New top grossing games of iOS and Google Play: W22-25 2025

Journal 10 Andriy Zmeul August 1

This short report is a continuation of a previous report of the same type, which was published 4 weeks ago and focuses on games that have generated notable revenue for the first time (or after a significant gap of several years) and based on an AppMagic data. A more detailed explanation of how this report is compiled can be found in the “Methodology” section.

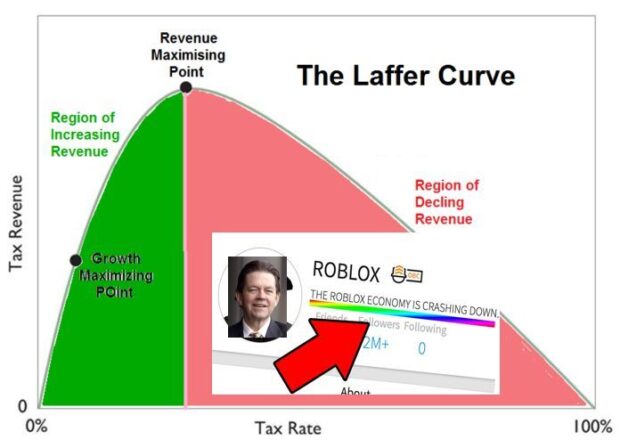

Looking at the list of games below which, by the way, includes a record-breaking nine unique titles for this period, 2025 might seem like the year the mobile gaming industry is finally recovering from its long stagnation. But there’s one big however: six out of those nine titles come from Chinese and Korean developers, and the remaining three are low-budget casual experiments. So yes, new games are entering the charts again but the balance of power hasn’t just shifted, it’s become even more skewed. The chart below illustrates each game’s ranking (Y-axis) over the corresponding weeks (X-axis).

Let’s run through the games one by one.

ATHENA:Blood Twins (Google Play)

ATHENA: Blood Twins is an anime-style action RPG targeting fans of Eastern fantasy, with flashy visuals, gacha monetization, and a cast of over-the-top “dark goddess” characters. It follows a proven formula seen in successful titles like Epic Seven and NIKKE. The game launched on both iOS and Google Play, but only charted on Android, and even there, performance is limited. Its current gross RpD is around $3.75, while the average CPI for RPGs in the US is ~$4.30 (gamedevreports). For an action RPG, the actual CPI is likely even higher, making profitable user acquisition almost impossible. Unless monetization improves significantly, ATHENA will likely follow the same path as other short-lived hits that faded from the top 200 within a year.

Etheria: Restart (Google Play + iTunes)

Etheria: Restart entered the US top 200 grossing charts simultaneously on both platforms. The developer, X.D. Network (obviously no linkedin representation), is already known for a couple dozen highly successful games that have collectively generated nearly $1 billion globally, including a Fortnite-style shooter and an anime-themed RPG about dinosaurs. With Etheria, the studio clearly aimed for something on the scale of Genshin Impact. In promotional campaigns, the developers emphasized competitive PvP with guild-based battles as the core endgame. Until players reach that point, the game is intentionally generous, offering a wide selection of heroes and content upfront.

With an RpD of $17, Etheria is performing well financially. But considering that Ulala, the top-performing RPG of this developer, reaches $23 RpD, it’s unclear why X.D. Network would pursue another game targeting almost the same audience but with lower monetization efficiency.

Flambe: Merge & Cook (Google Play)

Flambe: Merge & Cook will likely drop out of the top 200 by the next update (it’s already gone from the iTunes chart). The game appears to be an experiment from Microfun Limited, the developer behind two major hits in the merge genre, Gossip Harbor and Seaside Escape, which have generated over $700 million globally.

Interestingly, Seaside Escape launched just six months after Gossip Harbor in the second half of 2022 and still holds strong as Microfun’s number-two title. With Flambe, the studio seems to be aiming for a third strike by repeating the same formula. And they almost pulled it off: revenue is still growing, but downloads are declining and in the US, installs have been nearly absent for the past two weeks.

Mech Assemble: Zombie Swarm (Google Play)

Mech Assemble: Zombie Swarm is another experiment, this time a genre shift, from ONEMT, the studio best known for its 4X strategy titles Revenge of Sultans and Rise of the Kings. Currently, this action roguelike shooter is generating nearly $150K per week on Google Play, with an RpD of around $5 from IAP alone – a promising figure. However, the number of downloads hasn’t grown since the beginning of the year, suggesting that current performance may not be enough to justify large-scale investment in the game’s growth.

Ragnarok X: Next Generation (Google play + iTunes)

Ragnarok X: Next Generation is a new MMORPG set in the familiar Ragnarok universe, developed by Gravity Interactive, Inc., a studio that has already released over two dozen games based on this franchise. These titles rarely become breakout hits, but they typically feature upgraded visuals while keeping the core mechanics familiar to long-time fans.

The series has a loyal audience willing to try each new installment, and if the game proves solid, many are ready to transition to it. Ragnarok X: Next Generation gained popularity on both platforms. Downloads peaked at launch and have been gradually declining since, currently stabilizing at around 6,000 installs per week.

Dunk City Dynasty (iTunes)

Dunk City Dynasty is an NBA and NBPA-licensed streetball mobile game in the basketball simulator genre, where the player controls whichever character currently has the ball. At launch, the game was promoted by well-known NBA athletes and professionals, backed by a wide-scale marketing campaign. Monetization includes the full spectrum of mechanics typical for Asian-developed titles (the developer is NetEase Games), but that doesn’t seem to have helped much. Dunk City Dynasty launched at the end of May, stayed in the top 200 for four weeks, and has already dropped out of the charts. The most likely issue is high churn: aggressive pay-to-win monetization, such as gacha systems for premium sneakers that improve shooting accuracy, tends to perform poorly in Western markets over the long term. A Google Play version exists, but its performance is roughly 7–8 times weaker than on iTunes.

Epic Plane Evolution (iTunes)

Epic Plane Evolution is another experimental title in this week’s lineup this time from the hypercasual genre. The gameplay is simple: design a small plane, launch it from a slingshot, and see how far it flies. Games like this rarely make it onto my radar since they mostly monetize through ads. However, in this case, players can pay to remove ads and gain additional attempts, which creates a secondary monetization loop. The game launched sometime in the second half of 2024, but during weeks 6–7, weekly downloads grew from 50–60K to around 100K, and revenue increased accordingly. Still, the numbers weren’t high enough for the game to secure a stable position in the top 200.

Hole People (iTunes)

Hole People is another puzzle game from Rollic, the studio behind the hit title Color Block Jam. Rollic is known for aggressively scaling any new game that shows strong early potential – reallocating all resources and launching massive cross-promo campaigns from their current top hit, which can be generating millions in revenue at the time. (For more on this strategy, see the previous update: The Sorrow Story of Games Dropped Out of the Top 200 Grossing US. Weeks 20–25.) That said, Hole People doesn’t currently look like a major contender. Revenue is growing slowly, and seems only weakly responsive to increases in downloads, suggesting limited scalability at this stage.

Knit Out (iTunes)

Knit Out is yet another experiment from Rollic, a studio with enough resources to test multiple games at once. This puzzle title is currently performing slightly below Hole People in terms of revenue, suggesting it may not be ready for aggressive scaling, at least not yet.

Necessary mentions.

ONE PIECE TREASURE CRUISE-RPG was not in the chart 3 consequtive weeks, but still worth to mention that One peace, game made based on the most popular anime franchise couldn’t survive.

The Google Play version of Carnival Tycoon: Idle Games also entered the top 200 during this period. Its iOS version briefly charted earlier, during a timeframe when this report was not being published, so it’s worth highlighting the game’s overall success separately.

Fortnite has returned to the iTunes store following its legal victory over Apple. Since the game was never removed from Google Play, there’s no reason to include it in the charts — but its comeback on iOS is definitely worth mentioning.

Last Z: Survival Shooter is already a well-known title, this strategy game has been in the Google Play top 200 since November 2024, and currently holds the impressive rank of #16. Until recently, the game was unavailable on iTunes, likely due to some platform-related restrictions. But those seem to have been resolved, as the iOS version quickly climbed to #27 as of today.

Methodology.

The games featured in this report are sourced from the top-grossing charts on Google Play and iTunes, which list the top 200 games in the US. AppMagic collects and aggregates chart data at different intervals, with the initial dataset sourced from AppMagic ‘s API. To be included in this report, a game must have appeared in the top 200 for at least three random weeks within the last four weeks. Additionally, the game must not have appeared in the top 200 within the past year prior to this period. This report is updated every four weeks accordingly.