Written by our partner, InvestGame.

Take-Two Interactive (NASDAQ: TTWO) has built its reputation on blockbuster franchises, including Grand Theft Auto, Red Dead Redemption, and NBA 2K. Yet when its veterans launch their own studios, a surprising pattern emerges: the most significant wins come not from replicating AAA glory, but from mobile studios TTWO only recently acquired.

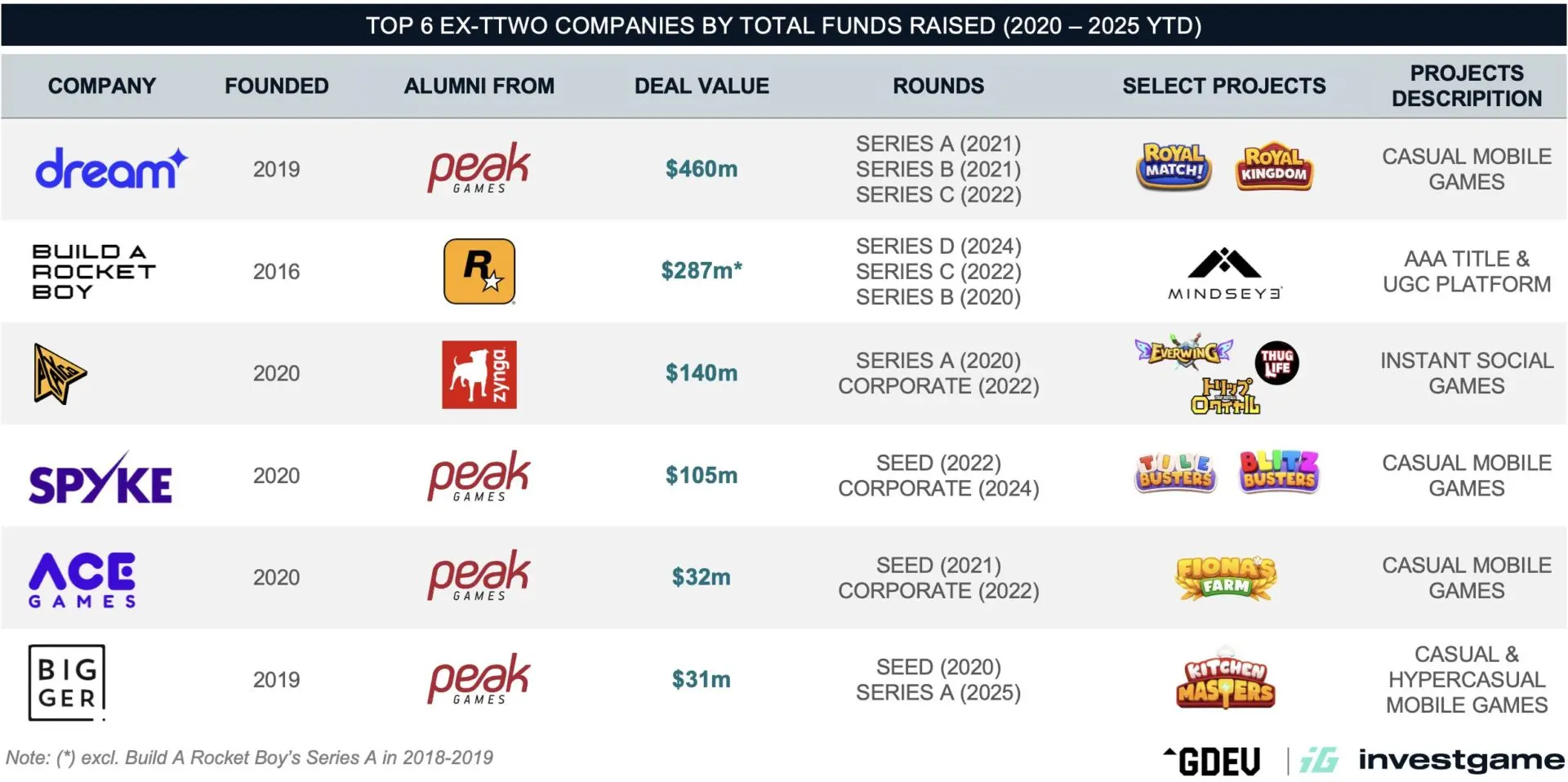

This paradox defines the Take-Two alumni ecosystem. While Rockstar Games and 2K veterans chase ambitious AAA dreams with mixed results, alumni from acquired mobile giants Zynga ($12.7B, Jan’22) and Peak Games ($1.8B, Jun’20) have already created multiple billion-dollar outcomes. Dream Games, founded by Peak veterans, reportedly reached a $5B valuation in its most recent deal. Boss Fight Entertainment, founded by ex-Zynga talent, was acquired by Netflix. The scorecard is stark: starting from 2020, mobile alumni have raised $671m in VC/CVC transaction value, while PC & Console founders have raised $325m in total (of which $287m by Build A Rocket Boy, according to the official filings), and continue to face execution risks that challenge even highly credentialed teams.

Since 2020, we’ve tracked 23 Take-Two alumni studios that have raised over $1.2B across 38 investment rounds—a diaspora that spans every gaming segment, from VR sports to web3 experiments. But beneath this diversity lies a clear hierarchy of success that challenges assumptions about what TTWO’s heritage actually means for founders.

Methodology note: Our analysis includes only those alumni-founded studios that raised external funding or were acquired between 2020 and 2025 YTD. Earlier ventures (funded or sold prior to 2020) are excluded from this dataset. The focus is on companies established by senior or C-level alumni of Take-Two and its subsidiaries, including Rockstar, 2K, Private Division, Gearbox, Zynga, and Peak. Within this scope, we track VC, CVC, corporate, and strategic investments, as well as M&A activity.

The Capital Verdict: Where Investors Place Their Bets

Take-Two alumni have attracted more than $3.7B worth of transactions across 43 deals since 2020, combining both investments and M&A. The distribution of this capital reveals clear investor preferences.

Early-stage rounds reveal several notable investor patterns. First, these financings, totaling approximately $358m, demonstrate strong initial confidence in alumni founders, with a median check size of $6m. Second, mobile founders captured almost 53% of all early-stage deals (15 transactions), with larger checks arriving faster than in PC & Console (average check ~$13.3m vs. $6.4m; medians ~$5.7m vs. $4.8m). This capital concentration creates a self-fulfilling prophecy: mobile studios utilize early funding advantages to iterate more quickly, achieve product-market fit, and attract subsequent rounds of funding. PC & Console studios, undercapitalized from the start, face longer development cycles with less room for error, a dynamic that explains why execution risks remain stubbornly high.

Late-stage activity tells a more selective story. With approximately $697m deployed, only two companies have reached this level: Dream Games’ mobile success and Build A Rocket Boy’s ambitious AAA venture. This concentration suggests that while many alumni can raise initial capital, few achieve the scale necessary for growth rounds. One has already justified its valuation with Royal Match’s dominance; the other recently announced layoffs after MindsEye underperformed.

Strategic investors, meanwhile, have concentrated $115m across 5 deals primarily in mobile and scalable multi-platform models, largely avoiding pure PC & Console plays.

Rockstar Legacy: Ambition at Scale

Take-Two’s global reputation rests on Rockstar’s blockbuster franchises, Grand Theft Auto and Red Dead Redemption. Yet when these veterans launch independent studios, a harsh reality emerges: AAA ambition without established IP leads to expensive struggles, not billion-dollar outcomes.

Build A Rocket Boy, founded by Leslie Benzies, former president of Rockstar North, exemplifies this challenge. The studio raised over $287m (excluding Series A rounds of $22.1m in 2018-2019) with the latest round being the $110m Series D round in Jan’24. The studio has developed an AAA-named game, MindsEye, the UGC-focused platform Everywhere, and Arcadia, a tooling layer for UGC content and publishing. While Everywhere and Arcadia remain in development, MindsEye has underperformed commercially, resulting in recent layoffs of nearly 300 people. Even with Benzie’s GTA world-class track record and substantial capital, replicating Rockstar magic remains extremely difficult.

Dan Houser, co-founder of Rockstar, chose a different path with Absurd Ventures. Rather than competing head-on in AAA development, his studio pursues transmedia IPs across multiple platforms, including games, books, and television. The December 2024 corporate funding round suggests investors see promise in this narrative-first, platform-agnostic approach—though with no products released, it’s too early to conclude.

Beyond studio creation, several PC & Console veterans have shifted into publishing. Former Private Division executives founded Lyrical Games, which has raised funding and already signed three mid-budget titles. Haveli Investments acquired another branch of the Private Division with some of their IPs, including Kerbal Space Program, Tales of the Shire, etc. These moves suggest that while building a new AAA IP is risky, alumni are finding more success enabling others’ content through flexible publishing and cross-media approaches.

Zynga & Peak Heritage: Mobile Powerhouses

Zynga and Peak alumni demonstrate how mobile expertise can scale into billion-dollar outcomes. The acquisitions of Peak and Zynga seeded a generation of founders who already understood UA, monetization, and casual design at a global scale—and the results speak for themselves.

At the center of this cluster is Dream Games, which has emerged as one of the most valuable mobile companies, with Royal Match consistently ranking among the world’s top-grossing puzzle titles. Backed by ~$460m in funding, reportedly valued $5B via a $2.5B secondary and debt transaction in 2025, Dream has become the flagship example of founders’ track record translating directly into venture-scale success.

The momentum didn’t stop there. Turkish startups, led by ex-Peak alumni, followed a similar playbook: Spyke Games ($105m raised across 2 rounds with most recent $50m corporate funding in May’24) and Ace Games ($32m raised across two rounds with most recent minority acquisition by Re-Pie Asset Management in Dec’22), have also built competitive puzzle titles, reinforcing Turkey’s role as a global mobile hub. Together with Dream, they’ve turned Istanbul into a hub for puzzle-driven mobile growth.

Note: see our previous feature “Five Years of The Rising Gaming Empire—Turkiye”

Some alumni took different paths. Playco, co-founded by one of Zynga’s founders, pursues instant-play titles distributed through messengers and social platforms—a continuation of Zynga’s early social gaming DNA. The company has secured a total of $140m, including its latest $40m investment from Meta (NASDAQ: META). Meanwhile, Boss Fight Entertainment, founded by former Zynga Dallas developers, was acquired by Netflix (NASDAQ: NFLX) in 2022, providing the streamer with a premium mobile content foothold.

The takeaway is clear: while PC & Console alumni face long development cycles and execution risks, mobile-first founders have been the most reliable investment bet, consistently attracting follow-on capital and marking billion-dollar valuations.

New Frontiers: Beyond Mobile and AAA

Not all Take-Two alumni are repeating the mobile or AAA formulas. A smaller wave of founders is exploring emerging niches and underserved genres.

- ForeVR Games: VR casual sports such as bowling and darts, that secured $20m across three rounds, including a $10m Series A round.

- Midsummer Studios: a modern life simulation game, which raised $6m in May’24.

- Loric Games: led by veterans from 2K and Irrational, is building a PC PvPvE RPG, combining Firaxis’ strategy roots with immersive world-building. The studio has raised $5.6m to date across two rounds.

- Smaller ventures (TaleMonster, TARK, Seven Stars, FunCraft) highlight how alumni continue to experiment across co-op, PvE, and mobile casual.

While these ventures are early, they underline the genre diversity within TTWO’s alumni ecosystem. They may not command the same funding headlines as Dream Games, but they show that pedigree founders are willing to test new frontiers rather than compete directly in saturated markets.

Note: this experimentation mirrors what we observed in our feature on Ex-Rioters alumni, where smaller bets beyond core genres added diversity but not yet scale.

VCs’ Approach

Investor behavior toward TTWO alumni reveals two clear patterns. First, mobile dominates capital allocation. The four most active funds in this ecosystem—Makers Fund, Index Ventures, Balderton Capital, and IVP—all invested in Dream Games, signaling a shared view on where scale is achieved. Notably, this set of investors differs from those most active in supporting former Activision Blizzard King founders, as well as former Riot Games founders.

Secondly, looking at most companies founded in the 2020–2021 wave raised additional financing within 1–2 years of their Seed rounds—faster than the typical cycle for gaming startups. In total, eight alumni studios secured follow-on rounds, with five of them focusing on mobile. This rhythm suggests that investors view early product signals or market traction as sufficiently strong to warrant a quick doubling down on their investment.

M&A & Exits

Despite the size of the alumni network, exits remain rare—a reminder that a strong resume opens doors but doesn’t guarantee successful exits. Since 2020, TTWO alumni have been involved in only 5 acquisitions compared to the 37 rounds. Most exits have centered on IP or minority stakes rather than full takeovers, reflecting buyer caution.

Highlights include Netflix’s acquisition of Boss Fight Entertainment (2022) and its minority stake in Dream Games (2025), which valued the company at approximately $5B; and Sensor Tower’s acquisition of VG Insights in Mar’25, expanding its market intelligence capabilities.

Still, the overall number of exits remains limited. More transactions are expected, particularly in the mobile segment, where alumni studios have already demonstrated strong monetization and scalability.

Note: This investor concentration around Dream Games contrasts with the broader set of backers we analyzed in the Ex-Activision Blizzard King alumni feature, where capital was spread across different genres and monetization models.

Conclusion

The TTWO alumni effect reflects a dual heritage:

- PC & Console: limited but evolving. Rockstar veterans have pursued ambitious projects, but execution risks remain high. Instead, more traction is emerging in publishing and transmedia IPs—such as Lyrical Games or Absurd Ventures—rather than pure AAA development.

- Mobile: dominant and proven. Zynga and Peak alumni continue to deliver the ecosystem’s strongest results, with Dream Games standing as the clearest example of founders’ expertise translating into billion-dollar scale.

The paradox is striking: Take-Two’s reputation was built on PC & Console blockbusters, such as Grand Theft Auto, Red Dead Redemption, and NBA 2K, yet its alumni’s biggest wins come from mobile, seeded by the acquisitions of Zynga and Peak.

This feature marks the third installment in our Alumni Effect series. Across ecosystems, one pattern has become clear: background helps, but it doesn’t guarantee success. Dream Games shows what track record can achieve under the right conditions—but most alumni ventures still face the same market challenges as any other startup.

Looking ahead, promising studios like Absurd Ventures, Playco, Loric Games, Midsummer Studios, and Lyrical Games could reshape the narrative and prove that Take-Two alumni are not limited to mobile dominance. For now, though, the scoreboard is clear: PC & Console heritage may inspire ambition, but mobile pedigree delivers outcomes.