Mobile gaming’s $4.1 billion reboot

Journal 51 Joost van Dreunen June 6

Three predictions on what’s next

Is Apple changing its stance on gaming?

With the financial fallout from its recent loss to Epic Games becoming more transparent (see below), Apple may finally have a reason to rethink its long-standing indifference toward interactive entertainment.

Steve Jobs never really cared about games, except when he did. In a 2010 earnings call, he proudly noted that Apple had become the world’s biggest mobile gaming platform “without even trying.”

One theory is that Apple doesn’t “get” games because it doesn’t need to. The company treats gaming as ancillary to its real business: hardware margins and ecosystem control. According to John Carmack in a 2008 interview, Apple’s design ethos and tight-fisted approach don’t mesh with the creative chaos and technical demands of user-driven, high-performance gaming

But that stance appears to be shifting.

In just one week, Apple made two announcements that felt off-script.

First, it acquired its first-ever game studio: RAC7, the team behind Sneaky Sasquatch. The game has been an Apple Arcade exclusive since 2019 and a quirky pillar of its subscription lineup. For a company that made $14 billion from gaming without publishing a single title, this hints at a new playbook: first-party content.

Sure enough, one swallow doesn’t make a spring. But if Apple follows this with a few more buys—What the Car?, perhaps, which just won Mobile Game of the Year at D.I.C.E.—then we’re talking movement.

Second, Bloomberg reported that Apple is launching a dedicated gaming app ahead of WWDC. It comes within days of Nintendo’s hotly anticipated release of the Switch 2. Even so, it’s still too early to determine if this would have an immediate impact on the overall gaming market, or if it will even present a meaningful competitor to other categories like console and PC. But it’s not the size of the announcement that matters here, but its symbolism.

For a company that supposedly doesn’t care about gaming, Apple is starting to look suspiciously like one that does.

On to this week’s update.

BIG READ: Mobile gaming’s $4.1 billion reboot

The Short: Epic’s court victory against Apple triggers a massive reallocation of value in mobile gaming, potentially shifting billions from platform holders to game developers.

Consumers will have noticed the return of Fortnite to the Apple App Store. The circumstances surrounding the game’s reactivation, however, are far more significant for developers.

With the U.S. Supreme Court’s refusal to hear its appeal, Apple is now obligated to allow developers the option to refer their users to external websites for payment. It means the end of its long-enforced ban on “steering,” which prevented game makers from directing players away from the app store ecosystem and toward alternative (and higher margin) payment channels. It slices deep into the economic structure of the App Store and sets the stage for a massive reallocation of value within the mobile ecosystem.

The anticipated impact on the mobile gaming ecosystem is materially significant.

For example, Take-Two reported its annual earnings just last week, totaling $5.65 billion in net bookings, with 51% of that coming from mobile, or about $2.88 billion. While not all of that is subject to Apple and Google’s platform fees, we can assume that about 70% of mobile bookings stem from in-app purchases made via app stores. That puts roughly $2 billion in App Store-governed revenue on the table.

Now imagine that as a result of the ruling, Take-Two sees a reduction of its effective platform fee by 10 percentage points, from, say, 30% to 20%. That’s a $287 million margin gain. Given that Take-Two posted just $199 million in EBITDA for the year, this one change could potentially double its operating profitability.

If we apply that same logic to the 25 largest mobile game developers (based on 2024 revenues), an approximate total of $4.1 billion would flow to these game makers and away from the platform holders. That type of wealth transfer does more than improve publisher margins. It redraws the power structure in the mobile gaming ecosystem.

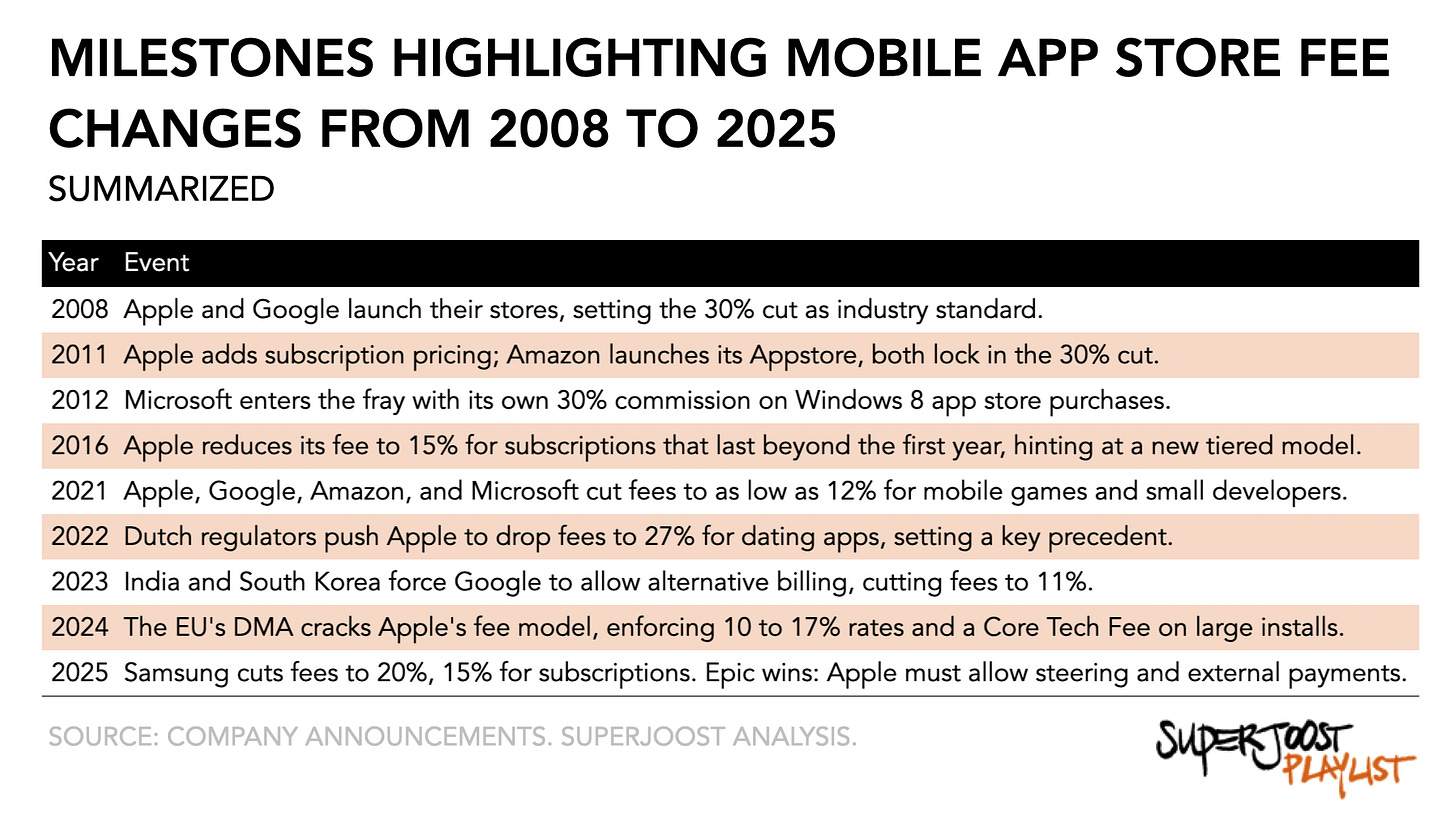

The 30% commission on all in-app purchases has been a pillar of the mobile economy since the 2008 launch of the App Store. Apple, confident in the strength of its walled garden, stuck to it for years, only offering small concessions under pressure. Subscription apps, for instance, dropped to 15% after one year, and smaller developers earning under $1 million annually were eventually granted a reduced rate. But the gatekeeping remained firm, especially when it came to steering users toward cheaper, external payment options. It was the reason why it banned Fortnite, denying the game’s publisher, Epic Games, access to hundreds of millions of players to enforce its rules.

That rigidity started to crack under regulatory pressure.

In the Netherlands, Apple was fined repeatedly by the ACM until it lowered fees for dating apps. In the EU, the introduction of the Digital Markets Act forced Apple to lower its commission to 17% and introduce a €0.50 “Core Technology Fee” per install past the first million.

A uniform 30% commission across digital storefronts will soon be a thing of the past. Regulatory pressure, competitive shifts, and developer pushback have chipped away at the once-sacrosanct revenue model. However, tracing the emergence of alternative fee structures across subscriptions, small business tiers, and regional exceptions indicates that the platform tax is in retreat.

Rather than business model innovations, these changes are compliance requirements. Against a background of gatekeepers like Apple becoming the most powerful firms in gaming, app store fees have become an increasingly contested aspect in game development and the broader digital economy at large. What used to be a fixed toll is now contested ground. And Epic’s victory in U.S. courts pushes that opening even wider.

Where mobile studios once burned through ad budgets to acquire users in a hyper-competitive environment, they can now redirect that spend toward incentivizing direct relationships.

So what happens next?

Prediction 1: Apple will shrink fees, selectively

Here, we can expect Apple to respond the way entrenched platform monopolists always do: by offering a mid-tier fee reduction just enough to keep the middle tier on board. So far, the firm’s strategy has been to drag its feet to protect its interests. I expect Apple to announce an updated, flat fee of 20% (down 10% from its current) for a subset of developers who opt into Apple’s existing payment infrastructure, paired, of course, with a waiver to forgo external links.

We saw something similar when Epic Games challenged Valve on app store fees, resulting in the latter adjusting its rates in 2018. Valve positioned its decision to lower Steam fees as a way to reward the positive network effects generated by top-performing games and to strengthen the alignment between successful developers, the platform, and the broader community. Or, as Valve put it:

“It’s always been apparent that successful games and their large audiences have a material impact on those network effects, so making sure Steam recognizes and continues to be an attractive platform for those games is an important goal for all participants in the network.”

By introducing tiered revenue shares, dropping from 30% to 25% after $10 million in revenue and to 20% after $50 million, Valve framed the change less as a concession but as a way to reinforce the health of its ecosystem by ensuring that the biggest contributors felt fairly treated and incentivized to stay. It was less a reaction to external pressure and more a preemptive move to keep the high performers inside the tent.

Prediction 2: Big publishers double down on user acquisition

The major winners here are, unsurprisingly, the top pure-play mobile developers like Supercell, Dream Games, Playrix, Playtika, Scopely, and others. They’ve already developed the necessary infrastructure (ie, digital storefronts) to start optimizing their margins immediately. They’ll use this moment to build more durable user relationships, backed by better data and more personalized pricing. Zynga’s Empires & Puzzles already offers players 10% more gems for buying off-platform, and Scopely insiders say they’d gladly pay users up to $100 to onboard outside the App Store entirely. (For more detail, listen to this excellent conversation between Wedbush’s Michael Pachter and behavioral economist Catalin Alexandru.)

However, the margin expansion for game makers raises the stakes. Willing to spend more to attract users because of their increased lifetime value, big publishers will likely push into bidding wars for attention. The cost of user acquisition is likely to spike. However, eventually this market dynamic will leave many indies and mid-size studios at a disadvantage to compete at scale.

For players, games won’t get cheaper. But they will get more value for their money. Expect more perks, more bundles, and more exclusive offers. The net effect is not a race to the bottom on price, but a renewed push to differentiate through offer design.

Prediction 3: Apple buys Unity to lock the supply chain

Let’s end with a spicy one. In a move to strengthen its grip on the mobile ecosystem and neutralize emerging threats, Apple will acquire Unity. The engine currently powers over 70% of mobile games and was fully integrated into the VisionPro at launch, making it both a strategic dependency and an opportunity. By bringing Unity in-house, Apple can preempt the engine provider from offering white-label direct-to-consumer infrastructure to small and mid-sized developers, effectively heading off the risk of Unity becoming the Shopify of mobile game storefronts.

The acquisition would serve multiple objectives: it undercuts Epic Games, Apple’s most vocal rival, by creating a fully integrated toolchain for mobile game development and monetization. It also helps reinforce Apple’s payment infrastructure by absorbing a potential counter-platform. Moreover, payment providers like Xsolla present an additional threat to Apple in this context as they have made it part of their business model to enable game makers’ direct-to-consumer initiatives. Investing in its ecosystem to offer content creators more options would benefit both consumers and Apple.

Plus, Unity is currently relatively cheap. Its market cap today is about $8.9 billion, down from $56 billion at its peak during the pandemic. Certainly, it would be Apple’s biggest purchase to date (the current largest was the acquisition of headphone maker Beats for $3 billion) and a deviation from its acquisition history, as it generally buys toolsets and backend infrastructure add-ons in the range of $200 to $400 million.

Nevertheless, acquiring Unity is unlikely to trigger major regulatory scrutiny since it doesn’t pose a direct consumer harm. As for the threat of regulators preventing such a deal, scrutiny is less likely because it doesn’t directly threaten consumer welfare. As we’ve seen in the lawsuits around Microsoft’s acquisition of Activision Blizzard and Wolfire versus Valve, the central concern is how different platform practices impact users.

In platform logic terms, this is about controlling supply before someone else makes it interoperable. By integrating Unity’s suite into its ecosystem, Apple would create more value and improve the incentive for developers to stay within the ecosystem on its terms (including the fee structure). A one-time purchase would neutralize a potential exodus.

What Wall Street analyst Michael Pachter calls Apple’s “decisive defeat” catalyzes the games industry to focus on improving distribution models around user acquisition, engagement, and monetization. The imminent change in app store fee structures will oxygenate the market and fuel further distribution innovations.

The uniform platform tax is dead. In its place, we’re seeing the emergence of a fragmented, contested landscape where developers have real leverage for the first time in over a decade.

The mobile gaming ecosystem’s power structure is being redrawn. The question isn’t whether change is coming—it’s who will adapt fastest to the new reality.

NEWS

Roblox hires head of parental advocacy

This week, Roblox appointed a legal expert for a newly created role aimed at helping families better navigate its digital environment.

Dr. Elizabeth Milovidov specializes in children’s rights in online spaces. Her writing has emphasized a holistic, rights-based approach to digital policy, advocating for the recognition of children as active participants online and stressing the shared responsibility of states, industry, educators, and families to safeguard and empower young users.

At a surface level, it feels a bit ceremonial to hire a single person to help parents better navigate Roblox. However, I think it is an encouraging step in the right direction. Roblox has faced increasing scrutiny from parents, regulators, and, by extension, investors. The firm’s willingness to create a dedicated position and fill it with someone familiar with the European perspective on digital governance bodes well. If anything, Europe’s more aggressive scrutiny of large tech firms and willingness to impose fines and regulations are starting to become real for firms managing digital ecosystems. It suggests Roblox is preparing for a world where safety and compliance are not afterthoughts, but a competitive advantage.

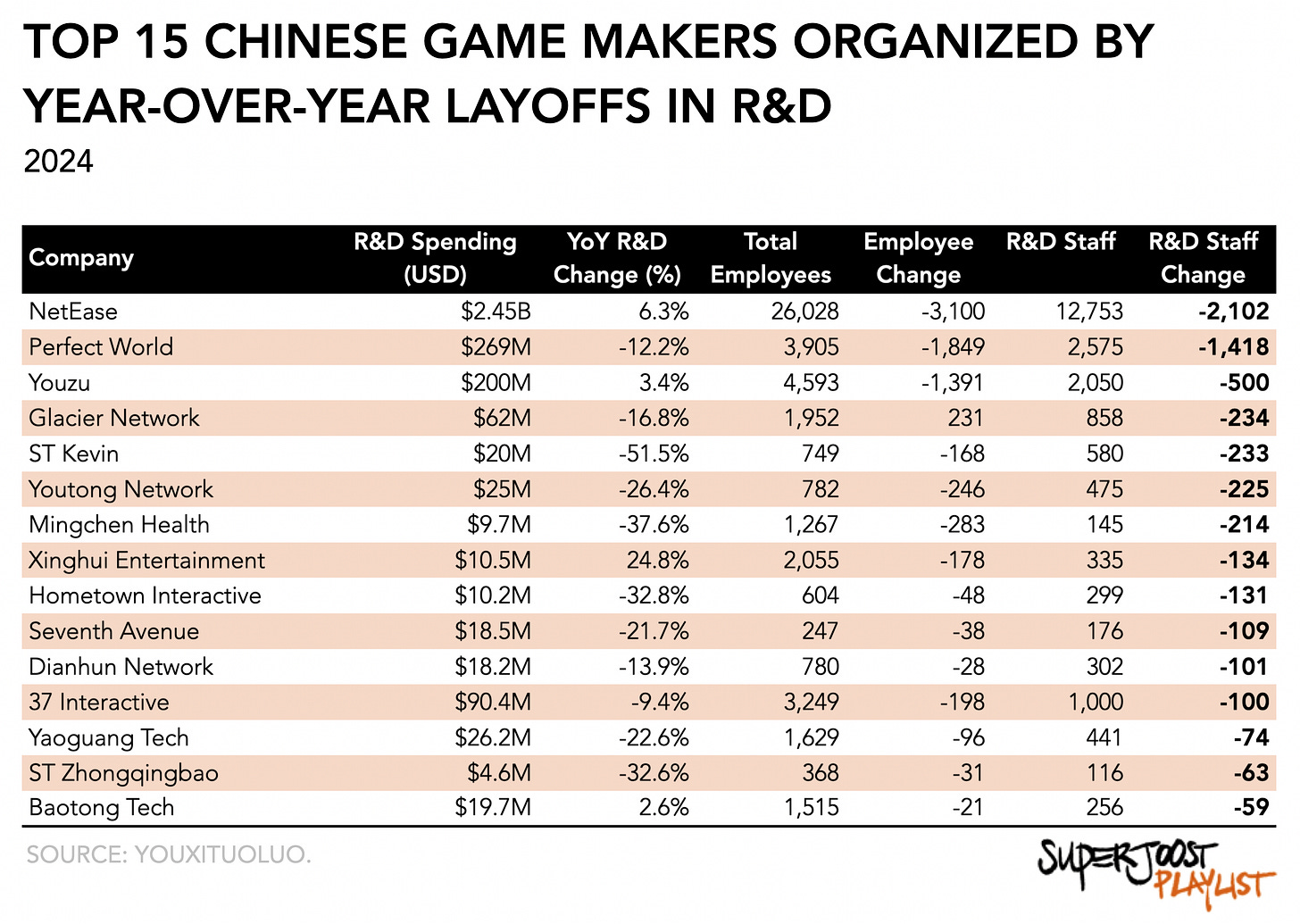

China’s game sector sees massive cutbacks

In an article spotted by Niko Partners (disclosure: I’m an advisor), China’s game industry has entered a period of sharp retrenchment.

Over 6,000 R&D jobs were cut across 30 listed companies, and only 150 new titles are in development. It shows a visible contraction in ambition. Flagship firms like NetEase and Perfect World implemented deep layoffs and project cancellations, while smaller studios slashed budgets or exited entire categories. These moves, often couched in terms of “optimization” or “AI-driven efficiency,” reflect a broader crisis of confidence in the commercial viability of new game development.

It stands in seeming opposition to Matt Ball’s 2025 report, where he points out that China remains the single largest growth engine in gaming, accounting for 42% of global industry expansion since 2011. (BTW, he keeps updating it. His most recent version is from May 24th because, evidently, Matt doesn’t sleep.) Chinese developers have increased their share of non-domestic content spend from 0.5% to 13%, and AAA titles from Chinese studios now rival global bestsellers.

What we’re witnessing, then, isn’t a collapse but a phase shift: from high-velocity expansion to cautious consolidation. The industry is maturing, prioritizing stable returns and proven IP over speculative bets—an echo of Ball’s thesis that old growth engines are exhausted, and future gains will come from structural adaptation, not scale alone.

PLAY/PASS

Pass. Ubisoft is back in court to face sexual harassment allegations. Le sigh.

Play. Hearing the giggles from the family room where my son and wife are playing It Takes Two. ❤️