure goes down.

Meta still gets paid.

According to Meta, early tests showed declines in scam reports, plus a minor dip in revenue.

When Meta Misses the Obvious

Some examples from the documents:

• Fifty four percent of UK payment scam losses in 2023 involved Meta platforms

• A Canadian military recruiter had her account hacked and used to scam colleagues

• Singapore police shared 146 scam examples and Meta determined that 77 percent did not violate the letter of its rules, despite clearly violating the spirit

• An account impersonating Canada’s prime minister ran two hundred fifty thousand dollars worth of scam crypto ads

• Some high value advertisers allegedly racked up hundreds of strikes without being banned

This paints a picture. Meta’s rules often fail to detect what any normal human instantly sees as suspicious.

The company knows this. A staffer even published weekly internal reports titled Scammiest Scammer to highlight the worst offenders.

Two of the featured accounts were still active half a year later.

Meta’s Response

Meta says the documents present a selective and distorted view.

According to the company:

• Scam ad user reports have dropped 58 percent in 18 months

• 134 million scam ads have been removed this year

• The 10 percent revenue estimate was “rough and overly inclusive”

Meta insists it aggressively fights fraud because it is bad for users and advertisers.

Still, it acknowledges scam ads are entrenched and that enforcement needs to grow.

A Tech Giant as a Pillar of Global Fraud

A May 2025 internal presentation estimated that Meta platforms play a role in one third of all successful scams in the United States.

Another internal review concluded:

“It is easier to advertise scams on Meta platforms than Google.”

For an industry that worships automation, optimization and machine learning, that is a sobering reality.

Why This Matters for Mobile Gaming and Ad Tech

Meta is the monetization backbone for a huge portion of the mobile gaming economy.

If a platform this central is simultaneously:

• battling massive fraud at scale

• optimizing revenue even from suspicious advertisers

• preparing for billion-dollar fines

• under pressure from global regulators

• and setting algorithmic incentives that may reward bad actors

This impacts everything from UA strategy to CPM volatility to brand safety to player trust.

The ad ecosystem is only as healthy as its biggest pipes.

When the world’s largest social ad network is tangled in a fraud economy of this size, the ripple effects hit everyone.

The Big Takeaway

Meta is not ignoring the problem.

Meta is not beating the problem either.

The documents show a company trying to minimize damage while still protecting revenue and preparing for regulatory storms.

But nothing captures it better than this line from Meta’s own internal review.

“It is easier to advertise scams on Meta than on Google.”

For a platform serving billions of people and powering hundreds of billions in ad spend, that is a warning siren.