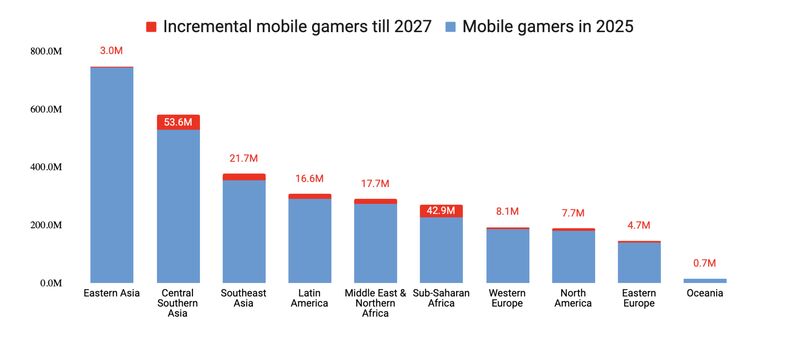

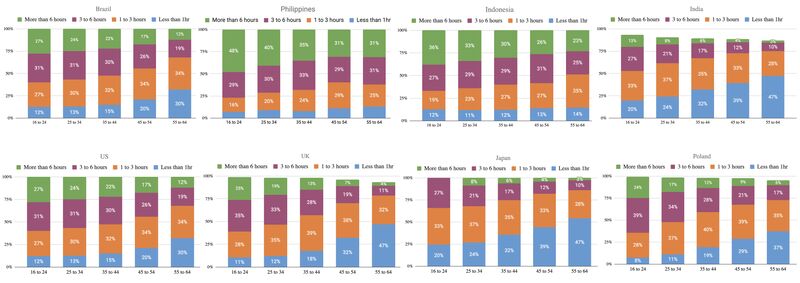

Incremental Mobile Gamers till 2027

In the next years, mobile gaming (and in general, whole gaming) will be growing more by growing the average value per gamer than just by growing the number of gamers. Still, there are some regions where we will see incremental mobile gamers in the next years (based on Newzoo data from February 2025). Most of those incremental gamers will come from Africa, Asia, and Latin America.