The Next Wave M&A Might Not Start Where You Expect.

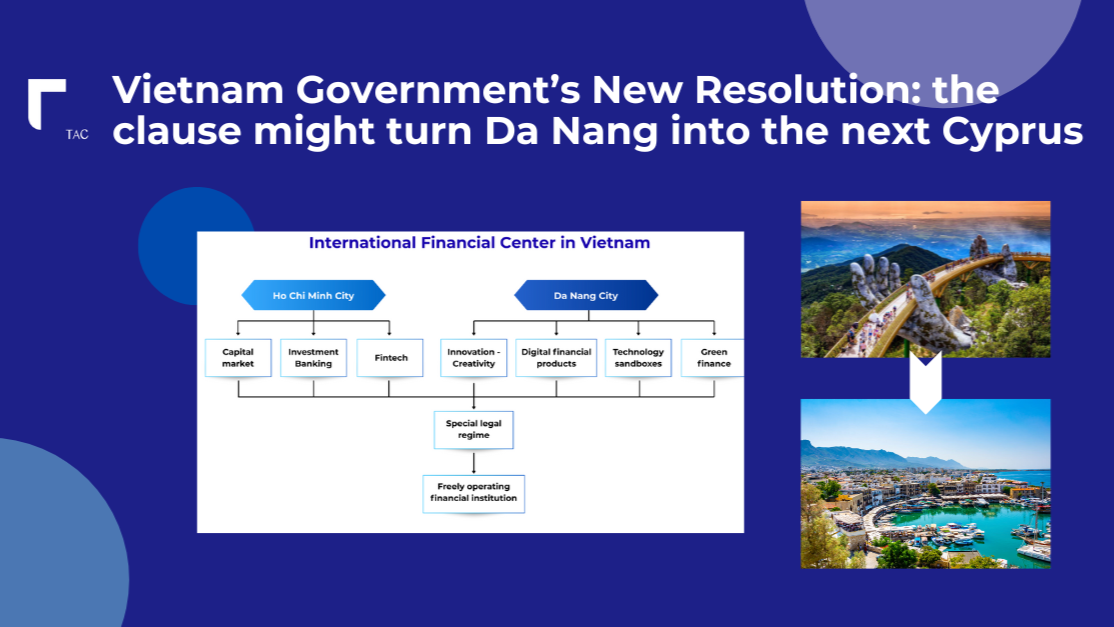

“The next wave of gaming M&A might not begin where you expect, but it could very well begin in Đà Nẵng or HCM” Last week, on a call with a London-based fund, someone said something that made me pause: “Cyprus, Turkey, and India are clearly leading the charge, but Vietnam feels like the bridge between them, or them in the past” It wasn’t said lightly. Cyprus has clarity. Turkey has speed. India has scale. And Vietnam, long known for its creative density and production agility, is starting to build the structure that holds it all together. A Quiet Policy That Could Change Everything On September 1, 2025, something quietly historic happened: Resolution 222/2025/QH15 came into effect, officially launching two International Financial Centers (IFCs) in Ho Chi Minh City and Đà Nẵng. For most outsiders, it barely made a headline. But […]