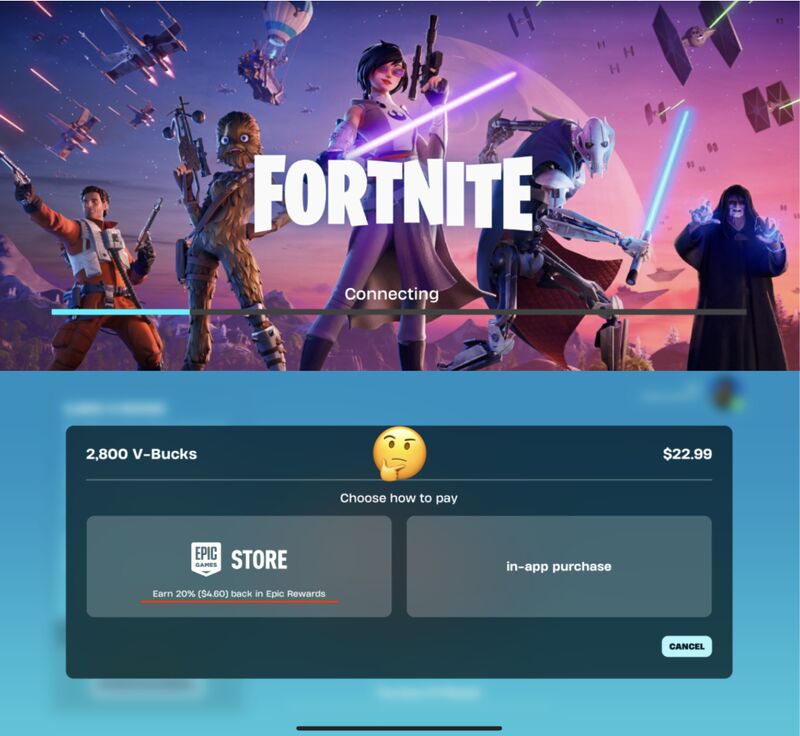

Fortnite is back! After 5-year Apple ban.

Fortnite is back! After 5-year Apple ban. Let's take a look at their purchase flow.1. Tap an item to purchase, then choose payment method: Epic or 'In-app purchase'2. That 'In-app purchase' button doesn't look very inviting to me, Epic store has a nice icon AND a 20% back kicker. Probably will choose that route. 😅 3. No scary popup confirmation after tap!Wild.Is this the beginning of a new era?