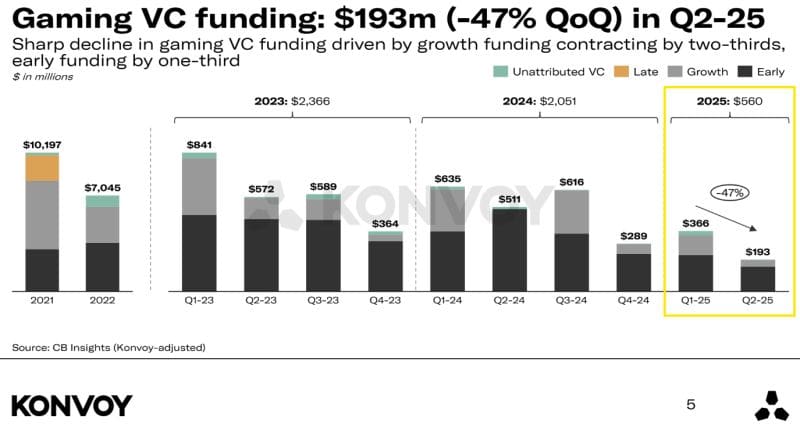

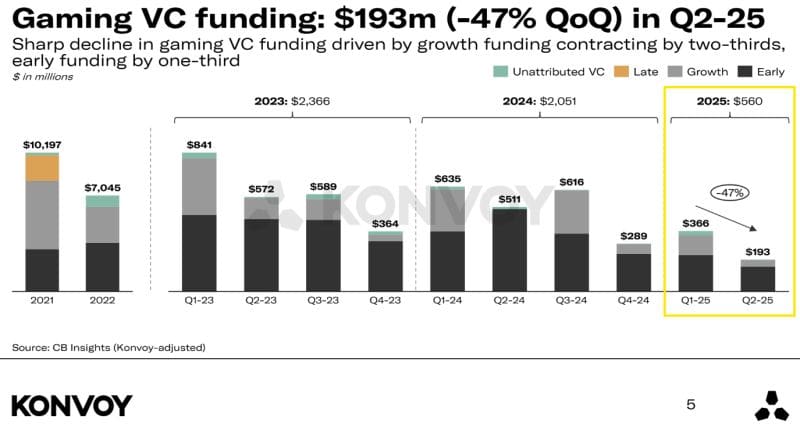

Gaming VC funding: $193m in Q2’25 globally, lowest in 5 years

Journal 5 Josh Chapman August 4

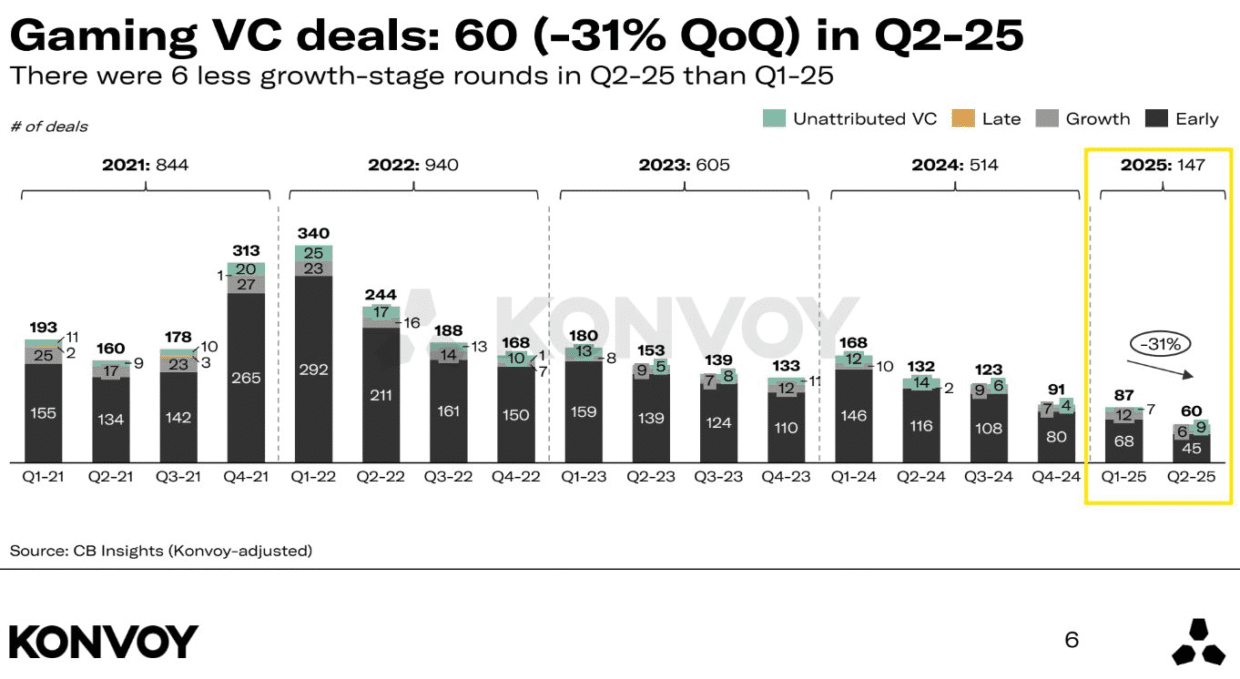

🎮 Gaming VC funding: $193m in Q2’25 globally (lowest in 5 years). This is a 47% decline from Q1’25 and a 62% decline from $511m in Q2’24. This was invested across only 60 deals (globally), which was a 31% decline from Q1’25 and a 54% decline from the 132 deals in Q2’24.

➡️ A few reflections:

– there are fewer active gaming investors today than 2-3 years ago

– there are also fewer new companies being started in gaming

– VC investments are concentrated in AI, a headwind to gaming deals

– the gaming market is growing but also consolidating (well known)

As we look ahead at the 2H of 2025, I believe we will continue to see fewer new companies launched (poor fundraising environment, low valuations, etc) but many of the deals that do get done will be over-subscribed rounds as investors will continue to do more party rounds together (the perception of safety in numbers).