- arrow_back Home

- keyboard_arrow_right Highlights

Biggest Buyout in Gaming? EA’s $50B Deal to Go Private

HighlightsJournal 1 Gamigion September 27

Electronic Arts, the publisher behind FIFA (now FC), Madden NFL, The Sims, Battlefield, and more, is reportedly on the brink of a seismic shift in its history. According to The Wall Street Journal, the California-based gaming giant is in advanced talks to go private in a deal valued at roughly $50 billion.

If finalized, this would mark the largest leveraged buyout ever — not just in gaming, but across all industries.

The Investor Group

A consortium of heavyweight investors is leading the charge:

- Silver Lake (private equity)

- Saudi Arabia’s Public Investment Fund

- Affinity Partners, Jared Kushner’s investment firm

The group could unveil the deal as early as next week, people familiar with the matter said.

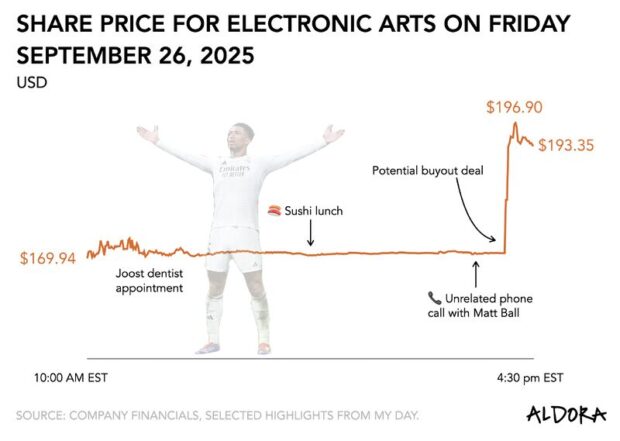

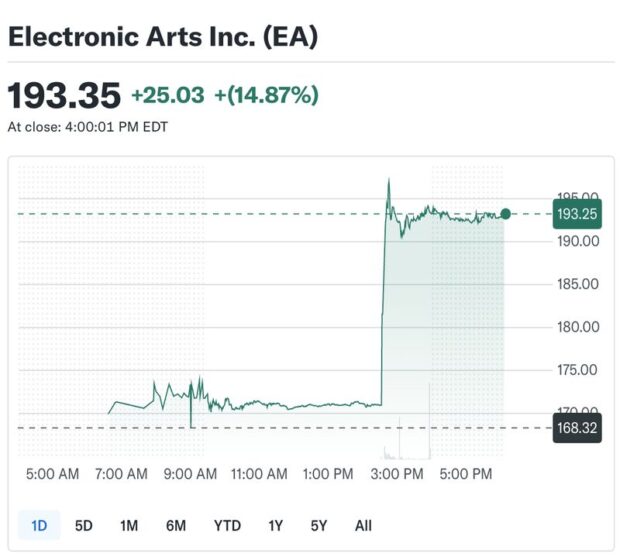

Market Reaction

EA’s market cap sat around $43B before reports of the talks surfaced. Once the news hit, shares skyrocketed nearly 15%, closing at a record $193.35 on Friday — pushing the valuation closer to $48B.

For context, EA’s sports titles (Madden, FC, NBA Live), along with blockbuster franchises like The Sims, Need for Speed, and Star Wars, have cemented it as one of the most valuable IP portfolios in the industry.

Why It Matters

- Historic Scale: At ~$50B, this deal would eclipse all previous gaming acquisitions and rank among the largest LBOs ever recorded.

- Strategic Control: Going private could give EA freedom from quarterly Wall Street scrutiny, allowing longer-term bets on live services, cloud gaming, and AI.

- Global Influence: With backing from both US private equity and Saudi sovereign wealth, the deal underscores gaming’s rising status as a global strategic asset.

See the industry’s take: