Mobile Games Radar: Week 46 to 49

Journal 4 Andriy Zmeul December 22

This short report is a continuation of a previous report of the same type, which was published 4 weeks ago and focuses on games that have generated notable revenue for the first time (or after a significant gap of several years) and based on an AppMagic data. A more detailed explanation of how this report is compiled can be found in the “Methodology” section.

This edition is a rare one – it features two games breaking into the US top 50, something that happens only two or three times a year at most. Interestingly, both titles are somewhat unconventional from a monetization standpoint. As expected, the list includes an anime heavyweight and a 4X strategy, staples of almost every recent edition, but this time the strategy entry comes with a twist: it’s set in the Resident Evil universe.

Together, these releases illustrate a wide spectrum of design approaches now breaking into (or slipping through) the US top-grossing charts on Google Play and iTunes.

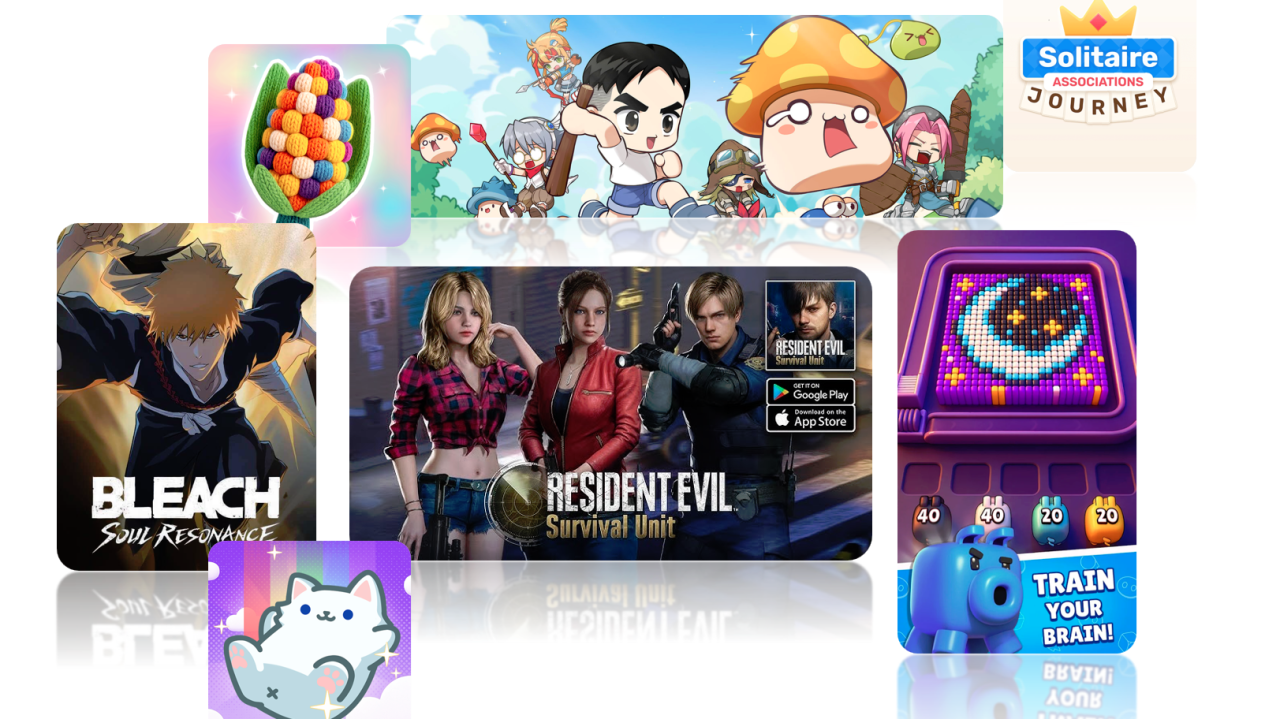

BLEACH: Soul Resonance (Google Play)

BLEACH: Soul Resonance is an unusual case where the same title exists as multiple regional builds, developed and distributed by different companies.

In total, there are three distinct versions of the game: one for Japan, one for the US, and one for China, each with its own distribution and potential gameplay or monetization differences. The US version is published by Crunchyroll (Sony). Despite the strong popularity of the Bleach anime in Western markets, the game is currently underperforming in the US. On Google Play, it has been declining week over week and recently hovered around rank #176 in the top-grossing chart. On iTunes, revenue is roughly on par with Google Play, but still insufficient to enter the top 200. For comparison, the international (Chinese) version of the game has already generated over $3 million, while the US version has reached only about $1.4 million so far, highlighting a clear performance gap between regions.

MapleStory : Idle RPG (Google Play and iTunes)

MapleStory: Idle RPG is, as the name suggests, an idle RPG developed by the Korean company NEXON DEV VINA , based on its own long-running IP.

Within the franchise, the top-grossing title remains MapleStory M: Fantasy MMORPG, which has generated nearly $500 million worldwide over its lifetime. At present, MapleStory: Idle RPG ranks 19th among Nexon’s titles by revenue, with approximately $43 million earned globally, including nearly $7 million in the US. Beyond MapleStory, NEXON DEV VINA also operates several other major IPs, most notably Dungeon Fighter, which has brought the company around $180 million and may have served as partial inspiration for the idle adaptation. Combined with MapleStory’s large and loyal fan base, this reuse of proven IP and genre familiarity has made the game commercially successful from a return-on-investment perspective, even without dominating the US top-grossing charts.

Pixel Flow! (Google Play & iTunes)

As anticipated in my follow-up to the previous Game Radar edition, Pixel Flow! has now entered the top-grossing charts and continues to grow.

Its fresh and distinctive puzzle concept has clearly driven strong organic traction. At the moment, the game’s RpD stands at $2.4 on iOS and $2.7 on Google Play, with both figures still trending upward. It’s quite unusual to see a young studio generate $10 million in revenue within just a few months with its very first title, including $5.7 million in the US alone, especially given that the game doesn’t appear to aggressively gate progression behind payments. It would be particularly interesting to see a deep monetization breakdown of Pixel Flow! from teams like two & a half gamers, GameRefinery or AppMagic.

Resident Evil Survival Unit (Google Play)

Resident Evil Survival Unit is a 4X strategy game set in the Resident Evil universe, with light RPG-style combat elements layered on top.

The game is published by Aniplex, one of the largest publishers in Japan. Its portfolio includes Fate/Grand Order, which has generated approximately $4.7 billion in revenue since 2015. Aniplex currently operates seven active titles, with Resident Evil Survival Unit ranking fifth by revenue within the company’s lineup. From a design standpoint, the game does not stand out for originality and shares many similarities with State of Survival, offering few meaningful differentiators beyond the strength of the Resident Evil IP.

Solitaire Associations Journey (Google Play & iTunes)

Solitaire Associations Journey by Hitapps combines classic solitaire mechanics with word game elements.

Hitapps has prior experience launching modestly performing titles such as Picture Builder – Puzzle Game, which has generated over $1.7 million since 2023, and Figgerits – Word Puzzle Game, with around $1.2 million since 2021. However, Solitaire Associations Journey has already outperformed them, earning $3.3 million since September 2025. This is another title on the list, alongside Pixel Flow!, that almost begs for a deconstruction. At first glance, the game appears to consist of little more than a clean, well-executed core loop, with no obvious pressure points for monetization. Yet according to LinkedIn, the studio employs five analysts, which suggests there is clearly more being measured and optimized under the hood than is immediately visible.

Drop the Cat (iTunes)

A couple of months ago, Game Radar featured Drop Away from Rollic.

Drop the Cat follows a similar formula, but with a cat-themed twist. The game was developed by the Korean studio ACTIONFIT, which has previously experimented across a range of genres, including sort puzzles, match-3, merge, and others. This is, however, their first real hit, having generated over $1 million in revenue. Alongside its iTunes release, the game also launched on Google Play, but performance there has been significantly weaker with Android revenue roughly ten times lower than on iOS.

Yarn Fever! Unravel Puzzle (iTunes)

The high frequency of yarn-unraveling puzzle games appearing on the charts is likely driven by seasonality, but their short lifespan in the US top-grossing 200 suggests that this sub-genre has a fairly limited audience ceiling.

Yarn Fever! Unravel Puzzle from Bravestars Games, a Vietnamese studio (or possibly a China-registered entity, as is often the case), is another representative of this trend. While the game features appealing visuals, they fail to compensate for largely cloned mechanics. The title does have an Android version on Google Play, but its revenue there is insufficient to break into the US top-grossing 200 for IAPs.

Methodology

The games featured in this report are sourced from the top-grossing charts on Google Play and iTunes, which list the top 200 games in the US. AppMagic collects and aggregates chart data at different intervals, with the initial dataset sourced from its API. To be included in this report, a game must have appeared in the top 200 for at least three random weeks within the last four weeks. Additionally, the game must not have appeared in the top 200 within the past year prior to this period. This report is updated every four weeks accordingly.