NCSoft acquired major stake in Indygo. Now what?

Journal 14 Tracy Phan December 23

So, my bingo tile “unexpectedly” got crossed out before 2026 comes. Still count, right?

Joke aside, let’s dig further into the deal details:

First, let’s get the number out of the way 💁♀️

- NCSoft acquired 67% stake in Singapore-based Indygo Group for ~$103.8M USD.

- Implied full valuation for Indygo: ~229 billion KRW (~$155M USD).

- Lihuhu (the core asset) is projected to hit 120 billion KRW (~$81M USD) in sales in 2025 with operating profit of 30B won (~20M USD) – a healthy ~25% margin

This means an implied multiple of somewhere between 1.5-1.9 (depending on the rest of IndyGo portfolio), which is in the higher band of a hyper-casual/ad heavy studio deal (usually at 1-2x).

This deal, by any metrics, is more than fair.

*Due to conflict of interest, I will not estimate their ad revenue. The above number is all public data.

Alright, now, on to the parties involved.

Who is NCSoft?

NCSoft is a Korean Gaming giant, iconic for MMORPGs (Lineage series – still prints money in Asia, Lineage M/2M massive in Korea). NCSoft is publicly traded in the Korea Stock Exchange (KRX), with market cap of 4.3T Won (~3B USD).

Historically, they are hardcore/RPG focused, but are aiming to expand to casual from this year.

And NCSoft means business.

In August this year, NC launched their new Mobile Casual division, appointing Anel Ceman -who led monetization at Tripledot, Wildlife and Outfit 7 (read: the man knows ad businesses in and out) – as Senior VP. Anel is also the one leading the IndyGo/Lihuhu deal.

Another notable hire later this year was Anthony Generoso Pascale to be in charge of UA and Data. He was the Head of Data for Miniclip & SuperSonic.

With the acquisition of Lihuhu, we have established a growth foothold in the global mobile casual game market – Park Byung-moo, co-CEO of NCSOFT

Outside of the Lihuhu deal, they are also in the process of acquiring another casual studio in Korea – Springcomes, and eyeing a few more 👀.

It is clear that they are buying the shortcut to casual. They have the cash, the senior brains, now acquiring production hub(s) is the reasonable next steps.

Who are Indygo & Lihuhu?

Indygo is a Singapore-based mobile games publisher, with their core asset being Lihuhu Games – a casual and puzzle game developer in Vietnam.

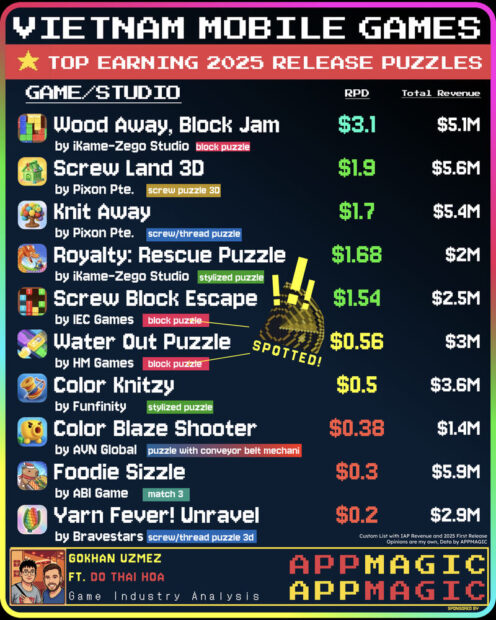

Lihuhu Games was founded in 2017, by now it has released and published more than 100 games, with genres across Match-3D, Number and Hole. In terms of scale & revenue, Lihuhu is probably within the top 10 among Vietnam studios.

For Lihuuhu, it’s clear that (cash aside 🤑) this strategic acquisition brings massive upside. They’ll gain access to NCSoft’s deep IP expertise and “IP-first” playbook, master advanced liveops techniques, and significantly strengthen their data and analytics capabilities. These are exactly the assets needed to supercharge their hybrid-casual expansion journey.

(And hopefully, we’ll soon see a breakout original IP originating from Vietnam!)

It’s a match made in heaven.

Other than NC, Indygo and Lihuhu, this deal has also been advised by Alfa Games Partners – who facilitated 3 of the biggest deals in Turkey thus far.

Now What?

Lihuhu acquisition is the first public inbound M&A in a while, but not the first M&A or investment that targets Vietnam developers/core team (*cough Athena/AppLovin) – and definitely won’t be the last.

But where it differs in the past is, this time, it’s not the investment into the product or small group of talent anymore – it is betting in Vietnam as a casual game development hub.

We expect Lihuhu to serve as a hub for casual game development in the Asian region. – Park Byung-moo

The Lihuhu I know would be very thoughtful when it comes to expansion, so it probably won’t be the case that they’ll flush the market with cash and inflate salaries in Gaming – but that, will come as a halo effect now that other studios are seeing the exit benchmark.

For the ecosystem in Vietnam, the $100M injection will be a healthy dose of competition, but like any other competition, there will be losers and winners.

The next 3 years will be the most exciting, market-shaping moment for Vietnam.

And as the wise words of Anel – Time will tell :).