Roblox’s Tax Cut: A Win for Devs, A Bet on Mobile Growth

Journal 6 Phillip Black September 12

One of Roblox’s most curious decisions has been to increase dev share payout rates. Now developers who go to cash out Roblox’s currency (which players pay in for USD) will be able to do so at a higher exchange rate, effectively increasing their take-home pay per dollar spent in their experiences. Interestingly, Roblox won’t have to write off an equivalent amount on the P&L for this new rev share, in fact it may revenue enhancing for Roblox itself.

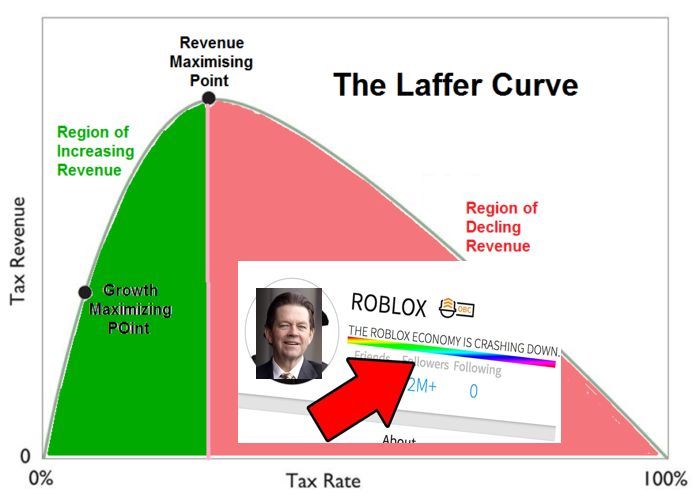

Economist Arthur Laffer’s original curve describes the relationship between tax revenue and tax rate. A government makes no revenue when the tax rate is 100% because no one works, and they make no tax revenue when the tax rate is 0% because there’s no collection point. With some simple assumptions, we can show that there exists some maximum point in between the 0 and 100 percent. The question is, what is that tax rate which maximizes tax revenue? This creates the interesting conclusion that in some cases, reducing the tax rate actually will increase the tax revenue, making it something obvious everyone should do. W

While we normally think the tax rates at which countries apply suggest increasing rates would increase revenue, Roblox’s platform “tax” is so high (from 70% to 80%) that it may be possible that decreases here are revenue-maximizing, especially given the maturity of the platform.

I remain perplexed that no one seems to embrace Steam’s inverse marginal brackets, where developers that earn above a certain amount face a decreased revenue share for the marginal dollar. This creates a superstar effect and has also kept key publishers on the platform while maximizing Valve’s revenue.

At the very least, we can assume that there’s some sort of elasticity effect or response to the amount of content developers provide to Roblox based on the payout rates they get. The higher the payout, the more capital they’re willing to re-invest, thereby increasing Roblox’s GDP and potentially more for base for Roblox to capture at a lower rate.

The rev share mechanism, a new exchange rate for Robux cashouts, also has an unintended consequence of acting like an effective interest rate, rewarding users who didn’t cash out, potentially decreasing future Robux cash out propensity.

The econ team has also been slaying with regional price discrimination, helping all developers, and what I’m sure is a lot of ad tech cooking.